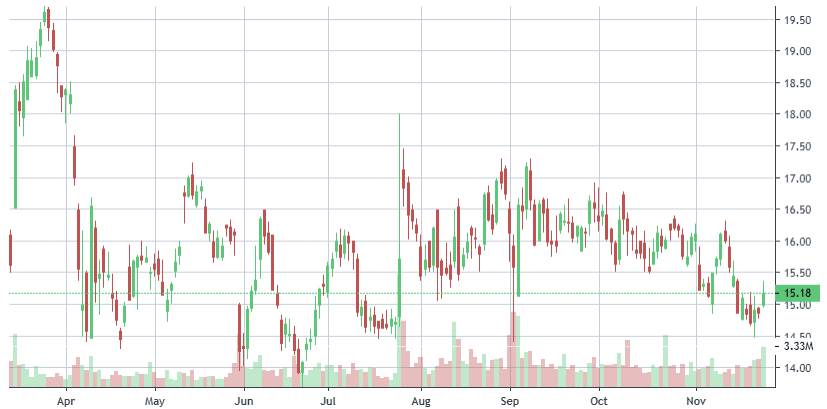

PagerDuty delivered its Q3 fiscal 2025 results with earnings coming in ahead of expectations but revenue falling short, a combination that pushed the stock down 7.4% in after-hours trading.

The company also trimmed its full-year revenue outlook, reinforcing market concerns around growth deceleration and the lingering effects of enterprise budget tightening.

Today, PagerDuty’s growth engine is driven primarily by strong net revenue retention and deepening engagement from its largest customers its core enterprise cohort continues to carry the business.

At the same time, the company is investing aggressively at the opposite end of the spectrum: expanding its free-tier footprint and cultivating long-tail users who can mature into paid, higher-value accounts.

The dual strategy underscores a long-term bet on broad ecosystem adoption even as near-term growth remains concentrated among major customers.

For investors, the thesis behind PagerDuty has always centered on one idea: real-time operations management and enterprise automation are foundational to the modern digital economy.

The firm’s recent move back to profitability and the appointment of a new Chief Revenue Officer are constructive steps, but they don’t change the core near-term dynamic.

One of the more consequential developments this quarter is PagerDuty’s renewed M&A activity. Its engagement with Qatalyst Partners confirms that the company is actively exploring strategic alternatives following inbound acquisition interest.

If buyout discussions progress, the stock could see a rapid re-rating; if they stall, the market may shift focus back to the slower-paced fundamentals and the pressure on forward guidance.

Overall, PagerDuty remains a company navigating a critical transition strength in its enterprise base, a long-tail expansion strategy still in incubation, and a valuation increasingly tied to strategic optionality rather than pure operating momentum.

PagerDuty is a familiar name for us, a stock we’ve traded multiple times over the years, and the underlying story remains largely unchanged. At its core, this is a small enterprise software company with modest growth, limited operating leverage, and thin cash flow margins. Fundamentally, PagerDuty has long looked less like an independent long-term compounder and more like a product suite designed to be folded into a larger enterprise software ecosystem.

And that dynamic is exactly what makes the stock compelling right now.

Market Context & Hedge Fund Positioning

Despite delivering another sluggish quarter, the stock’s reaction an immediate selloff underscores a broader truth: investors are no longer giving PagerDuty the benefit of the doubt when it comes to organic growth.

The market’s attention has shifted elsewhere, and the real story sits beneath the surface. Several sophisticated funds have quietly taken positions, including ARK Invest, Renaissance Technologies, and State Street. These are not passive, casual buyers; they are institutions known for anticipating M&A-driven re-ratings and leaning into asymmetric setups.

Their presence strongly hints that accumulation is happening ahead of a potential transaction, not because of confidence in PagerDuty’s standalone trajectory.

Sale Rumors & Corporate Actions

Management effectively validated the speculation a month ago when confirming that the company is exploring “strategic alternatives,” explicitly including a possible sale. That disclosure alone would’ve been enough to draw attention, but the timing became even more interesting after the company authorized a $200 million share repurchase program on its earnings call. Buybacks of this size, especially for a business with a market cap of PagerDuty’s scale, are often used to bolster valuation ahead of negotiations or smooth the path for potential acquirers.

The signals are not subtle PagerDuty is preparing itself for optionality.

Why a Sale Makes Sense

Nothing in the company’s execution over the last several years suggests it can graduate into a dominant, standalone enterprise vendor. The product suite is solid but not category-defining; the growth is steady but not accelerating; and the competitive landscape demands scale, breadth, and distribution advantages PagerDuty simply doesn’t possess.

