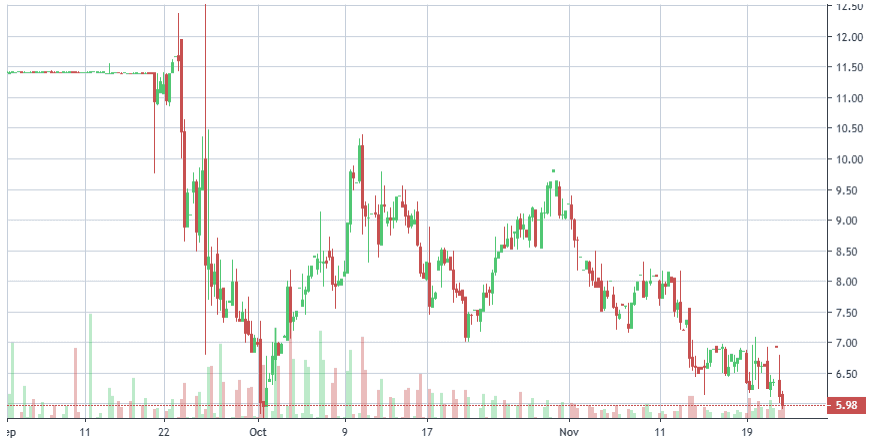

KDK’s first months on the Nasdaq were nothing short of a rollercoaster sharp swings, abrupt sentiment shifts, and a level of volatility that quickly defined its early trading identity.

After the debut buzz wore off, the stock slipped into a steep slide. Shares fell 22% on September 26, and the decline continued into the end of the month as traders grew wary of SPAC-related dilution, heavy cash redemptions, and concerns that the company’s post-merger foundation wasn’t stable enough to support its initial valuation.

By October 1, the stock had dropped another 13%, closing at $5.96 an undeniably rough start for a newly public company still trying to find its footing.

Then, almost overnight, everything reversed.

On October 2, news broke that Soros Fund Management had taken a 5.7% stake. The effect was immediate: the stock jumped 14.6%, marking the first real show of confidence from institutional money. The following day, momentum accelerated when Cathie Wood’s ARK Invest disclosed a position of its own, sending shares up another 8.8% to finish at $7.43.

That combination a deep de-SPAC selloff followed by two high-profile institutional endorsements—is exactly what put KDK squarely on our radar. It transformed what looked like early structural weakness into an argument for renewed confidence and long-term validation.

However, the story didn’t stop there.

KDK’s first quarterly earnings report as a public company arrived at arguably the worst possible moment: during a widespread sector pullback driven by valuation concerns, profit-taking, and broader market weakness.

The results themselves were disappointing, and the stock drifted back below $6, retracing nearly the entire Soros/ARK surge.

Given the current market tone and the earnings miss, it’s no surprise the stock is down.

Even so, we remain confident in KDK’s long-term trajectory.

The company is still early in its public-market life cycle, and this kind of turbulence is common especially in a sector where sentiment swings rapidly and liquidity can exaggerate every move.

We view the recent dip as an opportunity, not a warning sign.

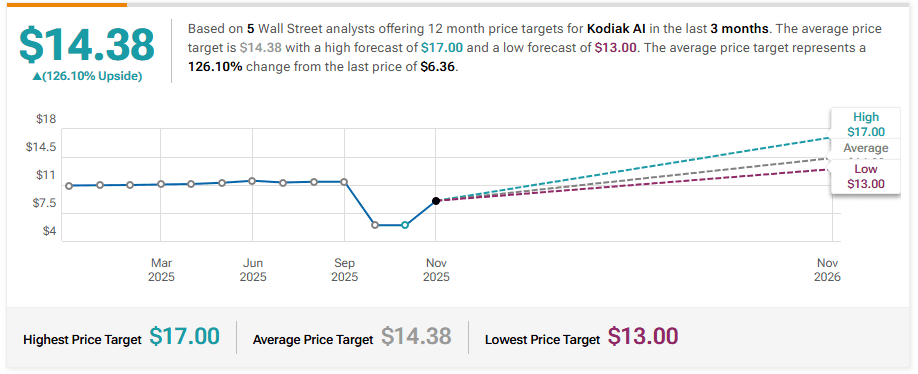

For positioning purposes, we see room for a short-term recovery toward $12, which roughly aligns with its initial listing price, and a long-term upside target above $20 as the company builds traction, executes on its strategy, and stabilizes investor expectations.

