This is a list of stocks that members asked us to do extra research on none of these are alerts/buy/sell recommendations.

Company: Exzeo Group, Inc.

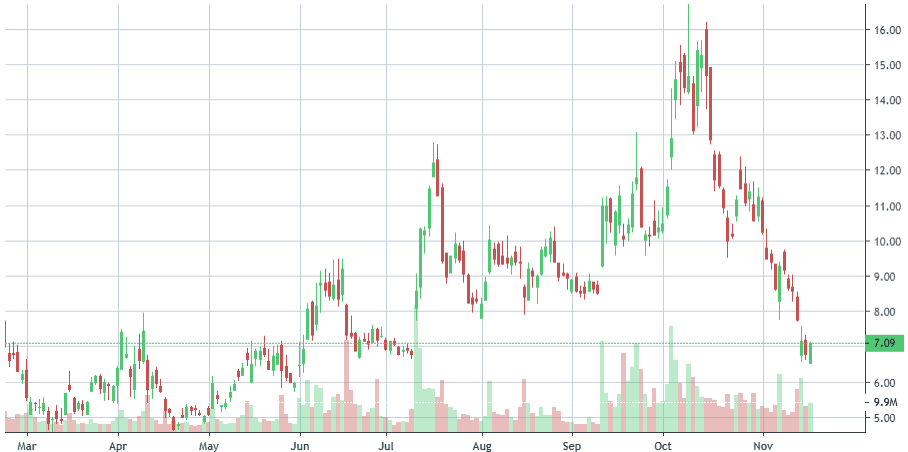

Quote: $XZO

BT: $12- $15 (there's still room to fall more pre lock up)

ST: $21- $24

Sharks Opinion:

XZO’s debut as a spin-off IPO has already drawn comparisons to Lemonade’s early days not because it’s reinventing insurance, but because it brings a layer of technology that could make it strategically valuable over time. It isn’t a category disruptor yet, and given the recent issuance, any realistic M&A timeline remains distant. Still, the structure of the spin sets the stage for something more interesting than a routine separation.

A More Strategic Split Than It Appears

The Exzeo spin-off represents more than a corporate clean-up inside HCI Group. It suggests that a once-embedded tech platform has matured to the point where it can operate and scale independently. For shareholders, that separation could prove meaningful. If management executes as planned, investors may enter 2026 holding positions in two more focused, more specialized companies, each with clearer operating priorities and their own catalysts.

With a defined roadmap, a product suite built around operational efficiency, and a leadership team that has already proven itself within HCI, Exzeo’s IPO is quickly becoming one of the more closely followed listings of the year. The growth story is early, the optionality is real, and while it’s not yet obvious whether XZO becomes a consolidation target or a scaled operator in its own right, its public-market debut marks the beginning of a narrative worth tracking.

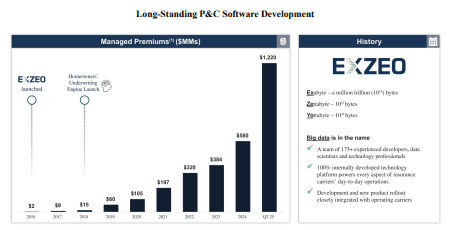

Description: Exzeo Group Inc provides turnkey insurance technology and operations solutions to insurance carriers and their agents based on a proprietary platform of purpose-built software and data analytics applications that are specifically designed for the property and casualty, or P&C, insurance ecosystem. Its Insurance-as-a-Service (IaaS) platform, which it refers to as the Exzeo Platform, currently includes nine configurable software and data analytics applications that are purpose-built to serve insurance companies and other customers in the insurance value chain. Through the Exzeo Platform, the company provides technology-based solutions and services for all operational and administrative activities and functions needed by P&C insurance carriers and their agents.

Exzeo Group isn’t an insurance company reinventing the wheel it’s the technology layer sitting underneath the property-and-casualty value chain, now being pushed into the public markets after a decade of development inside HCI Group. The platform delivers software, automation, and advanced analytics to insurers, MGAs, and brokers, positioning itself squarely in the growing demand for digitization across underwriting, claims, and distribution.

A Decade in the Making

Exzeo began as an internal initiative at HCI Group, where it was built to power the parent’s own underwriting, policy administration, and claims systems. Over ten years, that internal tech stack evolved into a commercial-grade platform—eventually leading to the 2025 spin-out so it could serve external clients at scale.

Post-IPO, HCI will continue to own approximately 75% of the business and consolidate Exzeo’s financials. But structurally, Exzeo will operate with full independence, responsible for its own product roadmap, client acquisition, and capital allocation. The split gives both firms cleaner strategic identities and clearer investor narratives.

A Solid Financial Base at the Time of Listing

Exzeo’s S-1 forecasts revenue between $162.0 million and $165.3 million for the 12 months ending September 30, 2025 a meaningful size for an insurtech still early in its commercial expansion. The revenue mix leans heavily on recurring software subscriptions, supplemented by services and consulting engagements tied to onboarding and system integration.

Because Exzeo is not an insurer, it carries none of the balance-sheet risk associated with underwriting or loss reserves. Its margin profile will be driven by software scale, data-processing efficiency, and the speed at which customers adopt its tools across multiple functions.

Technology at the Center

Exzeo continues to invest deeply in machine learning, cloud infrastructure, and real-time analytics. Its underwriting suite draws from property-data feeds, aerial imagery, and predictive models to generate instant risk scores—a capability that speaks directly to the industry’s biggest pain points: slow data, legacy systems, and manual underwriting processes.

Positioned for Optionality

With clean separation, a defined revenue base, strong internal history, and a scalable software-first model, Exzeo enters the market as a quietly compelling insurtech. It’s not a moonshot; it’s an engineered platform with clear utility and an identifiable buyer set down the road. Whether it becomes a consolidator, an acquisition target, or a scaled vertical software provider will depend on execution but its foundation is far stronger than the typical new-issue insurtech story.

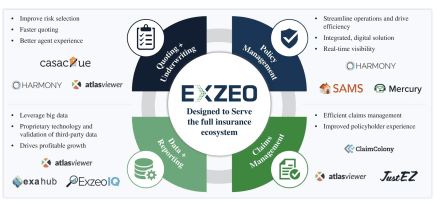

Company: Wolfspeed, Inc.

Quote: $WOLF

BT: N/A

ST: $20-?

Sharks Opinion:

Wolfspeed remains one of the clearest examples of why “cheap” isn’t always synonymous with “opportunity.” We’re not recommending the stock at this stage, largely because the management team has already steered this company into bankruptcy twice and has repeatedly diluted or wiped out shareholders in the process. Even with the revamped capital structure and new equity issuance, the fundamental question remains unanswered: How does this business ever sustainably generate a profit and will it ever?

For us, it’s a hard pass for now, though we’ll continue monitoring the situation in case the underlying story materially changes.

A Closer Look at the Wolfspeed Reset

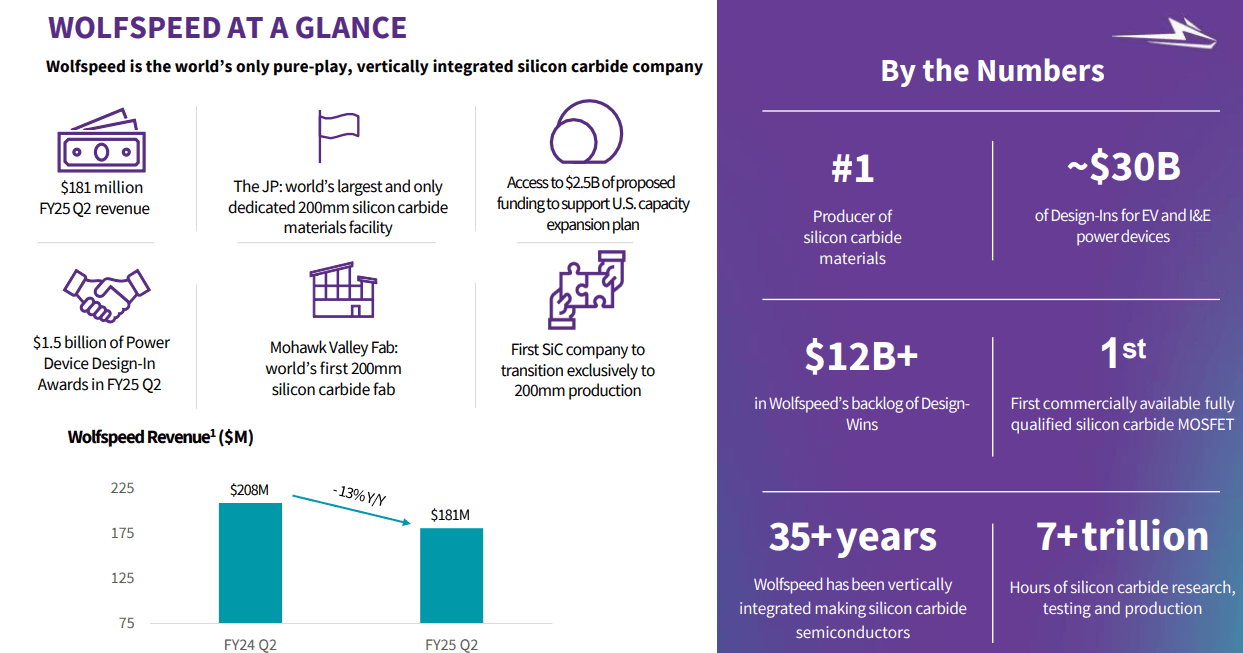

Wolfspeed, formerly known as Cree until its 2021 rebrand, is a long-time player in the silicon carbide (SiC) semiconductor market. The company fully controls its supply chain from raw materials to finished devices a strategic advantage that theoretically enhances U.S. semiconductor independence and aligns well with political priorities around reshoring and supply-chain security.