In a larger ecosystem, however absorbed into a major cloud provider, a security platform, or a private equity roll-up the product fits seamlessly as a high-utility, low-friction add-on. It has the exact profile of a tuck-in acquisition: strategic, synergistic, and structurally more valuable inside someone else’s machine.

Potential Sale: Current Status

As of July 2025, PagerDuty was formally evaluating strategic options with Qatalyst Partners advising a clear sign that this process is active and not merely theoretical.

Early interest has surfaced from both private equity firms and major tech players looking to bolster their AI-driven digital operations portfolios.

Importantly, this is not PagerDuty’s first dance: a 2023 exploration failed to produce an acceptable offer, but analysts view this round as a more serious, more mature effort, given the company’s operational plateau and leadership’s tone.

Whether the process culminates in a deal or simply reshapes valuation expectations, it represents the most meaningful catalyst for the stock over the next several quarters.

Our View & Target

We maintain our $30 sell target on PagerDuty. The market’s reaction to a mere $1 million revenue miss and a minor $1 million full-year guide down is an overcorrection, particularly given the company’s improved profitability profile.

But the investment case here is no longer about quarter-to-quarter operating beats it’s about how the M&A narrative unfolds, how aggressively institutions continue to position, and whether management can secure a deal at a premium multiple.

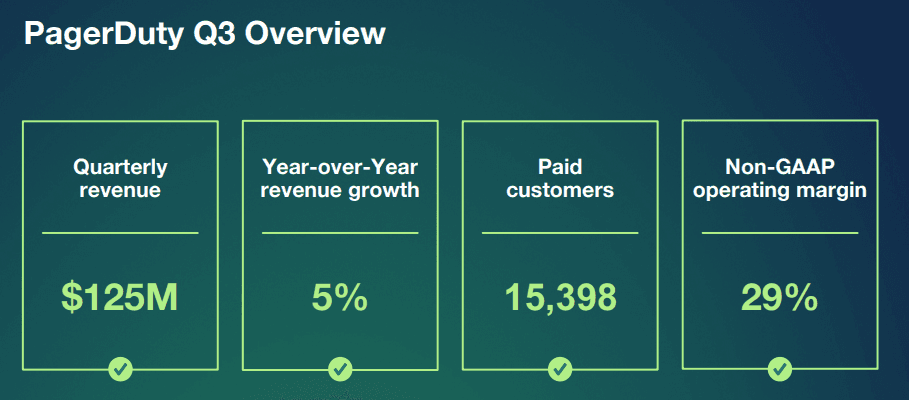

PagerDuty’s third-quarter fiscal 2026 results painted a familiar picture:

modest top-line growth, stronger-than-expected profitability, and a business still wrestling with customer optimization headwinds.

Revenue came in at $124.5 million, growing 4.7% year over year but landing just shy of analyst expectations at $125.41 million. In contrast, adjusted EPS came in meaningfully ahead of consensus at $0.33 versus $0.25 expected, underscoring the company’s ongoing focus on expense discipline and margin improvement.

This marks PagerDuty’s second consecutive quarter of GAAP profitability, with operating income of $8.1 million an important milestone for a company historically defined by thin margins and heavy reinvestment. But profitability wasn’t enough to buoy sentiment.

The company lowered its full-year revenue outlook to $490–492 million (from $493–497 million prior), missing the Street’s $498 million expectation. At the same time, it raised its adjusted earnings forecast to $1.11–$1.12 per share, well ahead of the $1.02 consensus.

This widening gap slower revenue, stronger earnings captures the tension at the heart of PagerDuty’s current story.

Key Metrics Reveal a Mixed Demand Environment

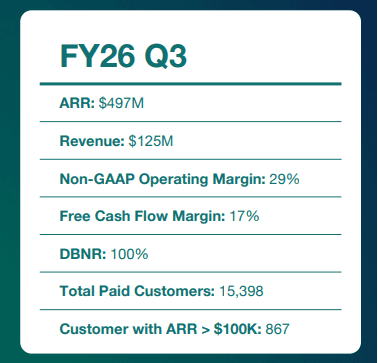

Annual Recurring Revenue (ARR) rose 3% year over year to $497 million, while large customers with ARR over $100K grew 5% to 867.