For now, we’re taking the trade step-by-step a swing setup with a long-term growth runway in a volatile but genuinely promising category.

In short:

$12 swing target

$20+ long-term target

Kodiak AI released its third-quarter 2025 results this week—its first earnings report since entering the public markets and the update offered a clear look into how the company is positioning itself for the next phase of autonomous trucking. Management emphasized accelerating operational momentum, growing customer engagement, and what they describe as a solid financial runway as the company approaches 2026.

Operationally, Kodiak highlighted a series of technical and regulatory achievements that materially shaped the quarter.

The company received the top safety score in a Nauto-conducted evaluation, a validation that adds credibility to its broader commercialization narrative. Kodiak also secured a federal waiver allowing the use of electronic warning beacons instead of physical reflective triangles when a driverless truck becomes disabled roadside.

While seemingly small, this removes a meaningful real-world barrier: the inability of a fully autonomous vehicle to deploy physical safety equipment without a human present.

The company also began hauling double trailers within its industrial freight segment a move that expands payload capacity and demonstrates an increasingly flexible operational profile. Kodiak further strengthened its technological foundation by integrating NXP’s ISO 26262–certified processors into its compute architecture, a requirement for advanced automotive safety standards.

Meanwhile, the partnership with ZF deepened, culminating in the supply commitment for 100 advanced steering systems, signaling shared confidence between hardware suppliers and Kodiak’s long-term platform.

Financially, Kodiak closed the quarter with $146.2 million in cash and equivalents, bolstered by proceeds from its merger with Ares Acquisition Corporation II.

Management reiterated that the company’s path to scaled revenue will rely heavily on its Driver-as-a-Service (DaaS) model servicing long-haul, industrial, and defense markets through recurring, usage-based revenue rather than solely through hardware sales. This approach, they argue, offers a more capital-efficient commercial structure and provides customers an easier entry point into driverless freight operations.

For the quarter, Kodiak reported $770,000 in revenue, up 92.5% year over year a small base, but strong directional growth for a company still early in commercial deployment. Total assets reached $177.8 million, representing a more than 400% increase since the end of 2024, reflecting both the SPAC merger and investments into scaling infrastructure.

Research and development spending rose 29% YoY to $13.5 million, consistent with the push toward technical maturity, while operating lease liabilities declined nearly 16%, showing better balance sheet management. The company posted a net loss of $269.9 million, significantly wider than the $19.1 million loss recorded in the same quarter last year driven largely by merger-related accounting charges, increased R&D, and scaling costs typical of autonomous vehicle companies pre-revenue.

Looking forward, management reiterated expectations tied to its earlier-announced agreement with Atlas Energy Solutions, which includes an initial deployment of 100 driverless trucks. Commercial long-haul autonomous operations remain on track for the second half of 2026, pending continued progress in safety validation, customer integration, and federal and state regulatory coordination.

Kodiak framed the quarter as a meaningful proof point: tangible progress across safety, operations, technology, and partnership depth. While still early in its commercialization journey and still operating with losses that reflect that stage the company is positioning itself as a differentiated player in the movement toward scalable autonomous trucking.