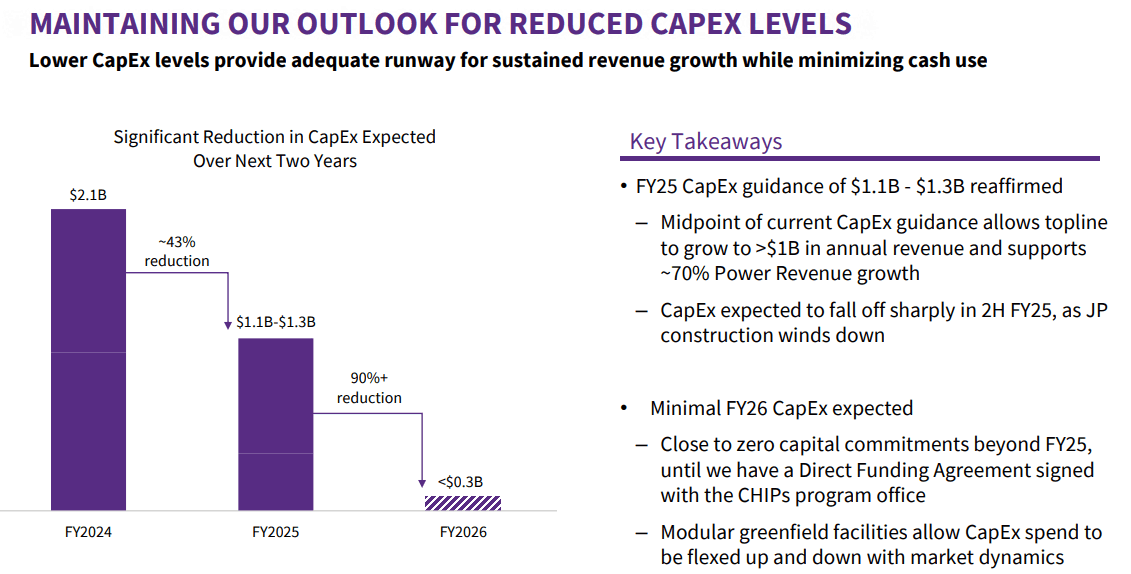

That positioning helped Wolfspeed secure $1.5 billion in CHIPS Act funding, and after emerging from Chapter 11 bankruptcy this summer, the stock soared more than 2,000%. On the surface, it looks like a comeback story.

But the real picture is far more complicated.

The Restructuring: A Win for Bondholders, a Disaster for Shareholders

The restructuring slashed roughly 70% of Wolfspeed’s $6.6 billion in debt, cutting interest expenses by 60% and pushing major maturities out to 2030. That kind of balance-sheet reset is rare and does provide meaningful breathing room for the business.

But it came at extraordinary cost to equity holders.

The bankruptcy wiped out all legacy Wolfspeed shares, replacing them with just 1.3 million new shares, amounting to an exchange ratio of less than 1% per old share. In other words:

Shareholders kept only fractions of a percent of their previous ownership.

The overwhelming majority of the new equity now sits with creditors including Apollo Global Management and several restructuring-focused institutions effectively shifting control away from public shareholders.

Where the Story Stands Now

Even with a cleaner balance sheet and a strategic footprint in a politically important sector, Wolfspeed is still left facing a brutal operational challenge. The business has never demonstrated a consistent path to profitability, and its capital-intensive model continues to raise questions about long-term viability.

The SiC market is growing, but competition is intensifying, and Wolfspeed’s track record of execution has been shaky at best. Without a clear roadmap to positive free cash flow, the company now looks more like a speculative restructuring play than a stable semiconductor investment.

Our View

Right now, Wolfspeed is a company with an interesting technology platform, a powerful macro tailwind, and a dramatically restructured balance sheet but none of that compensates for a decade of poor execution, shareholder destruction, and persistent unprofitability.

Until management proves it can actually run a sustainable business, the stock remains uninvestable in our view.

We’ll revisit the name if the fundamentals improve, but for now, this is one to watch from the sidelines.

Description: Wolfspeed Inc is involved in the manufacturing of wide bandgap semiconductors. It is focused on silicon carbide and gallium nitride materials and devices for power and radio-frequency (RF) applications. The company serves applications such as transportation, power supplies, inverters, and wireless systems. Geographically, it derives a majority of its revenue from Europe and the rest from the United States, China, Hong Kong, Asia Pacific, and other regions.

Wolfspeed occupies a distinctive spot in the semiconductor landscape because of its fully vertically integrated model the company designs, builds, and manufactures its silicon carbide devices entirely within its own U.S. facilities. Unlike peers that rely heavily on outsourced wafer processing in Taiwan, South Korea, or mainland China, Wolfspeed’s “made-in-America” footprint has placed it firmly at the intersection of geopolitics, industrial policy, and the domestic reshoring movement.

That timing has been fortuitous. In 2024, Wolfspeed secured $750 million in CHIPS Act support from the Biden administration, part of a broader push to bring advanced semiconductor manufacturing back to the U.S. (though the funds have not yet been dispersed).

Meanwhile,Trump administration while notably less focused on green technology has nonetheless advanced a suite of manufacturing incentives and tax advantages under the One Big Beautiful Bill Act, further strengthening the company’s strategic positioning within the U.S. supply-chain agenda.

A Strategic Winner on Paper but the Fundamentals Tell a Different Story

Viewed from high altitude, Wolfspeed checks every box:

• A cutting-edge semiconductor niche (silicon carbide).

• Massive bipartisan policy support.

• A clean balance sheet after bankruptcy.

• Deep-pocketed new owners with long-term incentives.

Yet none of these structural advantages overcome the same persistent issue that has plagued Wolfspeed for years: the company still cannot make money.

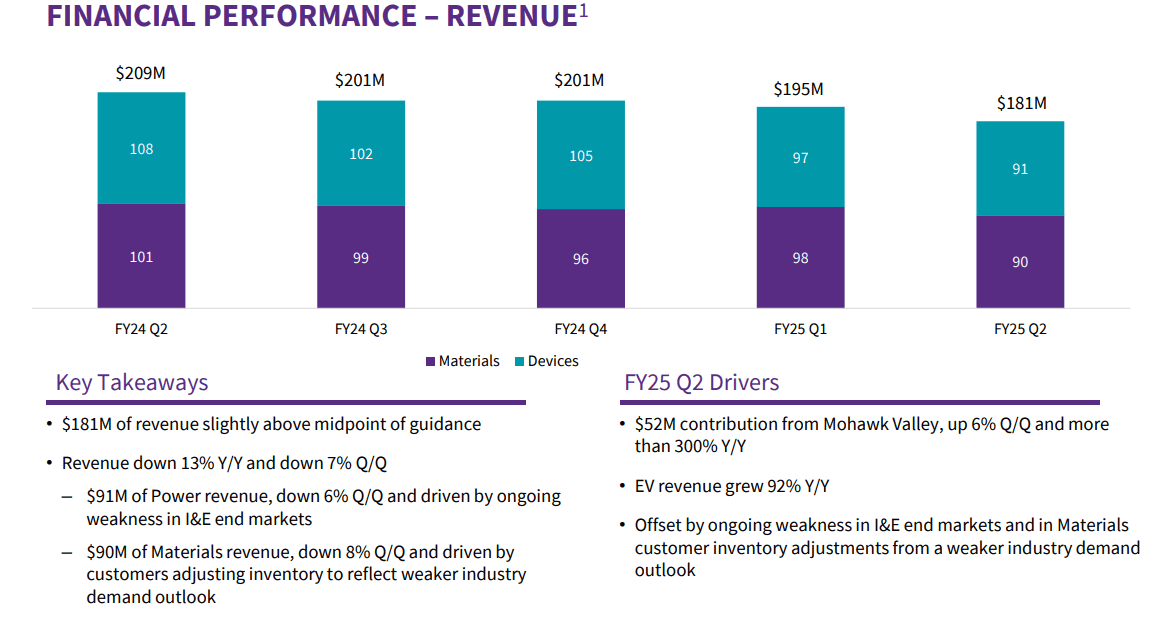

The fiscal fourth-quarter numbers highlight the severity of the challenge. Revenue fell 2% year over year to $197 million, but the real problem sits on the cost side. Operating losses ballooned from $148.9 million to $581.6 million, a staggering increase that underscores how mismatched Wolfspeed’s cost structure remains relative to the actual scale of its business.

