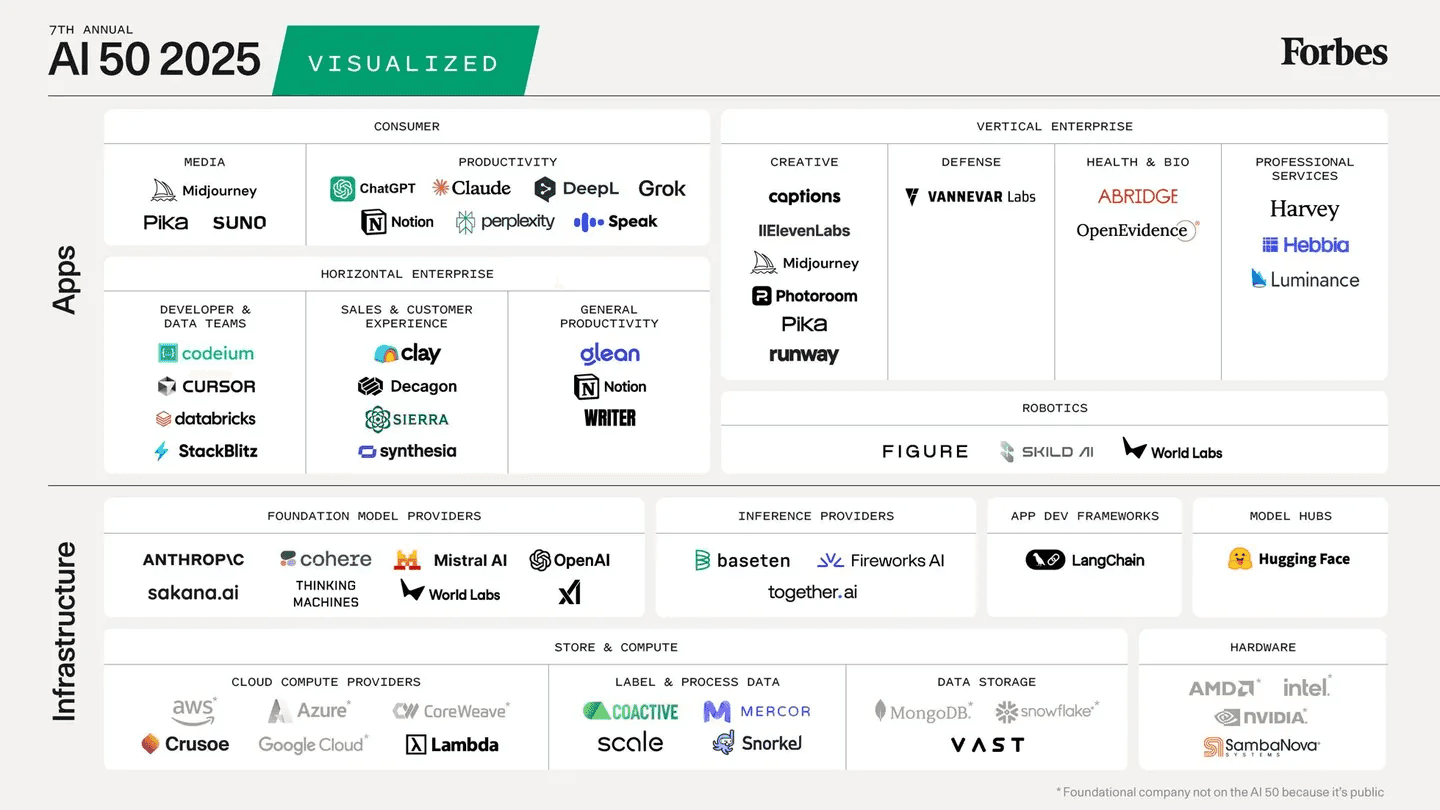

The AI boom has moved well beyond its early perception as a chatbot-driven novelty. What began as a consumer-facing innovation has evolved into a far larger and more durable story centered on long-term infrastructure investment.

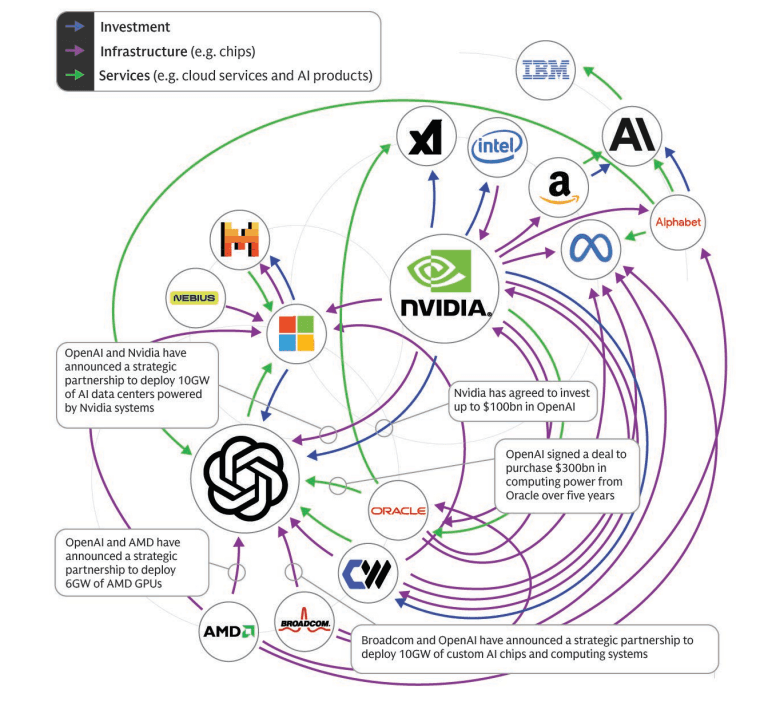

Today, AI represents a multi-year buildout of compute, power, networking, and physical assets required to support increasingly complex models and real-world deployment. This transition accelerated in 2025, as technology leaders, semiconductor firms, and cloud providers committed billions of dollars through large-scale partnerships and capital spending programs to secure their positions in the next phase of AI development.

As with previous technology cycles, some of the most durable opportunities lie in the “picks-and-shovels” layer of this buildout. Beyond chips and software, the AI ecosystem increasingly depends on companies involved in electrical infrastructure, data-center construction, site preparation, transportation, and the physical networks that connect it all.

These businesses may sit outside the spotlight, but they are becoming essential enablers of AI’s expansion from digital novelty to foundational economic infrastructure.

Part I: Bull Case — Is This the Golden Age of Investment?

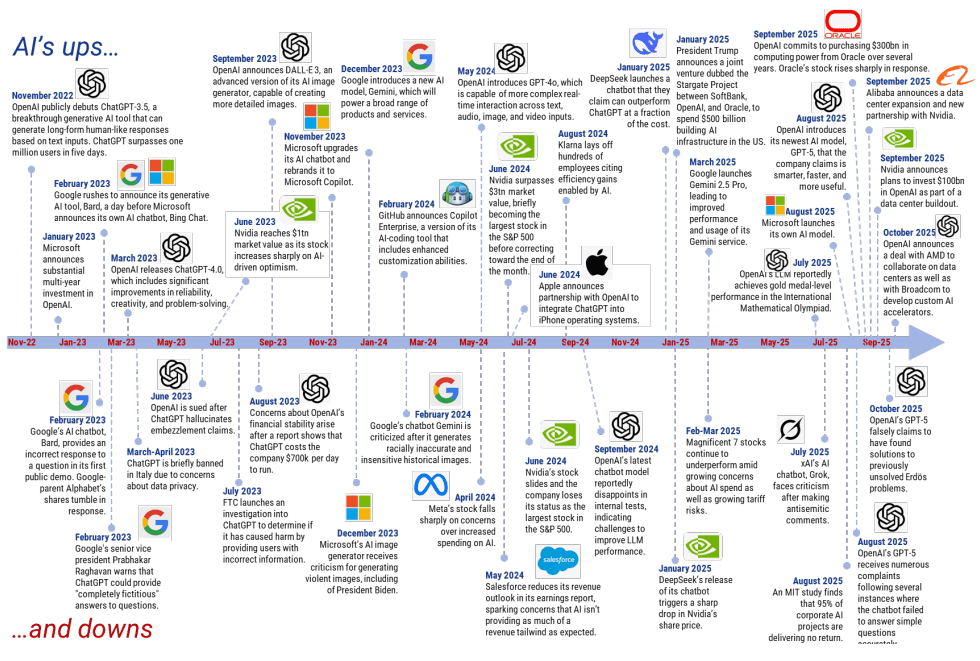

The AI-driven bull market that took shape in 2023 and 2024 extended into 2025, with momentum in AI infrastructure accelerating rather than fading.