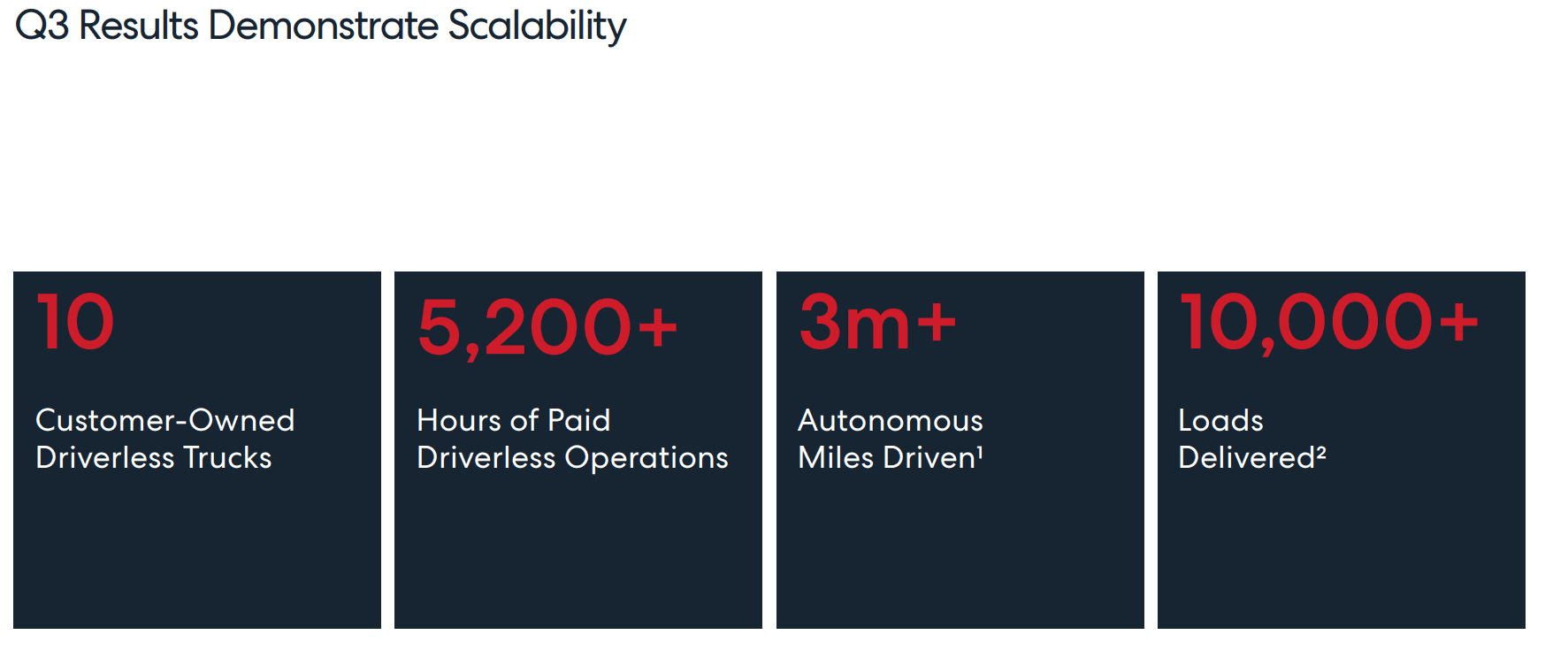

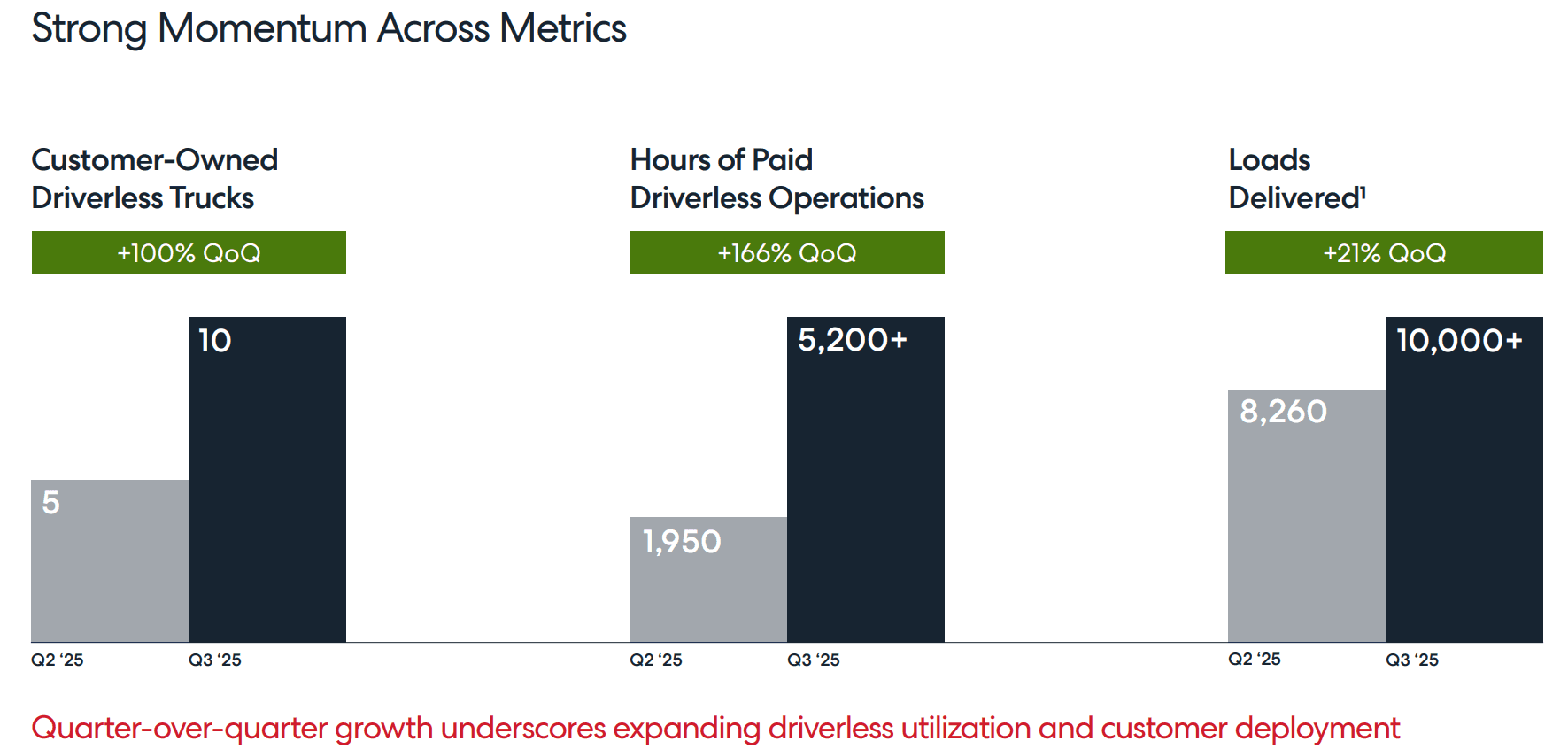

Kodiak continues to scale its autonomous freight network at a pace that stands out within the industry. During the third quarter, the company doubled the size of its fully driverless fleet, moving from five autonomous Class 8 trucks at the end of Q2 to ten active driverless units in commercial service by quarter-end. This marks one of the most significant step-ups in operational capacity the company has achieved since launching its platform.

As the fleet expanded, activity levels rose sharply. Kodiak reported more than 5,200 cumulative hours of paid driverless operations, representing a 166% increase compared to the end of Q2. That growth is not theoretical it is a direct reflection of real freight being moved autonomously, under contract, in live commercial environments.

The trucks also extended their long-term performance milestones. Kodiak surpassed three million autonomous miles driven and exceeded 10,000 customer loads delivered to date. These figures highlight the company’s steady transition from pilot-phase testing to scaled, revenue-generating deployment. In an industry where many competitors remain stuck in trial programs, Kodiak is demonstrating sustained performance in real-world conditions.

A key driver of this ramp-up is the company’s growing alignment with enterprise logistics partners. Atlas Energy Solutions, one of Kodiak’s flagship customers, had 10 driverless Kodiak-powered trucks deployed as of the end of Q3. This represents the early phase of what Kodiak describes as the largest known driverless trucking contract in the world a 100-truck commitment that underscores both customer confidence and long-term commercial visibility.

Founder and CEO Don Burnette emphasized on the earnings call that the operational scaling seen in the quarter is only the beginning. The company expects deployment numbers, customer load volumes, and operating hours to accelerate materially as it moves closer to its 2026 timeline for commercial long-haul driverless operations.

In short, Kodiak is doing what most autonomous trucking companies have struggled to prove: consistent scaling, real customers, real miles, and real freight moved autonomously. The ramp from here will determine whether Kodiak can convert its early operational lead into meaningful commercial dominance.

Kodiak’s commercial framework continues to center on its Driver-as-a-Service (DaaS) model, which the company positions as the autonomous equivalent of traditional human-driver compensation. Instead of paying wages, benefits, and overhead tied to a physical driver, fleet operators instead pay a recurring software and services fee to access the Kodiak autonomous driving stack.

As CEO Don Burnette explained, the structure is deliberate:

“This DaaS model allows us to generate recurring revenue while keeping our balance sheet relatively asset light.”

That asset-light positioning is critical. Rather than owning and operating large fleets an approach that demands heavy capital Kodiak enables customers to deploy the autonomous system on their own trucks, converting high-capex hardware operations into a scalable, software-driven revenue model. The result is higher margin potential, clearer revenue predictability, and reduced operational drag as the company grows.