The situation could deteriorate further. A number of Wolfspeed’s most important customers operate in the electric-vehicle supply chain, a sector now under pressure as the U.S. phases out several EV-related tax incentives. With demand softening and price cuts rippling through the industry, Wolfspeed’s revenue base is becoming more volatile at precisely the wrong time.

Wolfspeed reported $759.7 million in total revenue over the last twelve months (TTM) through its quarter ending September 28, 2025 — a figure that underscores the company’s ability to generate steady top-line output even as its operating model remains under strain. In its most recent quarter, Q1 Fiscal 2026, Wolfspeed posted $196.8 million in revenue, a marginal uptick from the $194.7 million recorded in the same period a year earlier.

While the growth is incremental, it reinforces that demand for silicon carbide technology remains intact despite mounting headwinds.

Recent Financial Highlights

TTM Revenue: $759.7 million

Fiscal Year 2025 Revenue: $757.6 million

Q1 FY26 Revenue: $196.8 million (+1% YoY)

The stability of these numbers stands in sharp contrast to the volatility occurring beneath the surface.

Revenue Mix, Geographic Strength, and Forward Guidance

Power Products, Wolfspeed’s most important business line, continues to anchor the company, contributing $414.0 million in fiscal 2025. This segment is central to Wolfspeed’s long-term thesis, tied directly to high-efficiency power devices that feed into electric vehicles, industrial power systems, and renewable-adjacent technologies.

On a geographic basis, Europe remains Wolfspeed’s strongest revenue engine, reflecting both entrenched automotive partnerships and the region’s broader pivot toward electrification and higher-efficiency power systems.

But the more telling signal lies in the near-term outlook. Management guided Q2 Fiscal 2026 revenue to a range of $150 million to $190 million, marking a material sequential decline. This reset reflects two realities: softening global demand conditions and a period of customer inventory digestion across EV and industrial end markets.

Analyst Expectations Going Forward

Despite the operational turbulence, Wall Street still models a return to growth:

FY26 Revenue Estimate: ~$800 million

FY27 Revenue Estimate: ~$926 million

These projections imply that analysts are betting on normalization in the supply chain, improving cost efficiencies, and the long-promised scale advantages of Wolfspeed’s vertically integrated model finally showing through.

Whether Wolfspeed can hit those marks remains an open question. The demand narrative is solid, the technology is proven, and the strategic positioning is strong — but execution, cost control, and cash discipline remain the defining challenges for this company going into the next two years.

Susquehanna Maintains Neutral on Wolfspeed, Raises Price Target to $30

Piper Sandler Maintains Overweight on Wolfspeed, Lowers Price Target to $6

Goldman Sachs Maintains Buy on Wolfspeed, Lowers Price Target to $8

Canaccord Genuity Maintains Buy on Wolfspeed, Lowers Price Target to $10

Company: Deckers Outdoor Corporation

Quote: $DECK

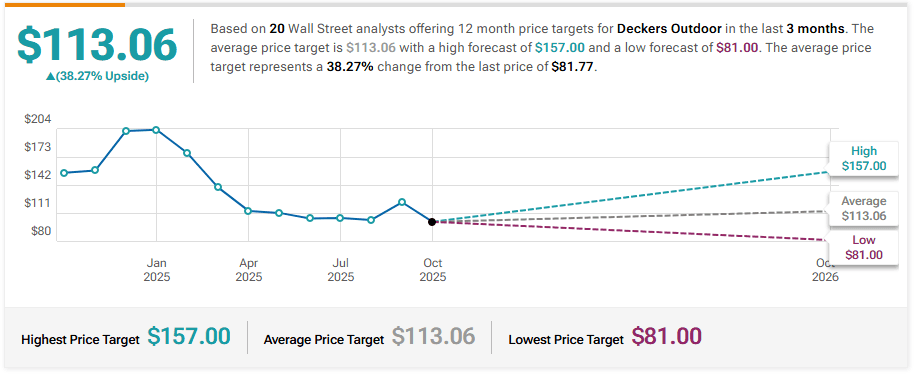

BT: $75 (would be my ideal entry we like this idea)

ST: $125 to start but we need to see consumer data change

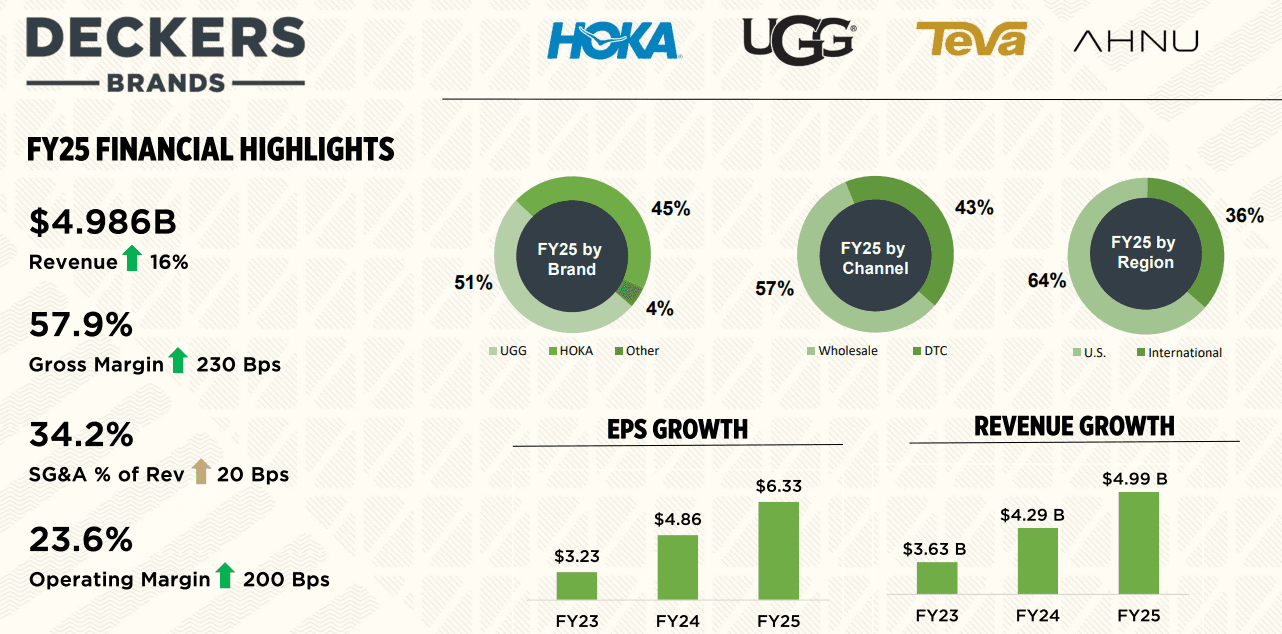

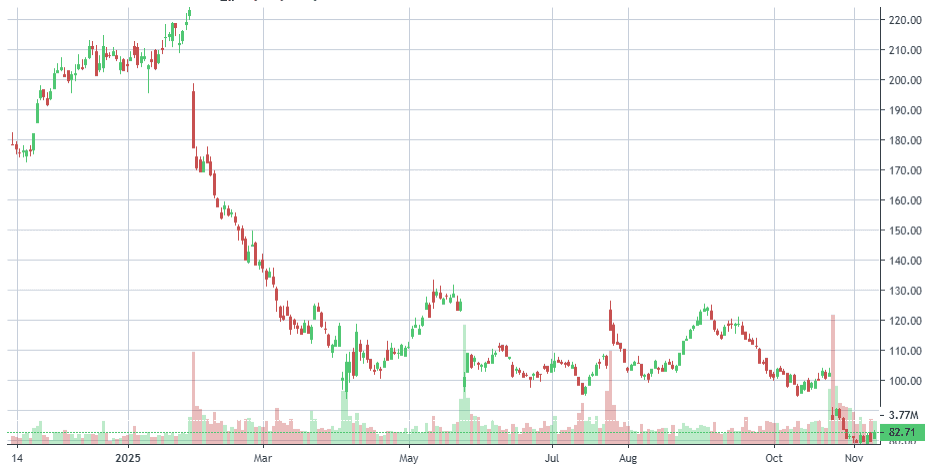

Sharks Opinon: Year-to-date, Deckers’ stock has declined nearly 65%, creating what we see as a potentially attractive entry point. Leveraging the company’s own revenue and earnings guidance, alongside historical performance trends, our proprietary discounted cash flow model suggests a fair value of $124 per share. By this measure, the stock appears significantly undervalued relative to its intrinsic worth.