Demand across the AI ecosystem remains exceptionally strong, supporting a sustained investment cycle that continues to reshape capital allocation across technology, semiconductors, and industrial infrastructure.

Financial markets have remained buoyant, and the optimism is not without foundation. Despite structural headwinds in 2025 including demographic slowdowns and rising trade frictions economic activity proved resilient. U.S.

corporate earnings and balance sheets held up well, supported by large-scale AI investment and a broader wave of productivity-enhancing technological adoption.

Among major secular trends, AI stands apart due to its potential to meaningfully alter labor dynamics and unlock productivity gains across multiple sectors.

The scale and intensity of AI-related capital spending have made it a disproportionate contributor to economic growth, a dynamic that carries forward into 2026 as both an opportunity and a source of risk.

At the same time, expectations embedded in U.S. technology stocks remain elevated. Earnings forecasts are already demanding, and history suggests that markets often underestimate the impact of creative destruction as new entrants and competing technologies emerge.

These forces tend to compress industry-wide profitability over time, increasing dispersion between winners and losers.

As a result, volatility within the technology sector and by extension the broader equity market is likely to rise even as the structural AI narrative remains intact.

AI Infrastructure: A Capital Cycle of Historic Scale

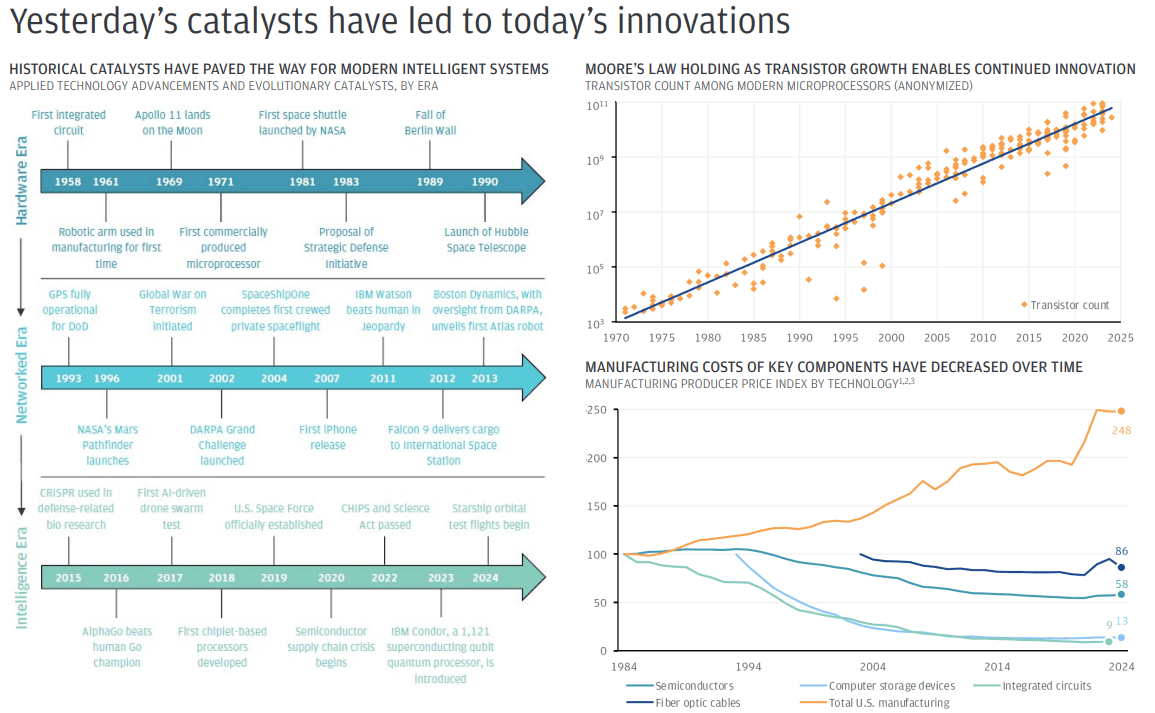

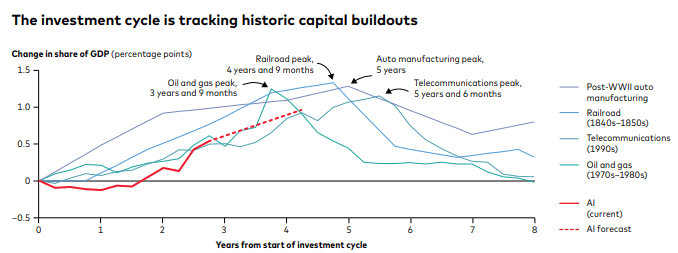

The current wave of AI-driven physical investment is shaping up to be one of the most significant capital expansion cycles in modern history, drawing comparisons to the buildout of railroads in the 19th century and the information and telecommunications boom of the late 1990s.

What distinguishes this cycle is not just the pace of spending, but the breadth of industries involved in laying the groundwork for long-term adoption.

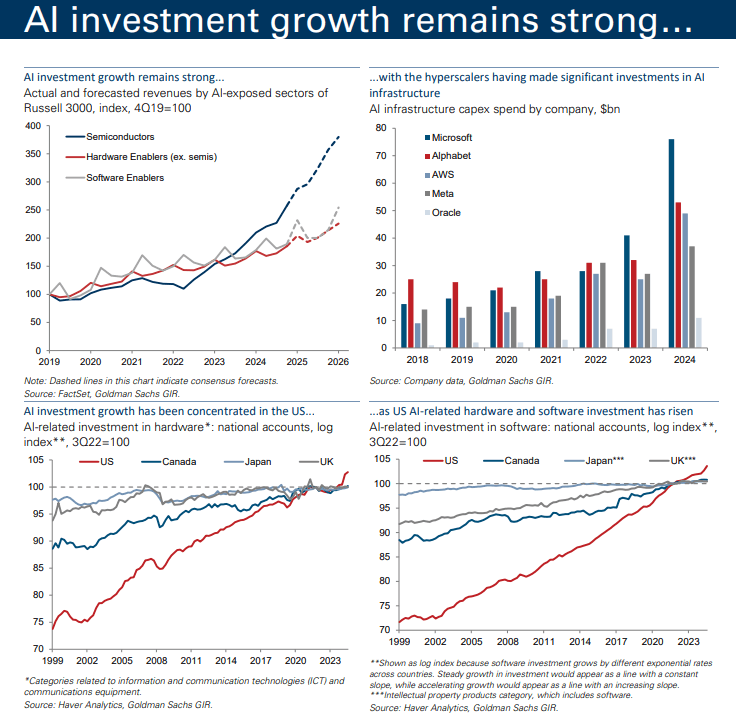

Capital commitments are already substantial.

Four members of the so-called “Magnificent Seven” allocated approximately $380 billion toward AI infrastructure in 2025 alone, representing a 54% year-over-year increase in AI-related capital expenditures.

Importantly, these companies have signaled that spending is likely to accelerate further in 2026 as competition for compute, power, and data center capacity intensifies.

Wall Street projections reinforce the scale of this buildout.

Goldman Sachs and Bank of America estimate that annual AI infrastructure capex could exceed $1 trillion by 2028, while JPMorgan and Citigroup project cumulative spending of roughly $5 trillion by 2030.

McKinsey’s research places global AI-powered data center infrastructure investment even higher, approaching $7 trillion by the end of the decade.

As the cycle progresses, the focus is expected to shift from deployment to application.

The next phase of AI adoption should bring more visible returns as industries move beyond experimentation toward real-world use cases.

Companies applying AI across areas such as autonomous transportation, industrial automation, and drug discovery stand to translate this infrastructure buildout into measurable productivity gains and potentially outsized investment returns.

Artificial intelligence has moved beyond the stage of technological breakthrough and is now emerging as a transformative economic force. It is reshaping expectations for productivity, growth, and competitiveness across industries.

Like electricity, railroads, and the internet before it, AI is driving a structural shift that requires substantial capital investment to retool the economy for a new era.

This is not a transient cycle, but the foundation for the next phase of long-term economic progress.

Historical infrastructure buildouts have done more than introduce new technologies; they have reshaped corporate structures, redrawn competitive boundaries, and led to new regulatory frameworks. The telecommunications and internet expansion of the 1990s, for example, brought landmark legislation such as the Telecommunications Act of 1996 and the Digital Millennium Copyright Act, which helped deregulate markets, encourage competition, and establish legal protections suited to the digital economy.

A similar process is now unfolding for AI, though its full architecture is still taking shape.

Regulatory and governance frameworks remain in active debate, and competitive dynamics across industries continue to evolve.

These uncertainties reflect an early stage of a broader transformation rather than its conclusion, suggesting that AI’s economic impact will extend well beyond near-term adoption cycles as standards, regulation, and industry structures mature in parallel with the technology itself.