Looking forward, Kodiak expects adoption to accelerate materially beginning in 2026. A major catalyst will be the ramp-up of its 100-truck deployment with Atlas Energy Solutions, which remains one of the most significant commercial commitments in the industry. Management also believes the company is positioned to benefit from strengthening federal support, rising interest in autonomous freight from government agencies, and expanding defense-related investment in autonomous mobility systems.

Kodiak AI’s growth trajectory is anchored in a network of strategic partnerships that accelerate its transition from development-stage innovator to a scaled commercial operator.

These alliances do more than validate the company’s technology they create the infrastructure, demand pipeline, and operational credibility needed for widespread adoption across both commercial and defense markets.

At the center of this ecosystem is Atlas Energy Solutions, arguably Kodiak’s most important early customer. Atlas operates Kodiak-enabled trucks around the clock in the Permian Basin, providing continuous, real-world freight activity rather than controlled pilot testing. The landmark 100-truck order represents one of the largest commercial deployments of autonomous freight vehicles anywhere in the world. It is a live demonstration of Kodiak’s operational maturity and an early template for broad, industrial-scale rollout.

But Atlas is just the beginning. Kodiak has built a roster of partnerships with some of the most influential players in the freight and transportation industry Kenworth, Bridgestone, C.R. England, J.B. Hunt, and Werner Enterprises, among others.

These relationships give Kodiak something no competitor can easily replicate: early access to real fleet data, deep integration opportunities at the OEM and carrier levels, and high-volume testing corridors that meaningfully accelerate adoption. Each partnership expands the company’s reach while embedding its technology deeper into the logistics ecosystem.

On the national security front, Kodiak’s contract with the U.S. Department of Defense specifically the U.S. Army adds a critical layer of diversification. Defense logistics demand resilience, modularity, and extreme-condition performance, all of which help strengthen the durability of Kodiak’s platform. Government work also brings long-cycle revenue streams and strategic validation that can influence broader regulatory and commercial acceptance.