Despite the headwinds of softer consumer confidence, inflationary pressures, and lingering tariff uncertainties, Deckers has built a resilient brand portfolio capable of navigating volatile macro conditions. Its strength lies in both product quality and brand loyalty, which continue to drive repeat purchases and sustain pricing power.

From a strategic perspective, Deckers is more than a footwear and apparel company it is a consumer-centric platform with growth potential across multiple segments.

The combination of robust brand equity, innovative product offerings, and disciplined execution positions the company well to rebound as market conditions normalize.

In short, while the market currently discounts the stock due to short-term uncertainty, Deckers’ fundamentals and long-term growth trajectory suggest that the current valuation represents a compelling opportunity for patient investors.

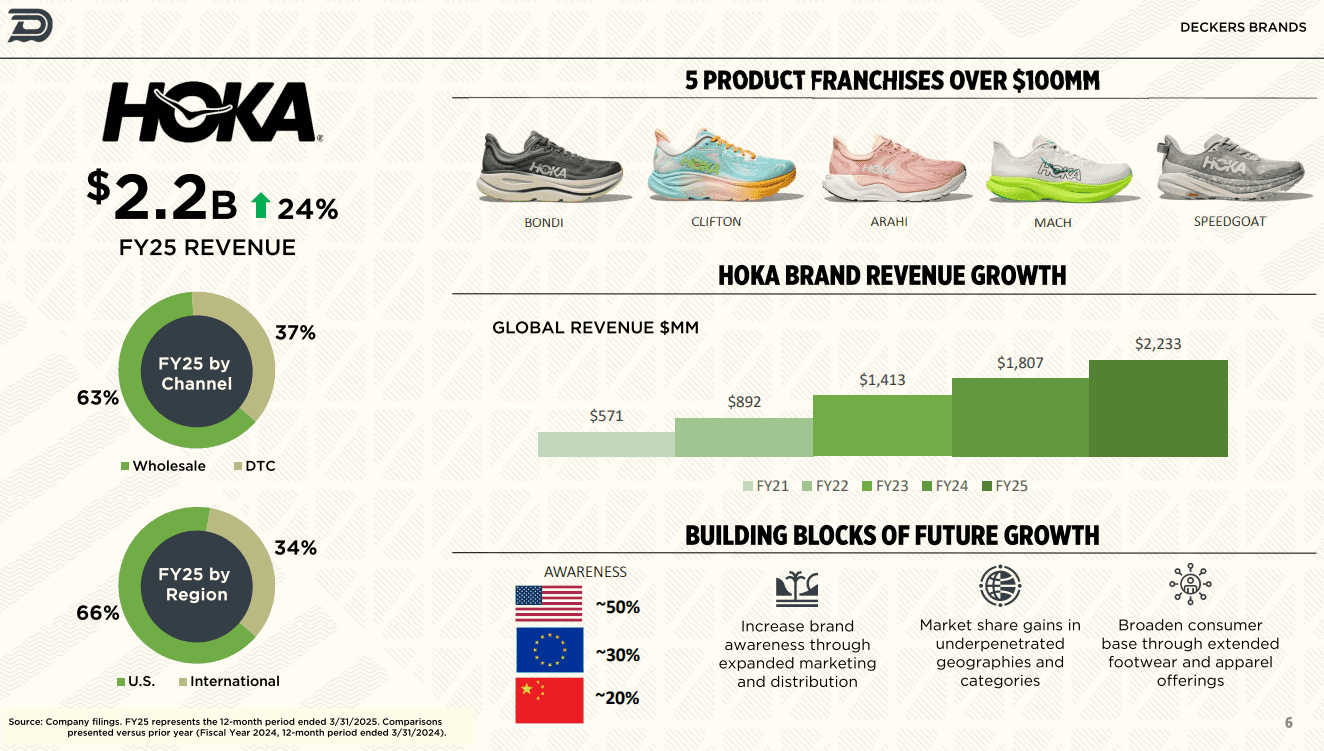

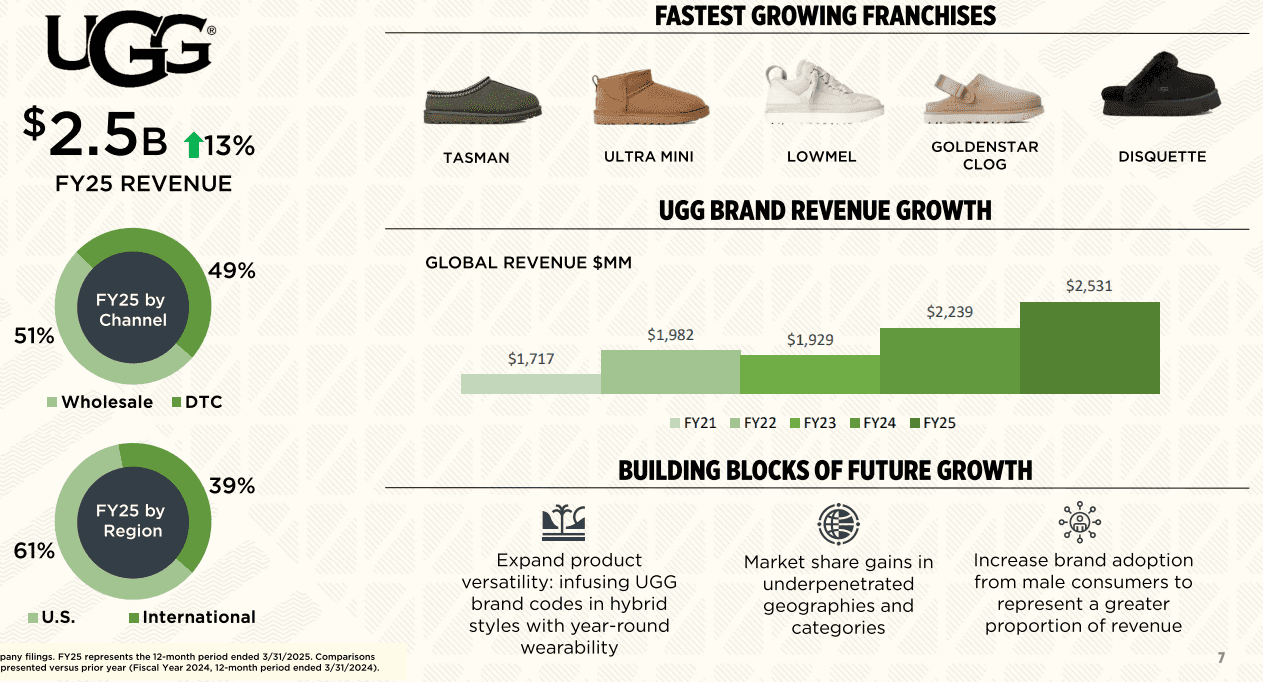

Description: Founded in 1973, California-based Deckers designs and sells casual and performance footwear, apparel, and accessories. In fiscal 2025, Ugg and Hoka accounted for 51% and 45% of total sales, respectively. The firm also markets niche brands Teva and Ahnu. Deckers produces most of its sales through wholesale partnerships but also operates e-commerce in more than 50 countries and about 180 company-operated stores. It generated 64% of its fiscal 2025 sales in the United States.

Deckers offers footwear, apparel, and accessories products under various brands, such as UGG, Hoka, Teva and Sanuk. The UGG brand represents just over 54% of Deckers’ annual revenue in the first three quarters of 2025, and saw sales grow 14.9% compared to the first three quarters of 2024.

Deckers’ second largest brand by revenue, Hoka, represented just under 42% of sales revenue and saw sales grow by 29.3% during the first three quarters of 2025.

The company sells their products through domestic and international retailers, international distributors, and directly to global consumers through their direct-to-consumer (DTC) business, which consists of Company-owned e-commerce websites and retail stores.

Deckers utilizes third-party manufacturers to manufacture their products and is working on expanding their network of global warehouses, distribution centers, and third-party logistics providers.

Much of their story bears a similar resemblance to Nike’s early days, where the company relied heavily on their Japanese partners for production.

Deckers has been executing a long-term strategy to grow its direct-to-consumer (DTC) channel, aiming for it to make up a larger share of total net sales. This shift is designed to enhance gross margins by capturing more profitable sales through company-owned stores and e-commerce platforms.