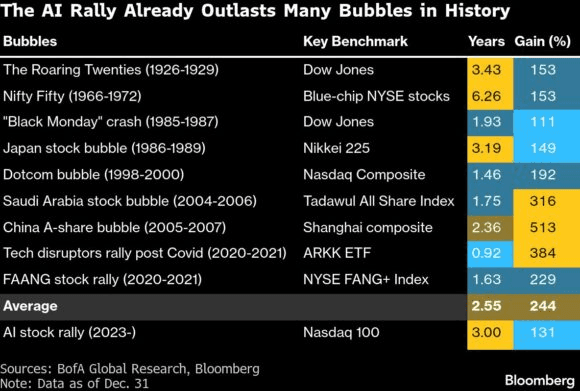

Part II: Bear Case — Are We in an AI Bubble?

As mega-cap technology companies accelerate spending on data center infrastructure and AI startups secure multibillion-dollar partnerships to lock in compute capacity, investors are increasingly asking a critical question: how much of this growth is sustainable, and how much reflects speculative excess.

Markets have a tendency to move faster than fundamentals. Periods of transformative innovation often invite oversimplification, where expectations for adoption and profitability are pulled forward too aggressively. In the case of AI, enthusiasm has clearly driven higher valuations for companies perceived to be positioned as beneficiaries, and early signs of froth are beginning to emerge.

Market concentration is one area of concern. During the peak of the dot-com era in 2000, a handful of technology leaders accounted for roughly 15% of the S&P 500. Today, the so-called “Magnificent Seven,” many of which are central to the AI narrative, represent more than one-third of the index.

Such concentration amplifies systemic risk, particularly if sentiment shifts or earnings expectations are revised downward.

At the same time, much of the current AI investment is being made in anticipation of future monetization rather than present-day returns.

Companies are deploying capital on the assumption that highly profitable AI-driven applications will materialize at scale. If the timing or magnitude of those profits falls short, the trade could be vulnerable to periods of sharp correction.

That said, important distinctions separate today’s environment from the excesses of the late 1990s. Unlike the dot-com boom, AI infrastructure spending is largely being funded with internally generated cash rather than leverage, and by companies with strong balance sheets and consistent free cash flow.

From a historical perspective, valuations, while elevated, remain well below the extremes typically associated with true market bubbles.

This suggests that while volatility and drawdowns are possible, the broader AI cycle may be better grounded than prior speculative episodes.

Over the past year, investors have seen a notable increase in large partnership announcements across AI model developers, hyperscalers, and semiconductor companies. These agreements are designed to deploy capital over multiple years, often with performance contingencies tied to execution, technology leadership, and long-term strategic alignment.

The scale and interconnected nature of these commitments—where suppliers, customers, and investors frequently overlap—have drawn comparisons to the late-1990s technology bubble. Circular financing, in which cash-rich technology firms effectively support customers purchasing their products and services, has added to this scrutiny. While caution is warranted, the more relevant question is not whether today’s deals resemble the dot-com era on the surface, but whether the underlying fundamentals align with past excesses.

Several distinctions stand out. First, balance sheets are materially stronger. In the 1990s, much of the infrastructure buildout was funded by companies with limited profitability and heavy dependence on external capital. Today’s AI investment is largely financed through the free cash flow of hyperscalers with durable margins, making the cycle more resilient to tightening credit conditions that historically exposed speculative bubbles.

Second, capital dynamics differ meaningfully from the vendor-financing loops of the telecom era. Rather than companies propping up demand through financial engineering, capital is flowing toward AI in response to demonstrable demand. AI now captures a significant share of venture funding, and spending is concentrated in tangible assets such as chips, electrical infrastructure, and data centers, rather than purely speculative capacity.

Third, revenue momentum is already visible. Unlike early internet companies that built infrastructure long before monetization, AI is generating revenue as it scales. Hyperscalers are benefiting from increased cloud usage and productivity gains across coding, advertising, and enterprise software. Model developers, while earlier in their lifecycle, are scaling revenues alongside rapid adoption, and enterprise investment continues to rise as organizations report measurable productivity and profitability improvements.

Finally, demand continues to outpace supply. Overbuilding was a defining feature of the dot-com era, when utilization of fiber-optic networks remained minimal for years. Today, data center vacancy rates are near historic lows, utilization remains high, and demand for compute continues to exceed available capacity. The exponential growth in data creation and AI workloads suggests that, while cycles will occur, the current buildout is being pulled forward by real and accelerating demand rather than speculative excess alone.

Caution around AI remains appropriate, even as the structural case stays intact. The scale of capital deployment is enormous, the pace of investment unprecedented, and key assumptions particularly around return on investment and the useful life of AI-related assets are still being tested.

History offers repeated examples of enthusiasm running ahead of economic reality, especially during periods of rapid technological change.

That said, the current cycle differs meaningfully from prior episodes of excess. Today’s leading participants are exceptionally well capitalized, funding expansion through internally generated cash rather than leverage.

AI monetization is already underway across cloud services, enterprise software, and productivity tools, providing early validation that demand is real rather than purely speculative. At the same time, supply constraints in compute and data center capacity suggest that the risk of near-term overbuilding remains limited.

Taken together, this points to a landscape where volatility and recalibration are likely, but where the foundational drivers of AI investment remain durable.

The challenge for investors is not avoiding AI altogether, but distinguishing between structural beneficiaries and those priced for outcomes that may take longer to materialize.

The AI-driven rally has already persisted longer than many historical market bubbles when measured by duration alone. While analysts acknowledge similarities to prior episodes such as the dot-com era, there are also important differences.

Most notably, the underlying technology is widely expected to generate lasting economic value, even if markets experience a period of correction or consolidation.

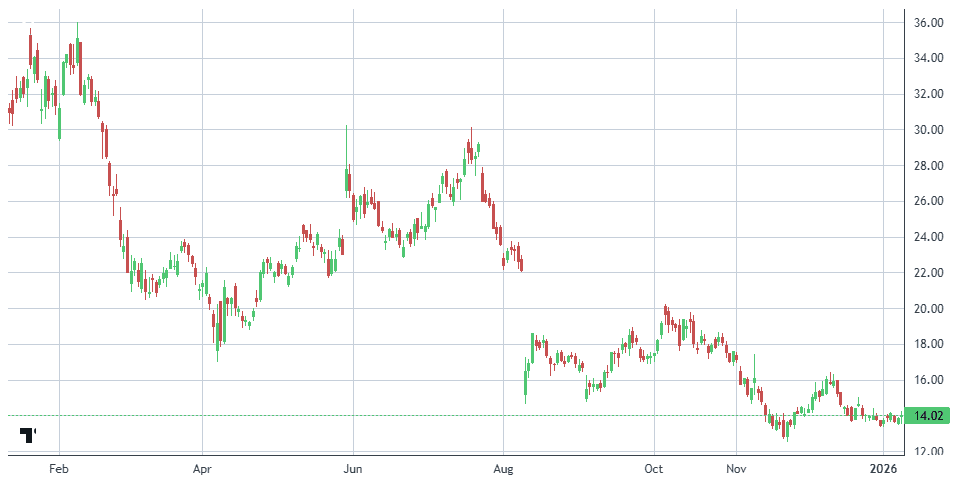

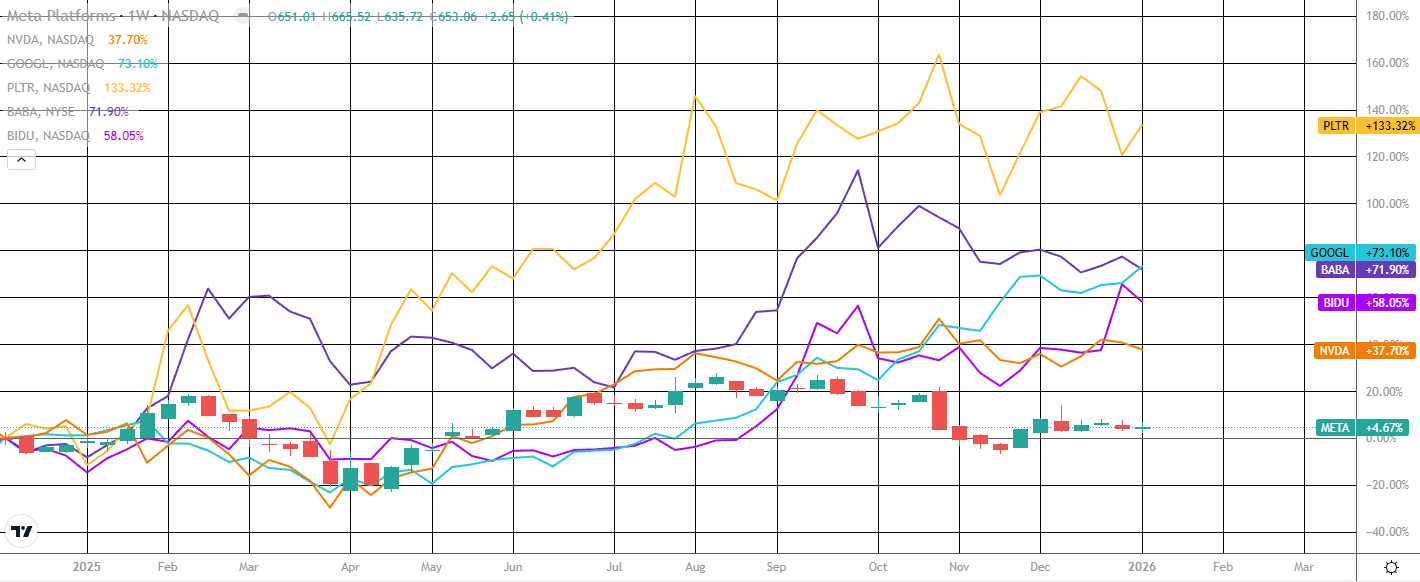

Recent stock performance illustrates this divergence. Several companies most closely associated with aggressive AI capital spending have faced pressure as investors reassess near-term returns. Meta Platforms shares have fallen more than 20% since its third-quarter update in late October, when management outlined substantial capital and expense commitments tied to its pursuit of “superintelligence.”