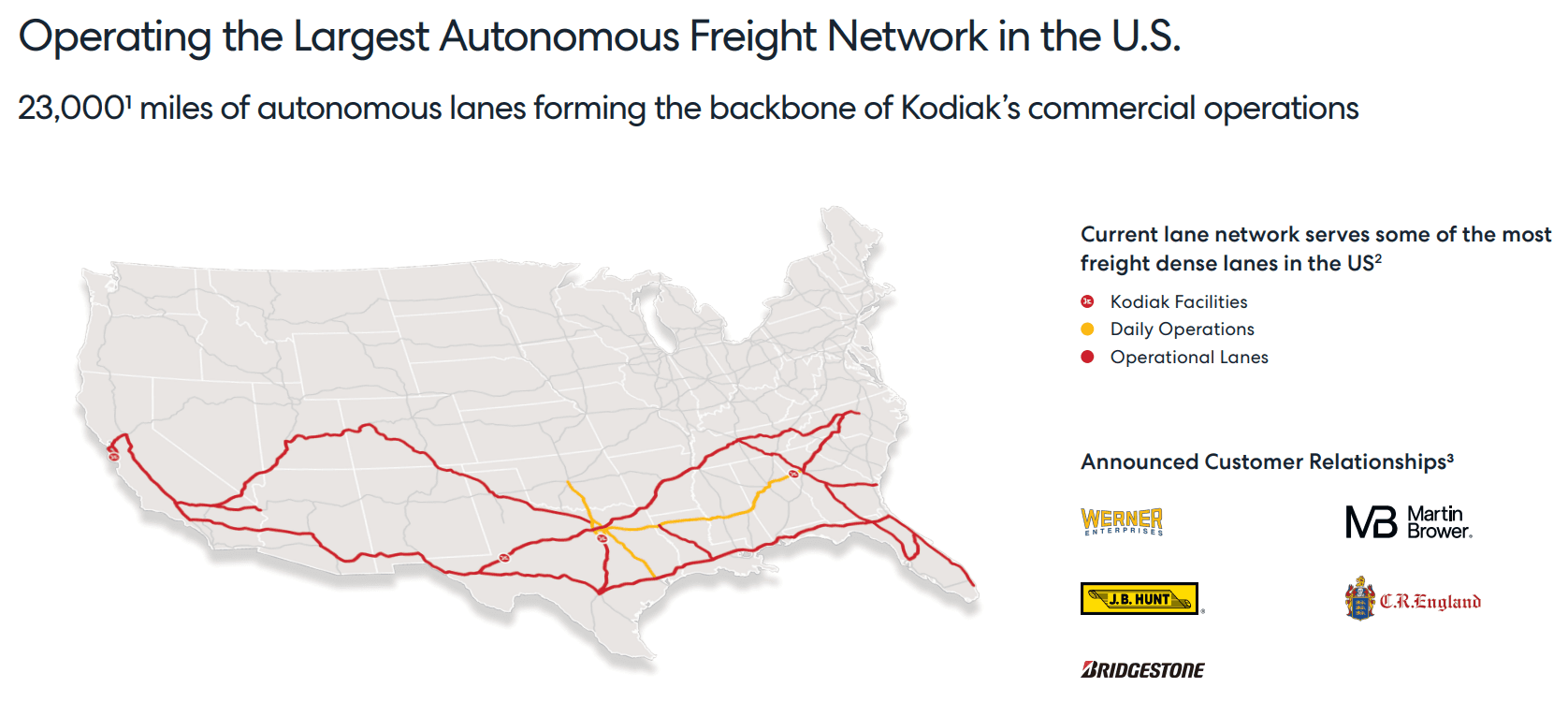

Operationally, Kodiak is rolling out autonomy through a phased market-entry strategy, targeting highway corridors that are structurally suited for autonomous operations. These routes have already been validated across varied weather, terrain, and traffic conditions, demonstrating that the system can perform consistently under the demands of long-haul freight.

Importantly, Kodiak is positioning itself not as a disruptor looking to replace existing supply chains, but as a force multiplier for them. By working directly with national carriers, OEMs, and logistics operators, the company ensures its system integrates seamlessly into established networks rather than attempting to rebuild them from scratch.

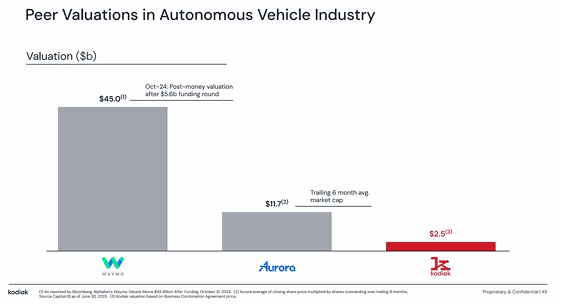

When you line Kodiak up against the rest of the autonomous-freight sector, the valuation gap is impossible to ignore. Waymo, under Alphabet, is estimated at roughly $45 billion. Aurora Innovation has held a six-month trailing market cap near $11.7 billion.

Kodiak, meanwhile, sits dramatically below both, despite having something neither competitor can match: a blend of commercial deployments, federal partnerships, and real, contracted revenue already in motion.

The company is approved to operate across 24 U.S. states, is supplying technology to both commercial carriers and the Department of Defense, and has thousands of autonomous trucks scheduled for deployment by 2027. Even more importantly, Kodiak runs with a leaner cash-burn profile than Aurora, giving it a capital-efficiency advantage that the broader market hasn’t fully priced in.

That doesn’t mean the road ahead is smooth. Competition in autonomous freight is intensifying, and the entire sector still carries the stigma of SPAC-era overhangs. Kodiak also provides limited financial disclosures, forcing investors to weigh the gap between promise and execution. The company still must prove it can scale beyond pilots and show its Driver-as-a-Service model can produce durable, recurring cash flow at scale.

But momentum is shifting. Institutional capital has begun to validate the story. George Soros and Cathie Wood have both taken positions—two names that don’t move unless they see asymmetric upside. Their involvement signals that Kodiak isn’t being evaluated as a speculative moonshot but as a legitimate challenger to the incumbents in autonomous logistics.

In other words: the market may still be uncertain, but smart money is already positioning ahead of the re-rating.

Chardan Capital Maintains Buy on Kodiak AI, Maintains $22 Price Target

TD Cowen Initiates Coverage On Kodiak AI with Buy Rating, Announces Price Target of $14

Citigroup Initiates Coverage On Kodiak AI with Buy Rating, Announces Price Target of $13.5

Cantor Fitzgerald Initiates Coverage On Kodiak AI with Overweight Rating, Announces Price Target of $13