The results are already visible: in FY 2025, gross margins increased sharply from 50.3% in 2023 to 60.3% in Q3 FY 2025, a remarkable 1,000 basis point improvement.

While the wholesale channel still accounted for just under 57% of net sales in 2024, the DTC segment grew significantly faster, with 26.5% growth in 2024 compared to 12.6% for wholesale. By Q3 2025, the DTC channel represented just over 55% of total net sales, highlighting Deckers’ success in executing its higher-margin, direct-to-consumer strategy.

Strategic Implication

The continued expansion of DTC is expected to drive sustained margin improvement and stronger profitability, reinforcing Deckers’ competitive positioning and providing a platform for long-term growth in both domestic and international markets.

Goldman Sachs Maintains Sell on Deckers Outdoor, Lowers Price Target to $81

Truist Securities Maintains Buy on Deckers Outdoor, Lowers Price Target to $105

TD Cowen Maintains Buy on Deckers Outdoor, Lowers Price Target to $12

Wells Fargo Maintains Equal-Weight on Deckers Outdoor, Lowers Price Target to $95

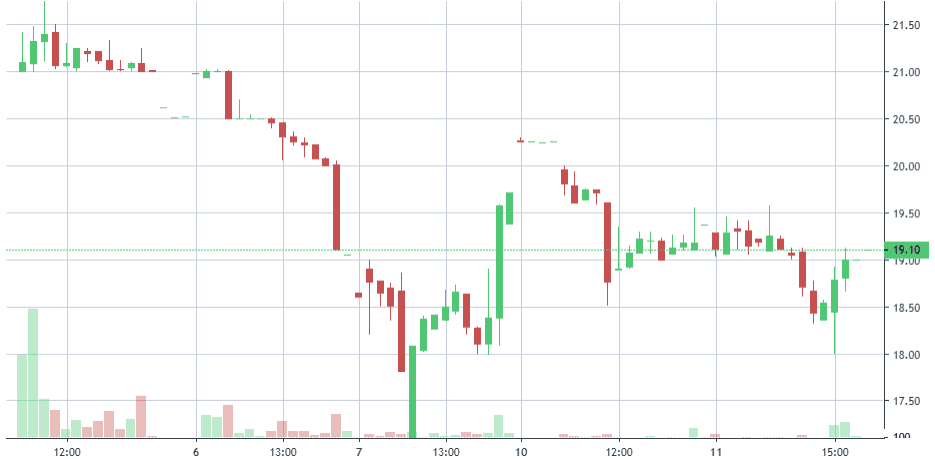

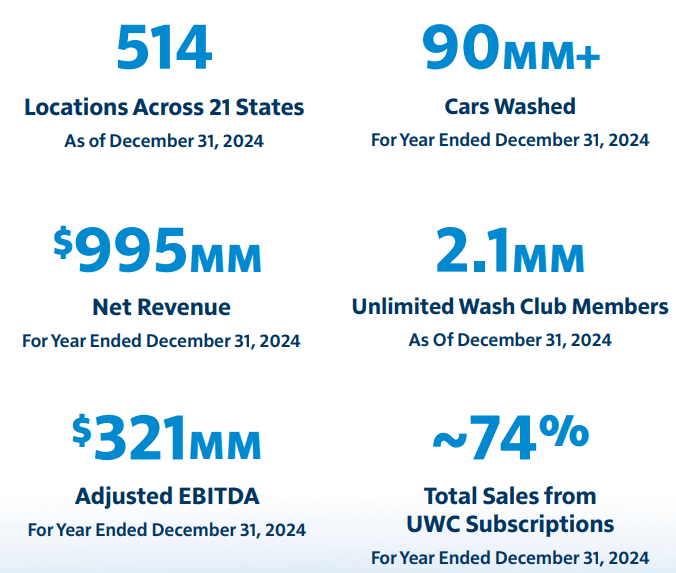

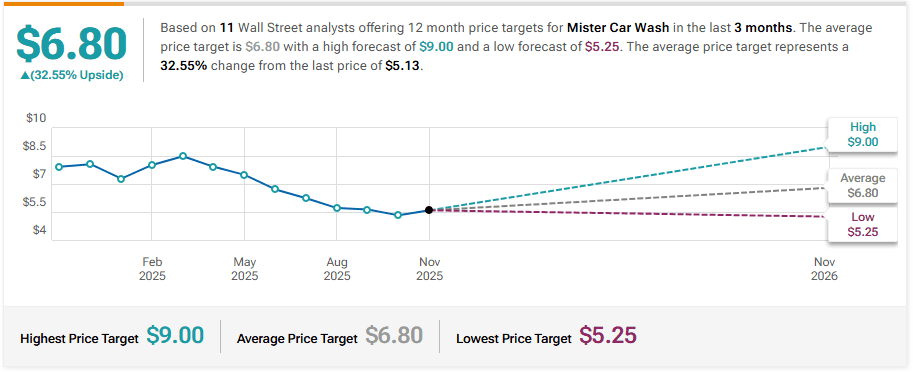

Company: Mister Car Wash

Quote: $MCW

BT: $5

ST: $8

Sharks Opinion:

Mister Car Wash caught our attention during its SPAC move, but we passed and in hindsight, that decision looks prudent. The stock hasn’t been a top performer, and at this point, the primary upside thesis seems limited to M&A. Even then, realistic buyers are likely private equity firms, which historically avoid overpaying in the current market environment. A premium takeout at these levels appears unlikely.

Performance-wise, the stock has struggled over the last six months, down 32.5% since March 2025, now trading at $5.48 per share. Softer quarterly results contributed to the decline, leaving investors weighing their next moves.

Volatility remains notable: 12 moves greater than 5% in the past year show the stock can swing sharply, but today’s activity signals the market views the news as meaningful but not transformational. Overall, the outlook is cautious, with limited catalysts beyond potential M&A activity.

Description: Mister Car Wash Inc is a car wash brand offering express exterior and interior cleaning services. Express Exterior Locations offers express exterior cleaning services and Interior Cleaning Locations offers both express exterior and interior cleaning services. The company recognizes revenue from activities related to providing car wash services at its car wash locations that are geographically diversified throughout the United States and have similar economic characteristics and nature of services.

Mister Car Wash reported revenue of $263.4 million, up 5.7% year-over-year, and adjusted EPS of $0.11, both beating analyst expectations. Same-store sales rose 3.1%, providing a clearer look at underlying demand.

Free cash flow saw a notable turnaround, reaching $25.81 million, compared to a negative $16.84 million in the same quarter last year, which caught investors’ attention.

Over the past two years, same-store sales averaged just 2.7% growth, signaling that the company may need to reassess pricing or strategy a move that could temporarily disrupt operations despite the positive quarter.

JP Morgan Maintains Overweight on Mister Car Wash, Lowers Price Target to $8

UBS Maintains Neutral on Mister Car Wash, Lowers Price Target to $6.25

Stephens & Co. Upgrades Mister Car Wash to Overweight, Lowers Price Target to $6.25

Piper Sandler Downgrades Mister Car Wash to Neutral, Lowers Price Target to $6

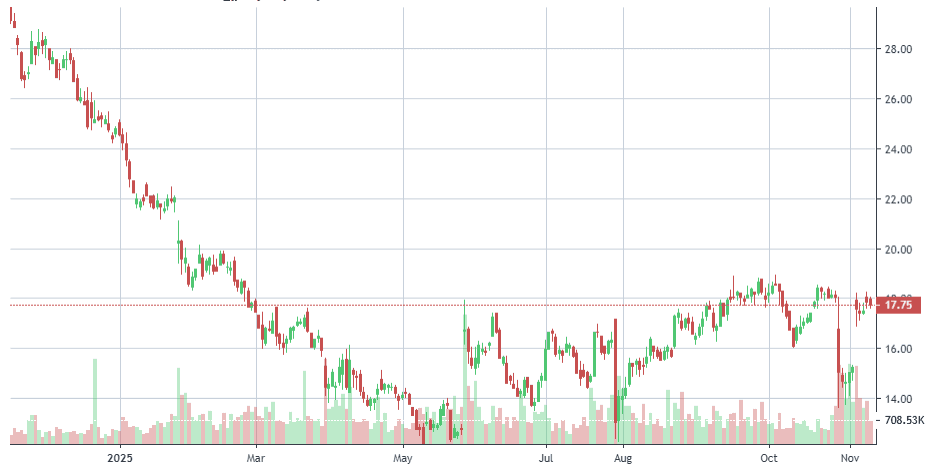

Company: Monro, Inc

Quote: $MNRO

BT: $15-$18

ST: $26-$28

Sharks Opinion:

Shares of auto services provider Monro (MNRO) jumped 15.1% last month after Carl Icahn disclosed a significant stake 639,473 shares at $15.19 each, totaling roughly $9.7 million.