Oracle has declined nearly 33% since announcing a sharp increase in its remaining performance obligations, later linked to a reported $300 billion OpenAI-related deal. Nvidia, often viewed as the bellwether of the AI trade, has largely tracked the broader market, sitting roughly in line with the S&P 500’s modest gains since its late-August earnings report.

By contrast, stocks moving higher have tended to do so on confidence in their core businesses rather than discounted expectations of AI-driven returns. Alphabet shares have climbed nearly 43% since early September, following a U.S. court ruling that allowed the company to retain control of Chrome and Android despite losing a landmark antitrust case in 2024. Apple, which has yet to excite investors with its longer-dated AI strategy, has risen roughly 34% since late summer, supported by resilient iPhone demand that drove a record $102.5 billion in quarterly revenue.

The pattern suggests a market becoming more selective. Rather than broadly rewarding AI exposure at any cost, investors appear increasingly focused on proven cash flows, defensible franchises, and execution in the core business—using AI as an enhancer rather than the sole justification for valuation.

Part 3: The AI Cold War (USA vs China)

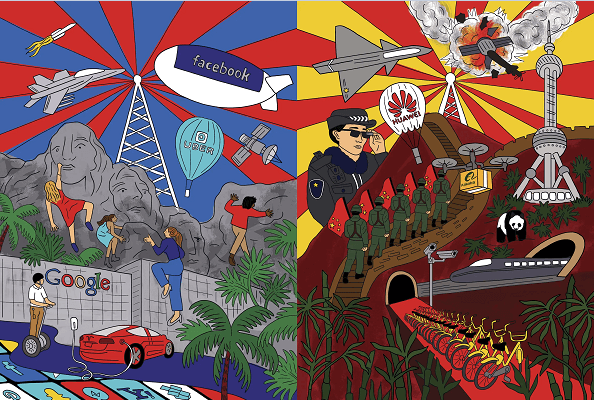

The global race for artificial intelligence leadership is increasingly framed as a strategic competition between the United States and China.

This is not a single contest, but a series of overlapping races across talent, infrastructure, hardware, software, and real-world deployment. Understanding where each country leads and where gaps remain helps clarify both geopolitical dynamics and investment implications.

AI innovation begins with human capital. The U.S. currently holds an advantage, hosting roughly 60% of the world’s most prestigious AI institutions and attracting nearly two-thirds of elite AI researchers. Higher compensation, flexible research environments, and a deep venture capital ecosystem continue to draw top global talent.

China, by comparison, accounts for a smaller share of elite researchers working within its institutions. However, a significant portion of top-tier AI researchers were born in China, highlighting a latent talent pool that could be mobilized through targeted repatriation efforts and national initiatives.

The two countries also differ in how AI development is financed and coordinated. In the U.S., progress is driven primarily by the private sector, supported by a growing policy framework that includes incentives for AI infrastructure and energy development, funding for research and workforce training, and tighter controls on advanced chip exports. This market-led approach has fostered rapid innovation, but it can also result in fragmented execution.

China’s strategy emphasizes speed and coordination. A centralized, state-directed model has enabled rapid construction of AI research parks, national compute infrastructure, and sector-specific deployment programs aligned with government priorities. This top-down approach allows China to mobilize resources efficiently, even if access to cutting-edge chips and global markets remains constrained.

While the U.S. currently leads overall due to its private-sector depth and access to advanced technology, the race is far from settled. China’s pace of development suggests it could narrow the gap over time, and other regions including South Korea, Europe, and the Middle East are emerging as meaningful participants in the global AI ecosystem.

For investors, this competitive landscape creates opportunities across the full AI value chain, from hardware and infrastructure to software platforms and end-use applications. The outcome will not be binary, but shaped by relative strengths in execution, policy, and technological diffusion across regions.

The First Shot in the AI Cold War: Deepseek

Nearly a year ago, DeepSeek sent shockwaves through the global AI landscape.

Markets reacted swiftly and violently as news spread that a relatively unknown Chinese AI lab had developed a model capable of challenging long-held assumptions about U.S. dominance in artificial intelligence.

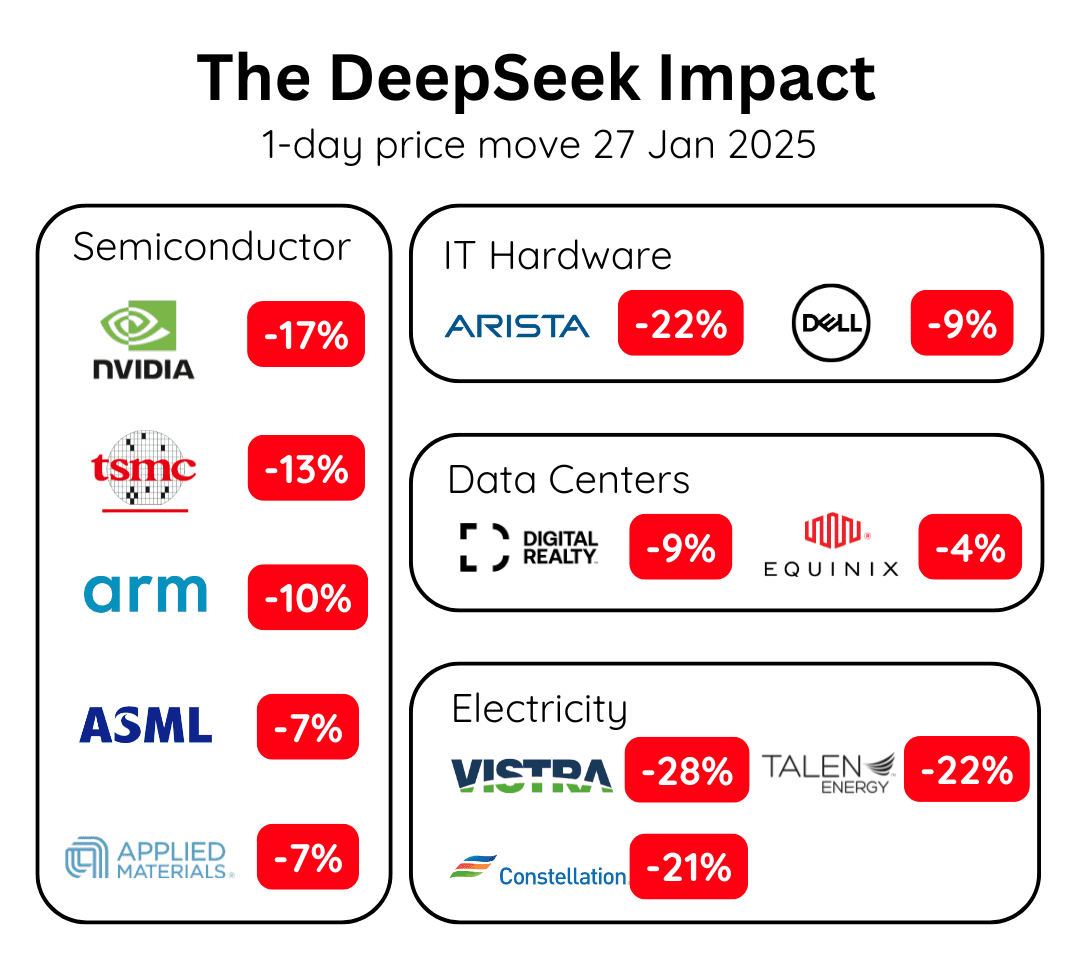

The reaction was immediate: shares of leading Western technology companies sold off sharply as investors reassessed competitive risks.