Monro’s performance has faced challenges, including store closures and softer consumer demand, pushing the stock down 26.2% YTD and 39.2% below its 52-week high of $29.78.

Icahn’s involvement is bullish, signaling potential strategic changes and value creation opportunities. While Monro’s business is largely commodity-driven, its scale in the aftermarket offers some competitive edge. Key drivers remain miles driven, tire replacements, and input costs like rubber and shipping.

With inflation easing and margins recovering, the stock’s current levels and valuation present a compelling risk/reward opportunity, particularly if M&A comes into play given low debt and stable revenue.

Description: Monro Inc is an operator of retail tire and automotive repair stores in the United States. The company offers replacement tires and tire related services, automotive undercar repair services, and a broad range of routine maintenance services, on passenger cars, light trucks, and vans. It also provides other products and services for brakes; mufflers and exhaust systems; and steering, drive train, suspension, and wheel alignment.

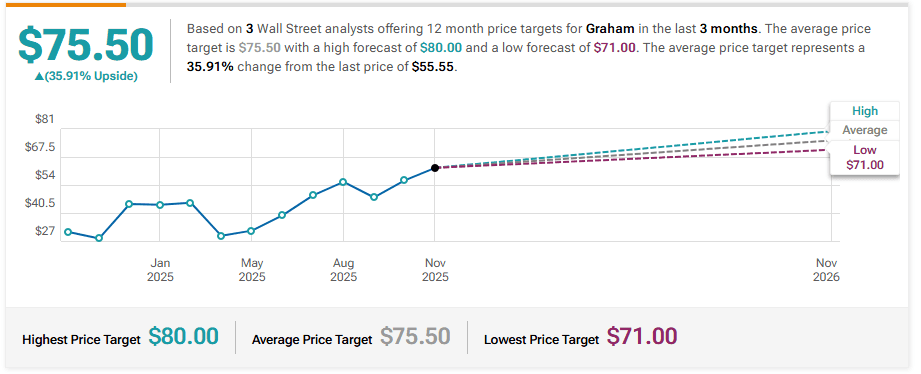

Company: Graham Corp

Quote: $GHM

BT: $50-$55

ST: $80

Sharks Opinion:

It’s not flashy, but Graham operates at the foundation of critical infrastructure. The company supplies precision equipment and systems that keep power plants running, ships moving, and refineries operating efficiently. Its products often go unnoticed by the general public, but within the industries it serves, quality, reliability, and technical precision are everything.

Graham operates in specialized niches where switching costs are high and performance standards are rigorous, giving the company a degree of resilience and pricing power. Unlike consumer-facing tech or retail names that face rapidly shifting trends, Graham’s customers depend on its solutions for essential operations, creating steady, recurring demand.

Financially, the company shows strong revenue growth and expanding market penetration, particularly in sectors benefiting from infrastructure upgrades and industrial modernization. While macroeconomic conditions—like global supply chain disruptions or energy market fluctuations—could temporarily slow growth, there’s no structural reason the business should stall in the medium term.

The story bears resemblance to the RAVN trade in 2019, where a specialized industrial company delivered consistent performance and ultimately became an attractive acquisition target. With Graham, the combination of operational stability, niche dominance, and potential M&A interest creates a compelling risk/reward profile. For investors looking for a steady, industrially essential name with upside potential, Graham is a name to watch closely.

Description: Graham Corporation designs and manufactures mission-critical fluid, power, heat transfer, and vacuum technologies for the defense, space, energy, and process industries. The company also services and sells spare parts for its equipment. It designs and manufactures custom-engineered vacuum, heat transfer, cryogenic pump and turbomachinery technologies.

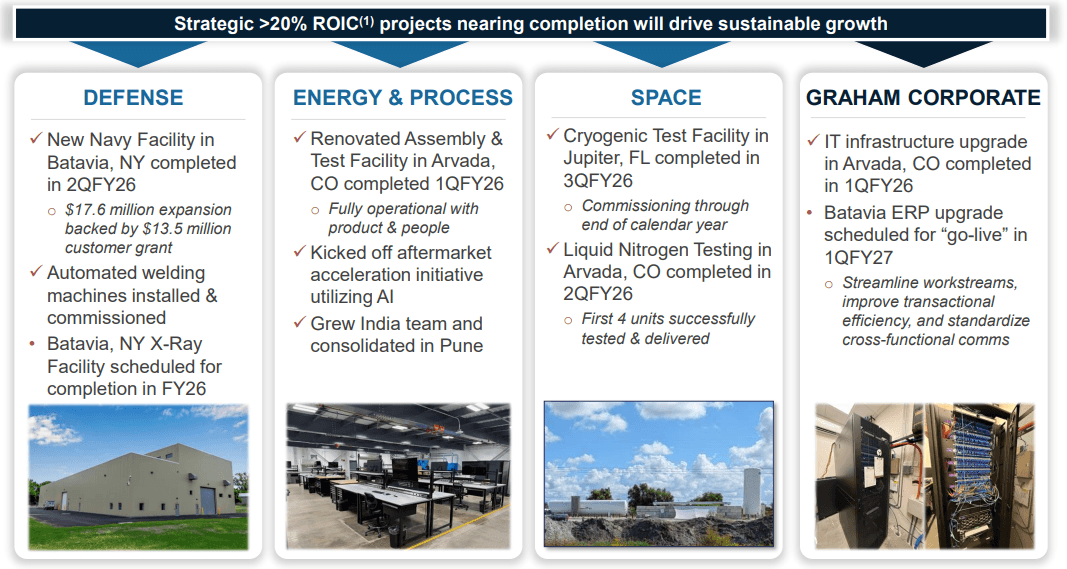

New York-based Graham specializes in designing and manufacturing custom-engineered fluid, power, heat-transfer, and vacuum technologies for some of the most demanding industries: defense, energy, process, and space. With approximately 636 employees across U.S. facilities and international support offices in China and India, Graham blends precision engineering with global operational capabilities.

The company’s acquisition of Barber-Nichols further strengthened its position within the U.S. defense supply chain. Graham now plays a critical role in supporting next-generation nuclear submarines and aircraft carriers, providing turbo pumps, propulsion components, and high-performance systems. These are not commodity products—they are mission-critical systems where reliability and engineering excellence are non-negotiable.

Rising global defense budgets and the U.S. Navy’s ongoing modernization programs create a long-term tailwind for Graham. Its long-cycle contracts and high barriers to entry ensure both stability and defensibility, insulating the company from typical market volatility.

Graham is far more than a contractor—it is a strategic supplier embedded deeply in infrastructure and defense projects that will remain essential for decades. Its expertise, niche positioning, and government relationships make it quietly powerful, delivering steady revenues and positioning the company for continued growth, even in a challenging macro environment.