Nvidia plunged roughly 17%, erasing close to $600 billion in market capitalization in a single session.

Broadcom fell a similar 17%, while ASML dropped around 7% in one day.

The selloff reflected more than short-term panic it exposed how tightly valuations had become tied to the belief that advanced AI would remain an American stronghold.

DeepSeek’s emergence fundamentally altered that narrative.

Until then, China was widely viewed as lagging the U.S. in frontier AI development. DeepSeek suggested that gap may have been far narrower than markets assumed—and that China could leapfrog in select areas.

Venture capitalist Marc Andreessen famously described the release of DeepSeek-R1 as “AI’s Sputnik moment,” evoking the shock of the Soviet Union’s first satellite launch, which reshaped global perceptions during the Cold War and triggered a technological arms race.

What truly unsettled investors was not just model performance, but efficiency. DeepSeek claimed it had trained a leading-edge model using a fraction of the computational resources and capital typically required by U.S. labs. While OpenAI reportedly spent roughly $5 billion in 2024 alone, DeepSeek researchers said DeepSeek-R1 which outperformed OpenAI’s o1 model across several benchmarks was developed for just $5.6 million.

Whether those figures ultimately prove fully comparable is still debated, but the message was clear: AI leadership may not be determined solely by who spends the most, but by who can innovate most efficiently. That realization marked a turning point in how markets view the global AI race.

The initial promise of DeepSeek’s model achieving performance on par with the most advanced AI systems while using far less compute raised immediate concerns across the market.

Investors worried that reduced infrastructure demands could depress revenue for key players like Nvidia and other hyperscalers, potentially upending the AI hardware and services narrative.

Eleven months later, those fears have not materialized. The companies most directly exposed to AI infrastructure demand have not only recovered but continued to grow, demonstrating resilience in the face of technological disruption.

The January launch of DeepSeek-R1 prompted a broad repricing because it fundamentally altered global assumptions about frontier-model efficiency and China’s ability to compete at scale.

The impact was felt most acutely among semiconductors and hyperscalers, as the market recalibrated expectations for compute intensity and revenue growth.

Since that initial release, DeepSeek has rolled out seven additional model updates. None have triggered the dramatic market reactions seen in January, suggesting that investors are now better able to contextualize incremental advances.

Wedbush Securities analyst Dan Ives, however, warns that shocks are not over: “Some of these moments that we’ve seen, we’ll continue to see next year,” highlighting the ongoing potential for sudden market repricing as the global AI race unfolds.

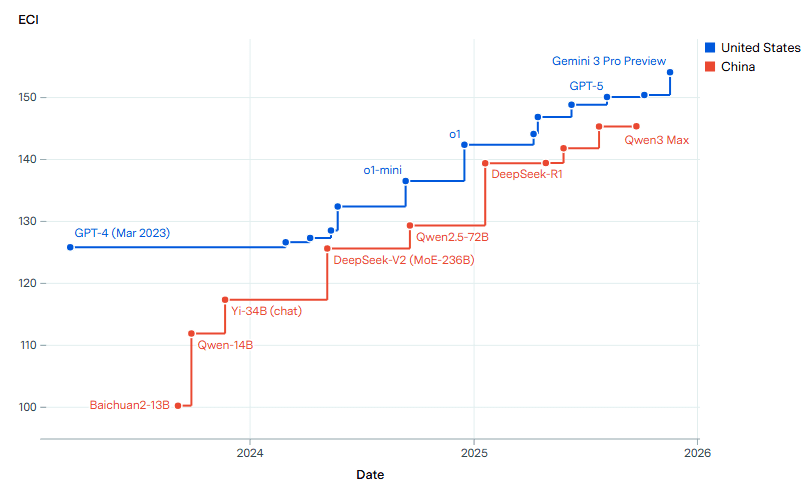

Since 2023, every AI model at the cutting edge measured by the Epoch Capabilities Index—has been developed in the United States.

During the same period, Chinese models have consistently lagged behind U.S. counterparts by an average of seven months, with the gap ranging from a minimum of four months to a maximum of 14.

This lag mirrors the broader performance differences between proprietary and open-weight models.

Nearly all leading Chinese models are released as open-weight, whereas U.S. frontier models remain closed, which helps explain the observed lead in capability and pace of advancement.

Global investors are increasingly placing bets on Chinese AI companies, seeking the “next DeepSeek” while also looking to diversify amid growing concerns of a speculative bubble on Wall Street.

Demand for China’s AI firms is being bolstered by Beijing’s push for technological independence. The government has fast-tracked high-profile listings, including chipmakers Moore Threads dubbed “China’s Nvidia,” and MetaX , both debuting this month. These moves signal Beijing’s commitment to closing the tech gap with the U.S. and supporting domestic AI innovation.

Foreign investors are responding, seeing opportunity as China accelerates its AI chip ecosystem.

This comes even as concerns mount over elevated valuations of U.S.-listed AI stocks.

For context, the Nasdaq currently trades at 31 times earnings, compared with 24 times for Hong Kong’s Hang Seng Tech Index .

The latter provides AI exposure through leading firms such as Alibaba, Baidu, Tencent, and semiconductor foundry SMIC.

The combination of government support, fast-moving IPOs, and international investor interest is creating a rapidly evolving landscape for Chinese AI, offering both opportunity and risk for those seeking global exposure to the sector.

Part 4: AI IPO Landscape, AI M&A Landscape

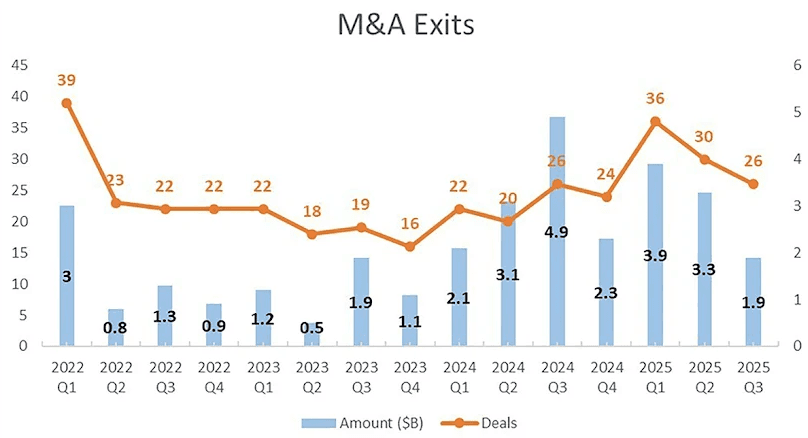

Artificial intelligence has become a central driver of global deals in 2025, reshaping both M&A activity and the IPO market.

The pursuit of AI-driven computing power continues to fuel semiconductor acquisitions, while the broader evolution of AI technologies has shifted attention from companies developing large language models to those building the critical infrastructure that underpins the ecosystem.

After the severe freeze of 2022–2023, any sign of activity in the IPO market felt like a victory.

2025 started with a sense of thaw following a few IPOs in 2024.

Most of these listings initially traded higher, generating optimistic headlines and signaling a tentative return of liquidity to venture-backed investors.

However, the underlying data paints a more measured picture: the market is far from fully recovered.

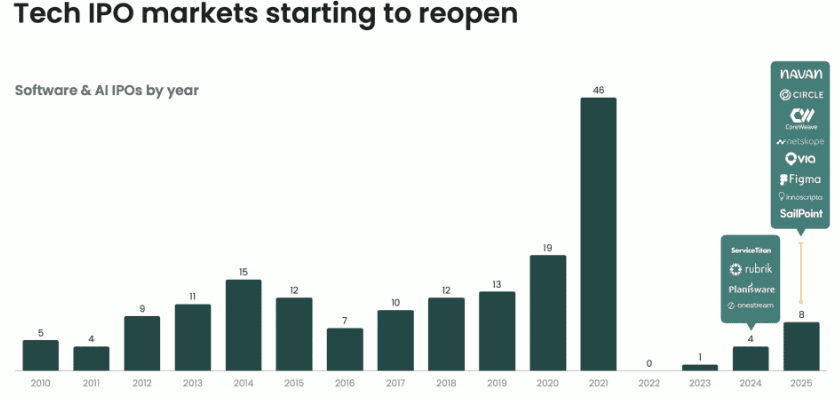

Looking at software and AI IPO volumes:

Boom years (2019–2021):

2019: 13 IPOs

2020: 19 IPOs

2021: 46 IPOs (peak)

In just three years, 78 software and AI companies went public a truly unprecedented window for tech exits.

Crash (2022–2023):

2022: 0 IPOs

2023: 1 IPO

The IPO market essentially shut down, rendering exit strategies nearly irrelevant for most software companies.

Recovery (2024–2025):

2024: 4 IPOs (Rubrik, OneStream, ServiceTitan)

2025: 8 IPOs so far (Maven, Circle, CW, Netskope, Via, Figma, Invoscript, SailPoint, ServiceTitan)

The market is healing but slowly, and from a much deeper wound than many acknowledge.

The October 2025 Navan IPO illustrates this reality.

Despite strong fundamentals $613 million in revenue, 32% growth, and over 10,000 customers the company went public at just 10x revenue, down sharply from the 20–25x multiples typical in 2021.

Investors immediately marked the stock down roughly 20% post-IPO.

This was not a sign of a recovered market; it was a reminder that, even in the era of AI optimism, the IPO landscape remains highly selective and functional only for the very strongest companies.

The adoption of AI has moved decisively from hype to operational necessity. Companies are no longer investing solely in software; the race now encompasses integrated AI hardware, cloud infrastructure, and specialized vertical solutions.

Big Tech Spending: U.S. tech giants are committing over $320 billion in planned AI investments for 2025. Microsoft, Meta, and Google alone are channeling hundreds of billions annually into AI infrastructure, fueling a wave of strategic acquisitions across data centers, chip designers, and AI-focused hardware firms.

AI-First Hardware: OpenAI’s $6.5 billion acquisition of io Products, an AI-driven hardware startup co-founded by legendary Apple designer Jony Ive, highlights the growing convergence of design, hardware, and generative AI. This transaction signals a push toward dedicated AI-native devices and deeper integration of conversational AI into everyday technology.

Energy Infrastructure: The AI expansion is also reshaping energy markets. Anticipating a long-term “supercycle” in power demand, major players have made large-scale acquisitions: Constellation Energy’s $26.6 billion purchase of Calpine and NRG Energy’s $12 billion acquisition of gas-fired power plants are directly linked to the need to support AI data centers.

Acquihiring for Talent: Beyond products and infrastructure, large tech companies are increasingly acquiring startups to secure elite AI talent.

These acquihires accelerate innovation, strengthen technical capabilities, and help maintain a competitive edge in a rapidly evolving AI landscape.

Across software, hardware, and energy, AI is no longer optional it has become a core operational driver shaping strategic corporate moves and investment opportunities.

Part 5: Sharks’ Favorite AI Stocks

With the exception of PONY and KDK, which we’ve already highlighted, there are several other names firmly on our radar within the AI ecosystem. These aren’t speculative concepts or hype-driven trades.

They are companies positioned along critical layers of the AI value chain, where real capital is being deployed and real demand is materializing.

Our focus remains on businesses that benefit from the AI buildout regardless of which model or application ultimately wins. That means prioritizing infrastructure, hardware, and “picks-and-shovels” providers with durable demand, improving fundamentals, and long runways for growth.

Company: Schrodinger, Inc

Quote: SDGR

BT: $18

ST: $34

Sharks Opinion:

SDGR is a name many Sharks members will recognize, as it’s a stock we’ve traded successfully in the past.

What’s changed and why it’s back on our radar is the company’s evolution in 2025 into a much cleaner, more focused healthcare AI story.

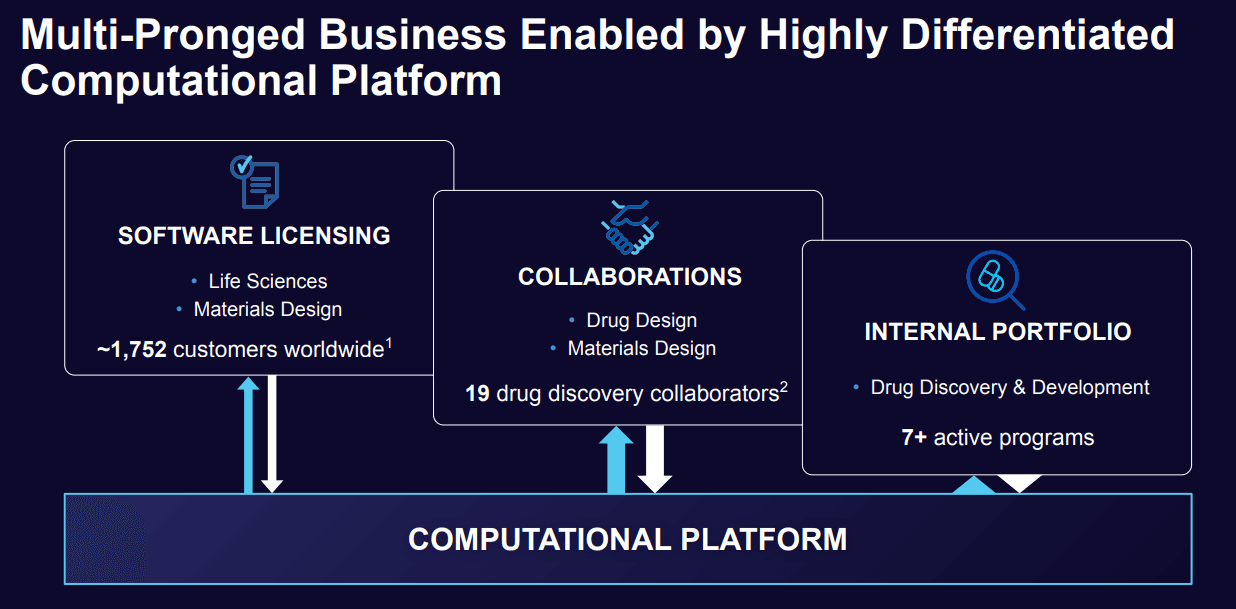

Schrödinger’s strategic refocus on its core software operations has simplified the business materially, reducing both operational complexity and cash burn that previously stemmed from its clinical development programs.

This shift matters. By prioritizing its high-margin software platform over capital-intensive drug development, Schrödinger is positioning itself as a pure-play healthcare technology company rather than a hybrid biotech with uneven risk exposure. The result is a more predictable revenue profile and a clearer path to scalability as pharmaceutical companies increasingly lean on computational tools to cut costs and shorten development timelines.

From a valuation perspective, we view SDGR as compelling. The stock is trading at roughly three times 2026 consensus revenue estimates, which we believe understates the long-term value of its platform given its strategic importance to modern drug discovery. For investors looking for exposure to AI in healthcare without taking on binary clinical trial risk SDGR stands out as one of the most attractive options in the space.

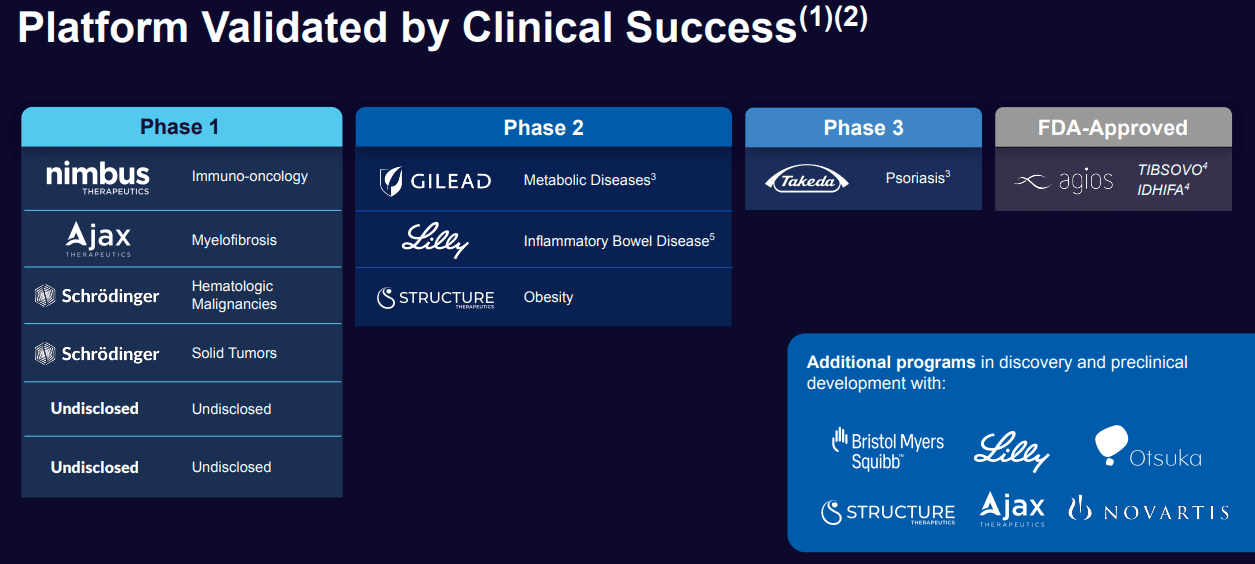

At its core, Schrödinger develops advanced computational platforms that combine physics-based molecular modeling with artificial intelligence to accelerate drug discovery. As AI adoption shifts from experimentation to necessity across pharma, tools like Schrödinger’s are becoming embedded in R&D workflows, positioning the company as a quiet but critical beneficiary of the AI healthcare buildout.