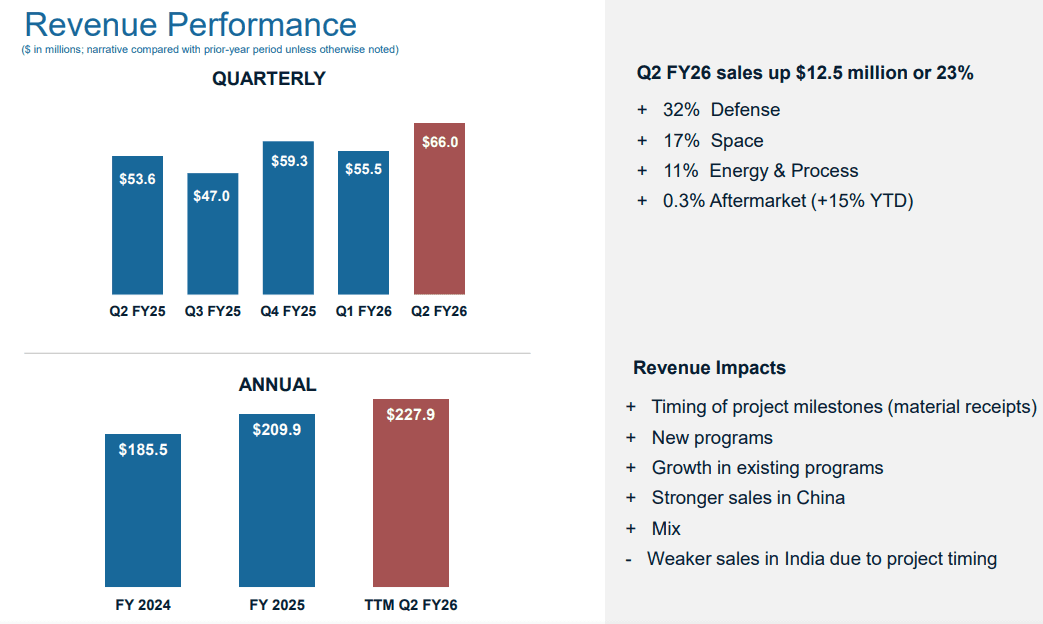

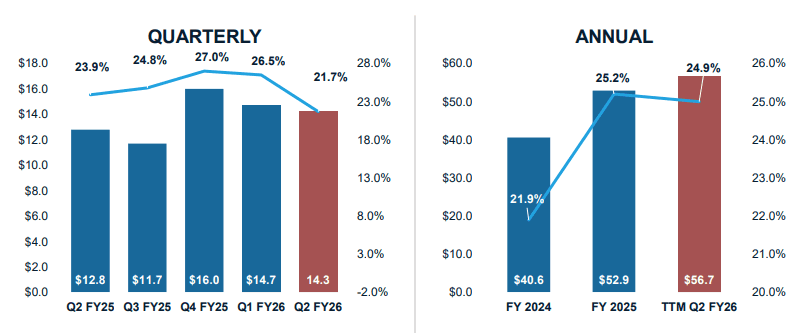

Revenue growth at Graham Metals has been impressive over the past three years, consistently outperforming industry averages and placing the company in the upper percentile of its peer group. Last quarter, GHM posted $55.5 million in revenue, an 11% year-over-year increase. While this represents a slowdown from the 17.6% compounded growth seen over the past three years, it still reflects strong underlying demand.

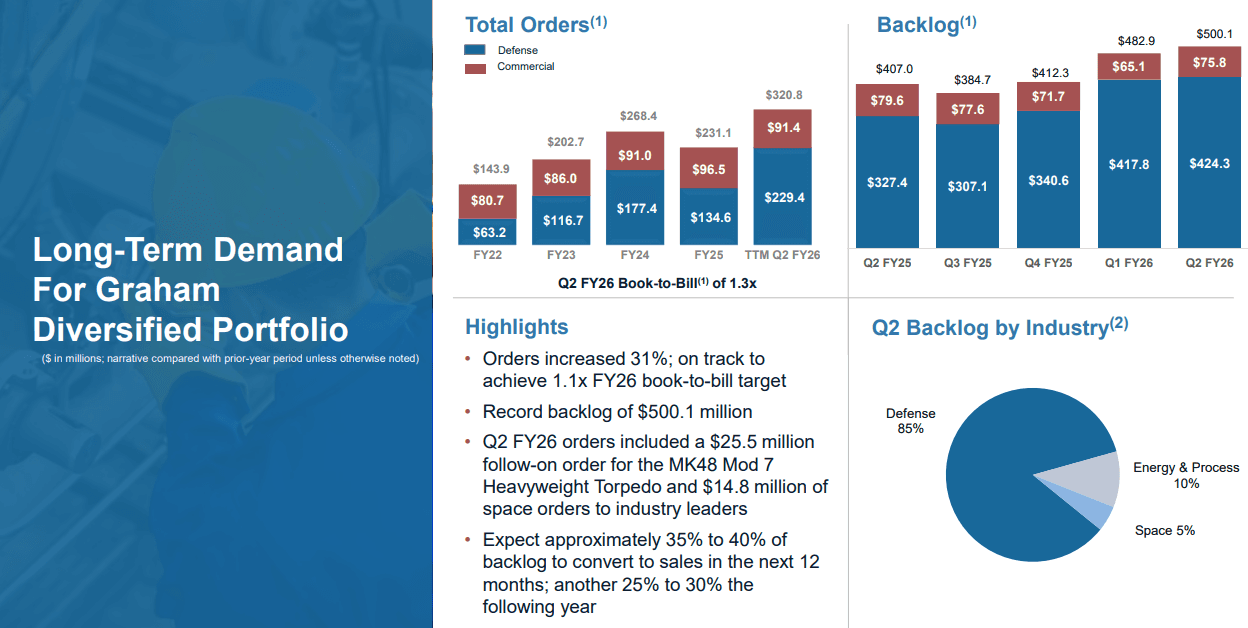

One of the company’s key strengths is its record backlog, which now sits at $482.9 million—a 49.6% increase from two years ago. This backlog provides visibility into nearly nine quarters of work, underpinned by growth in the U.S. defense budget, which is up about 9.8% over the same period (assuming the 2025 budget passes as expected).

In Q1 FY2026, GHM added $126 million to its backlog. This inflow highlights continued demand but also raises the need for capacity expansion to convert orders into revenue efficiently. Having a massive backlog is valuable, but it only benefits shareholders if GHM can accelerate conversion. Currently, the company projects that 35–40% of the backlog will convert to revenue in the next 12 months, with an additional 25–30% in the following year.

While slower top-line growth slightly tempers near-term momentum, the combination of strong backlog, consistent revenue growth, and alignment with U.S. defense spending trends makes GHM a compelling buy. The upside potential would be even greater if management can accelerate backlog conversion, effectively turning strong orders into tangible revenue faster.

GHM is set to report strong new orders, book-to-bill, and backlog figures in Q1, largely driven by the previously announced $137-million follow-on order for the Virginia Class submarine program. Of this order, $50 million was already reflected in Q4, with the remaining $87 million expected to post in Q1, providing a notable boost to the quarter’s numbers.

“Considering that GHM’s quarterly new orders have averaged $62 million over the last eight quarters, the Virginia contract alone positions the company to report a relatively high new order total, even before factoring in additional bookings,” said Stanley. This suggests a book-to-bill ratio of 1.6x for Q1, or 1.2x on a last-twelve-month (LTM) basis, highlighting healthy demand relative to production capacity.

As of the previous quarter, GHM’s backlog stood at $412 million, with 83% tied to its Defense segment, the majority of which supports U.S. Navy programs. This strong defense exposure, coupled with long-cycle contracts, underpins GHM’s predictable revenue stream and operational visibility, positioning the company well for sustained growth.

In short, GHM’s Q1 performance is expected to reflect both the strength of its defense pipeline and the continued relevance of its high-barrier-to-entry capabilities, reinforcing its attractiveness as a long-term play in defense manufacturing.

Maxim Group Reinstates Buy on Graham, Announces $65 Price Target

Northland Capital Markets Initiates Coverage On Graham with Outperform Rating, Announces Price Target of $55

Noble Capital Markets Initiates Coverage On Graham with Outperform Rating, Announces Price Target of $35

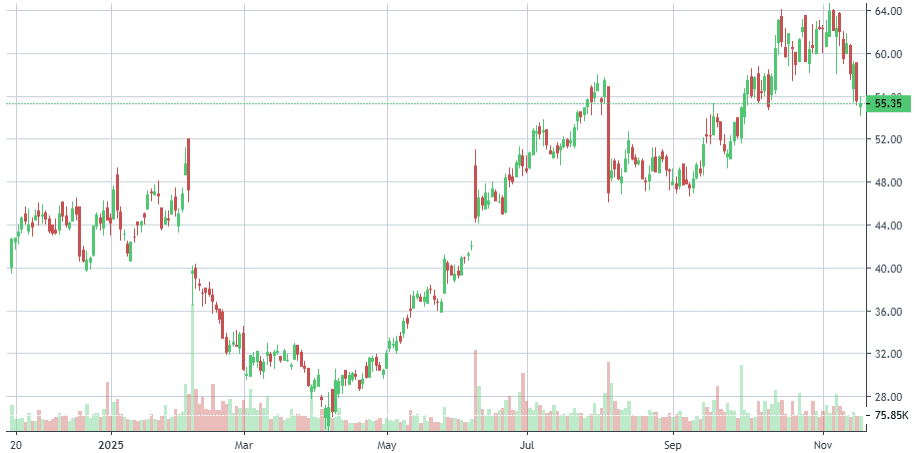

Company: Red Cat Holdings

Quote: $RCAT

BT: N/A

ST: $2

Sharks Opinion:

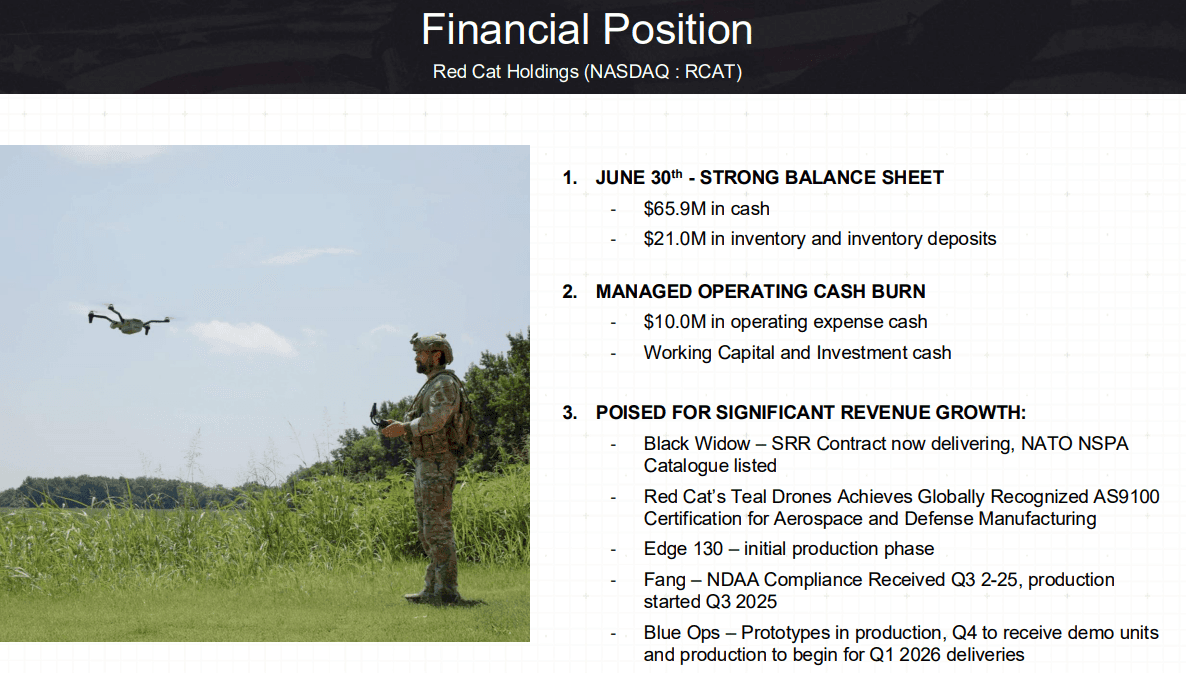

Red Cat continues to be a company we view with caution, primarily due to its promotional approach and lack of tangible products capable of driving sustainable growth. While the company can see short-term spikes in its share price following announcements such as new DoD contract wins history suggests that these gains are often eroded by subsequent share dilution and aggressive spending practices.

The company has heavily invested in influencer campaigns and even added the President of the United States’ son to its board, yet these moves have done little to bolster long-term shareholder value. Despite occasional bursts of media attention, Red Cat’s market performance continues to reflect structural weaknesses, highlighting that hype alone cannot replace a robust product pipeline or operational fundamentals.

Overall, while short-term volatility might present trading opportunities, we remain skeptical of Red Cat as a sustainable growth story, given its history of dilution and promotional tactics outweighing meaningful business execution.

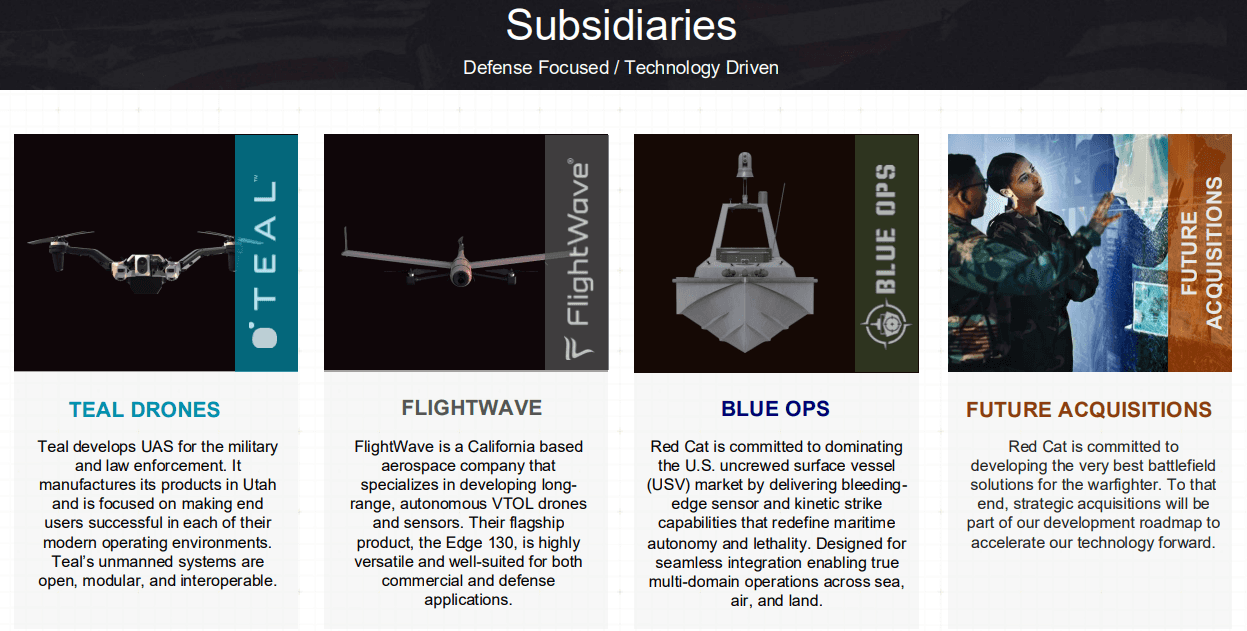

Description: Red Cat Holdings Inc is a drone technology company integrating robotic hardware and software for military, government, and commercial operations. Red Cat's suite of solutions includes the Arachnid family of ISR and precision strike drones, which includes the Black Widow, a small unmanned ISR system; and WEB (Warfighter Electronic Bridge) GCS, designed to command and control an entire drone family of systems for military operations. Its other offerings include Edge 130 Blue drone systems, Trichon, a fixed-wing VTOL for extended endurance and range, and FANG FPV drones optimized for military operations with precision strike capabilities.

Red Cat Holdings currently operates with only two products Black Widow and Edge130 serving a narrow slice of the small unmanned aerial systems (sUAS) market. While recent contract wins have provided short-term momentum, the company’s lack of product and customer diversity exposes it to significant risk if market conditions or defense priorities shift. Most of Red Cat’s revenue is concentrated in military contracts and the U.S. Border Patrol, leaving the company vulnerable to disruptions or budgetary changes in these sectors.

The sUAS industry has become a rapidly evolving battlefield, especially since the Ukraine conflict, with ongoing advancements in drone technology and counter-drone systems. If the Black Widow is outmatched by emerging kinetic or electronic warfare (EW) technologies, adoption rates could slow, reducing Red Cat’s addressable market, even if use cases for the product remain.

Another critical concern is production scalability. Red Cat has yet to demonstrate it can meet the Army’s demand at the necessary scale. Failure to scale efficiently and profitably could limit growth, strain relationships with the U.S. military, and delay the path to profitability.

Financial results highlight these operational challenges. In Q3, Red Cat reported revenue of $9.65 million, falling nearly 32% short of the $14.12 million consensus estimate. Adjusted losses were $0.16 per share, substantially worse than the $0.09 expected, representing a 77% negative surprise. The stock reacted sharply, declining approximately 10% in regular trading.

Forward guidance raises further caution. For Q4, Red Cat projects revenue of $20–23 million, below the $26.4 million market consensus, signaling potential underperformance against expectations. Taken together, the limited product lineup, concentrated customer base, production scalability risks, and recent earnings disappointments paint a challenging outlook for the company, making it a high-risk proposition for investors.

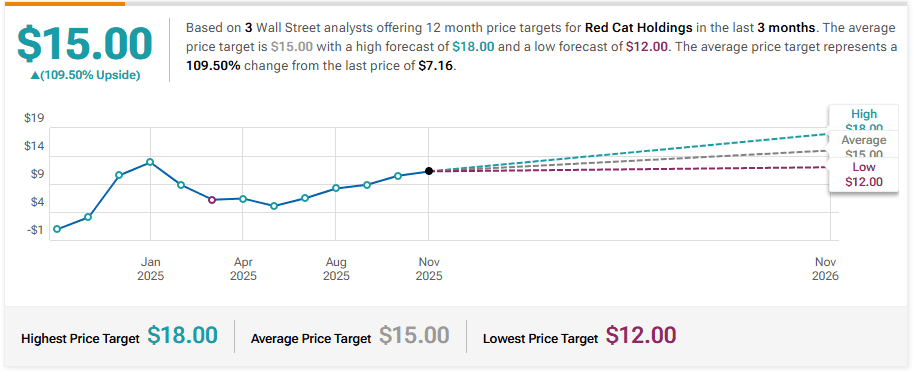

Needham Maintains Buy on Red Cat Holdings, Lowers Price Target to $12

Northland Capital Markets Initiates Coverage On Red Cat Hldgs with Outperform Rating, Announces Price Target of $13

Ladenburg Thalmann Initiates Coverage On Red Cat Hldgs with Buy Rating, Announces Price Target of $4