Description: Schrodinger Inc is a healthcare-based software company. Its operating segments are Software and Drug discovery. Through the Software segment, the company is focused on selling software to transform drug discovery across the life sciences industry and customers in materials science industries. In the Drug discovery segment, it is engaged in generating revenue from a portfolio of preclinical and clinical programs, internally and through collaborations. It generates revenue from the sales of software solutions and from research funding and milestone payments from its drug discovery collaborations.

Schrödinger is ultimately aiming at one of the largest and most entrenched spending pools in the world: the $100–$150 billion in annual pharmaceutical R&D.

The company’s core thesis is straightforward but powerful. Instead of physically synthesizing and testing thousands of molecules in a lab, Schrödinger enables pharma companies to generate and evaluate billions of molecules in a physics-based simulation environment.

Artificial intelligence then narrows that universe down to a small set of the most promising candidates, allowing laboratories to synthesize and test only a few dozen high-probability molecules. The potential cost and time savings for drug development are enormous, which is what gives Schrödinger such a large and durable total addressable market.

Rather than relying solely on a traditional enterprise sales cycle to penetrate Big Pharma, Schrödinger took a more aggressive and strategic approach. The company began using its own platform internally to generate drug candidates and form partnerships.

This strategy has already produced tangible results. One of the most notable examples is Morphic, which was acquired by Eli Lilly and generated approximately $48 million in revenue for Schrödinger, while also embedding potential long-term royalty streams tied to drugs now sitting inside Lilly’s pipeline.

Over time, management’s vision is for Schrödinger to evolve into a hybrid model: part high-margin, recurring software revenue and part royalty-driven cash flows from partnered or licensed drug programs.

The royalty component is not expected to move the needle overnight. Management has been clear that it will likely take six to seven years for these royalty streams to meaningfully compound. But if successful, this structure could create a powerful long-term flywheel, combining predictable software revenue with asymmetric upside from drug commercialization.

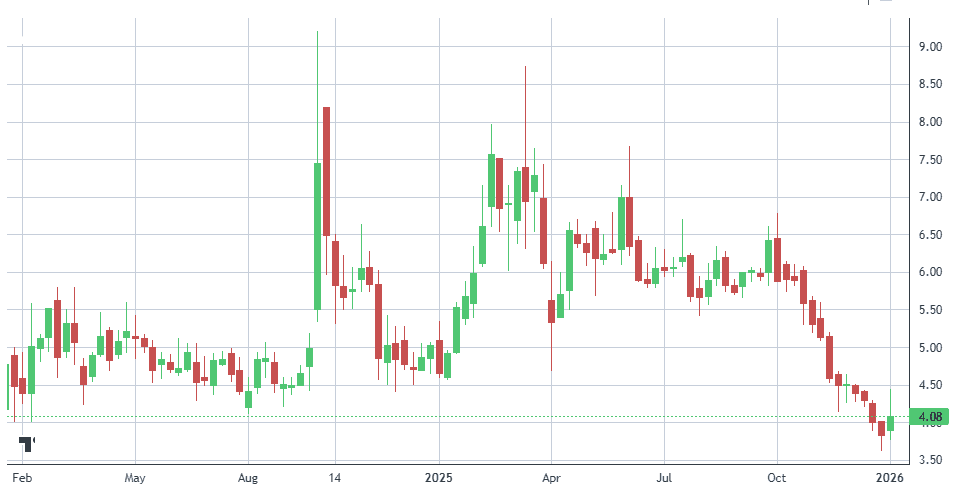

Company: Yiren Digital

Quote: YRD

BT: $3.50 -$4.00

ST: $6-$8

Sharks Opinion:

Yiren is a relatively new name for us, but after spending weeks scanning through a wide range of Chinese AI plays outside of PONY that fit our criteria for a swing trade, Yiren consistently stood out. There is a lot happening beneath the surface with this company, which is why we’re still somewhat on the fence. That said, if our thesis plays out, this could turn into a meaningful winner in 2026 once the broader market begins to pay attention.

What makes Yiren particularly interesting is its positioning within China’s AI ecosystem and its indirect exposure to the DeepSeek narrative. As investors continue to reassess China’s competitiveness in advanced AI models and infrastructure, names with credible linkages to that ecosystem could see a repricing. Yiren, in our view, functions as a de-facto way to express that theme without going directly into the most crowded or obvious trades.

At this stage, the setup is more about asymmetry than certainty. The downside comes from limited visibility and market awareness, while the upside comes from a potential shift in sentiment as capital rotates toward under-the-radar Chinese AI names. If the DeepSeek narrative continues to gain traction and Chinese AI momentum builds into 2026, Yiren is a name we want firmly on the radar.

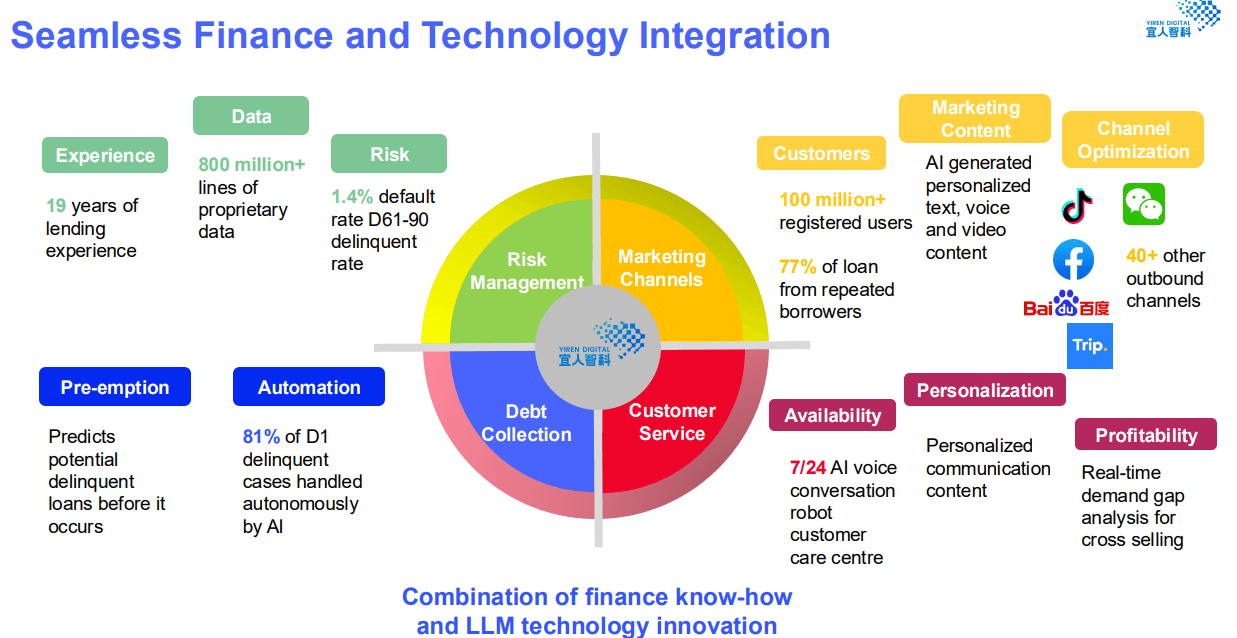

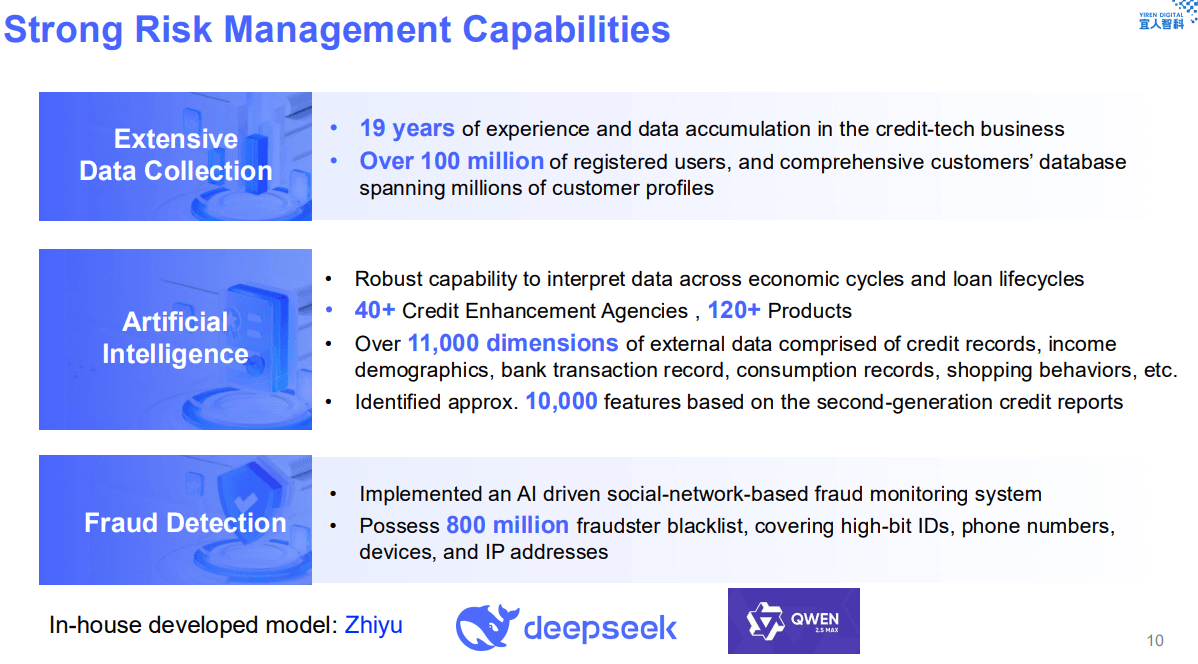

Description: Yiren Digital Ltd is an AI-powered platform providing a comprehensive suite of financial and lifestyle services in China. Its mission is to elevate customers' financial well-being and enhance their quality of life by delivering digital financial services, tailor-made insurance solutions, and premium lifestyle services. The company supports clients at various growth stages, addressing financing needs arising from consumption and production activities, while aiming to augment the overall well-being and security of individuals, families, and businesses.

Yiren Digital is not a new company, but it is a newly evolving one. Founded in 2012 under the CreditEase umbrella, Yiren has spent more than a decade building a digital financial services platform that now sits at the intersection of fintech, data, and AI-driven decision-making.

What’s changed recently is the company’s ambition and its willingness to reposition itself for the next phase of growth.

The most important development is Yiren’s move into AI-powered innovation through its integration with DeepSeek. This is not a cosmetic upgrade. By embedding advanced AI models into its platform, Yiren is aiming to improve credit assessment, operational efficiency, and customer engagement at scale.

In a sector where margins are won or lost on risk pricing and automation, AI becomes a structural advantage, not just a feature.

From a business-model standpoint, Yiren is relatively straightforward once you break down the income statement.

Its core revenue engine is loan facilitation.

The company specializes in small, revolving consumer loans, which account for roughly half of total revenue. Crucially, Yiren does not lend from its own balance sheet. Instead, it operates as a facilitator connecting borrowers with funding partners and earning fees for origination, servicing, and risk management.

This asset-light structure limits balance-sheet risk while allowing the company to scale volumes more efficiently.

Layered on top of this core is a broader push toward diversification through technology, international expansion, and adjacent financial services.

When you combine an established fintech platform with AI-driven underwriting and automation especially one tied into the DeepSeek ecosystem you get a business that looks less like a legacy Chinese fintech and more like a re-rated AI-enabled financial infrastructure play.

For investors, the story is not about what Yiren was, but what it is becoming. If AI integration translates into better unit economics and renewed growth, this is the kind of transition that markets often price in late creating opportunity for those paying attention early.

Company: Alpha and Omega Semiconductor

Quote: AOSL

BT: $18

ST: $28-$32

Sharks Opinion:

AOSL is not a core long-term compounder in our view, but it does stand out as an interesting flyer tied to the semiconductor cycle. This is very much a tactical name rather than a fundamental conviction play.

At its current levels, AOSL fits the profile of a classic “cigar butt” setup limited expectations, depressed sentiment, and asymmetric upside if the semi cycle turns more favorable.

The stock doesn’t need a reinvention story to work as a trade; it simply needs incremental improvement in demand, inventory digestion, or broader sector momentum for capital to rotate back into laggards like this.

From a trading perspective, the setup is clean. Semiconductor cycles tend to reward names that have been left for dead once conditions stabilize, and AOSL has the balance-sheet resilience to participate in that kind of rebound. If the group heats up, multiple expansion alone could drive a meaningful swing without fundamentals materially changing.

That said, this is not a long-term hold. Growth visibility remains weak, the fundamental story lacks catalysts beyond the cycle itself, and there’s little evidence yet of a sustained earnings inflection. We view AOSL as a short-to-medium-term opportunity to express a view on the semi cycle not a business to own through it.

In short: attractive as a swing, questionable as a long, and worth watching closely if semis regain momentum.

Description: Alpha & Omega Semiconductor Ltd designs, develops and supplies a portfolio of power semiconductors targeting various applications, including personal computers, flat-panel TVs, LED lighting, smartphones, battery packs, consumer and industrial motor controls and power supplies for TVs, computers, servers and telecommunications equipment. It generates revenue mainly from the sale of power semiconductors, consisting of power discretes and power ICs with a presence in Hong Kong, China, South Korea, the United States and other countries. It operates in one operating segment: the design, development and supply of power semiconductor products for computing, consumer electronics, communication and industrial applications.

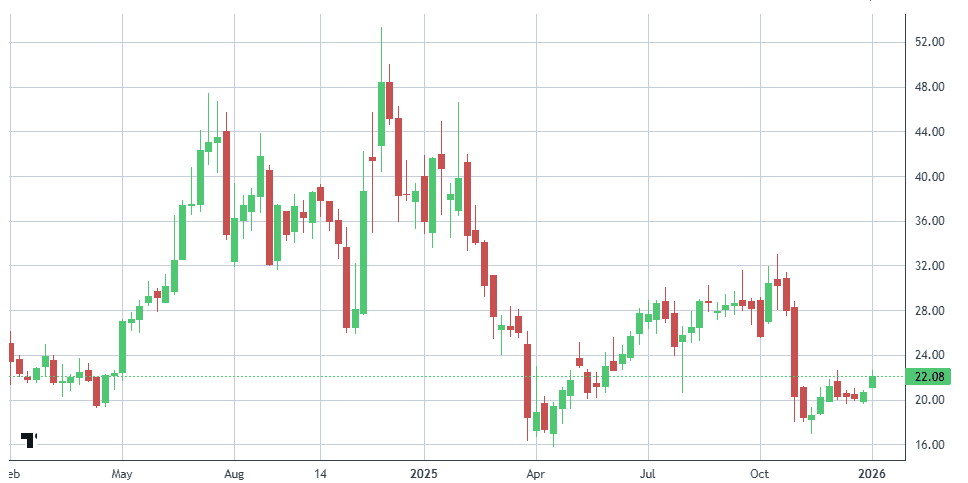

Company: C3.ai, Inc.

Quote: AI

BT: $12-$14

ST: $24-$28

Sharks Opinion:

On our watchlists last year, we flagged C3.ai as a potential M&A candidate and that thesis moved from speculation to confirmation. Management announced the company is formally exploring strategic alternatives, including a possible sale.

The market’s reaction was counterintuitive: shares sold off roughly 5% on the news, despite buyout headlines typically triggering upside. We see that weakness as an opportunity rather than a red flag, especially in a tape still dominated by AI-driven narratives.

C3.ai remains one of the most speculative names in the AI universe, not because of its cash position or survival risk, but because of what it represents.

Once positioned as an early enterprise AI pioneer, the company has struggled to keep pace since its 2020 IPO, gradually losing mindshare to faster-moving platforms like Palantir and newer model-centric players such as Anthropic.

Execution has been uneven, growth has disappointed at times, and the stock has spent years de-rating.

That said, the real asset here may not be the operating business it’s the ticker, the public shell, and the branding. In today’s market, “AI” still commands a premium.

With a roughly $2.5 billion market cap and about $400 million in annual revenue, C3.ai could function as a clean reverse takeover vehicle for a high-growth private AI company looking for speed, liquidity, and instant recognition in public markets.

For firms like Anthropic or Perplexity AI both scaling rapidly but still private C3 offers a ready-made public platform, existing enterprise relationships, and a recognizable name that shortens the path to market.

This is not a fundamentals-first investment. It’s a narrative and optionality trade. But in an environment where momentum, symbolism, and strategic scarcity often matter more than near-term earnings, C3.ai has a non-zero chance of reinventing itself as the gateway listing for the next major AI disruptor. That asymmetry is what makes the setup interesting here.

Description: C3.ai Inc is an enterprise artificial intelligence company. The company provides software-as-a-service applications that enable customers to rapidly develop, deploy, and operate large-scale Enterprise AI applications across any infrastructure. It provides solutions under three divisions namely, The C3 AI Platform, which is an end-to-end application development and runtime environment for designing, developing, and deploying AI applications: C3 AI Applications, which is a portfolio of pre-built, extensible, industry-specific, and application-specific Enterprise AI applications: and C3 Generative AI, which combines the utility of large language models. Geographically the company derives revenue from North America, Europe, the Middle East and Africa, Asia Pacific, and the Rest of the World.