These figures, while positive, point to steady not accelerating

enterprise adoption. Customer count expanded modestly, with total paid customers rising to 15,398 from 15,050 last year.

Meanwhile, paid + free users grew 13% to over 34,000, reinforcing the company’s long-tail strategy to seed future expansion through its free tier.

The most telling figure, however, was the company’s dollar-based net retention rate: 100%, down sharply from 107% a year ago.

Operationally, PagerDuty delivered strong cash generation once again. The company posted $24.8 million in operating cash flow and $20.9 million in free cash flow, ending the quarter with a robust $547.8 million in cash and investments.

For a company entertaining strategic alternatives including a potential sale this balance sheet strength is a meaningful asset.

Third-Quarter Highlights

• ARR grew 3% YoY to $497M.

• Customers with ARR >$100K grew 5% to 867.

• Net retention declined to 100% (from 107%).

• Paid customers reached 15,398; total customers exceeded 34,000.

• Remaining performance obligations stood at $415M, with 69% expected to convert to revenue within 12 months.

These metrics reinforce a stable but sluggish demand environment: steady customer counts, slower expansion, and continued reliance on cost efficiencies to drive earnings.

Guidance & Outlook

PagerDuty’s fourth-quarter outlook calls for revenue in the range of $122–$124 million, implying near-flat growth of 0–2% year over year. Non-GAAP EPS is expected to land between $0.24 and $0.25.

For the full year, the company now anticipates:

• Total revenue of $490–$492M (vs. $493–$497M prior), representing ~5% YoY growth.

• Non-GAAP EPS of $1.11–$1.12, raised from $1.00–$1.04 previously.

Overall, the narrative remains consistent with what we’ve been tracking: PagerDuty is increasingly defined by disciplined cost control, strong net revenue retention at the top end of its customer base, and a relatively muted demand environment. Revenue growth is slow, but margins are improving.

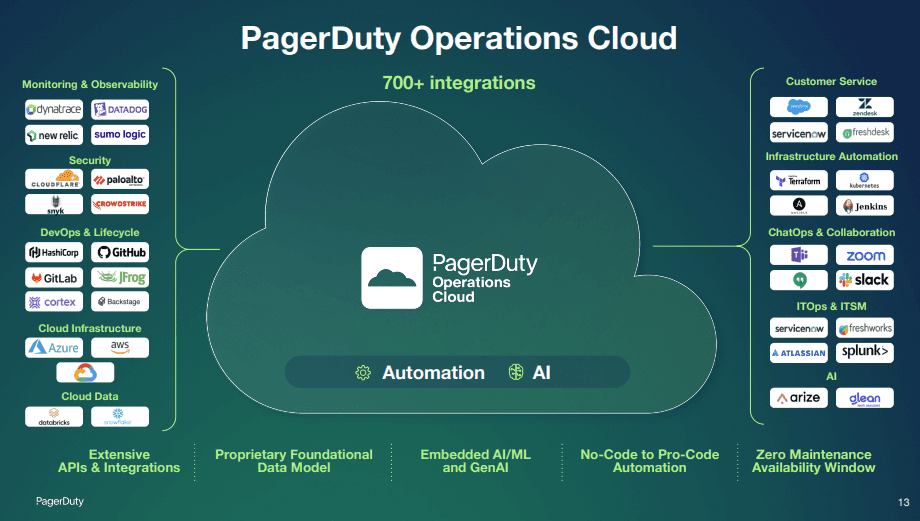

PagerDuty’s business model sits at the core of modern digital infrastructure. Operating as a SaaS platform with a metered, tiered subscription model, the company delivers an AI-first operations management system designed to keep critical services online, responsive, and protected from downtime. Customers range from small startups to global Fortune 500 enterprises, but the value proposition is identical across the board: PagerDuty is the engine that detects issues, interprets signals, orchestrates response, and prevents failures across complex digital ecosystems.

Incident Management: The Core of Its Platform

Incident response is still the foundation of PagerDuty’s business. The platform handles everything from advanced on-call scheduling to automated escalations across SMS, phone, push, and email. It centralizes the entire response workflow, ensuring teams can identify, triage, and resolve outages with speed and consistency. In practical terms, PagerDuty acts as the connective tissue between a company’s systems and its people, making sure the right teams are mobilized when seconds matter.

Reducing Downtime Across Digital Ecosystems

PagerDuty’s value emerges most clearly during outages. The platform monitors every software-enabled system within the infrastructure stack and uses real-time signals to pinpoint failures before they cascade. In an environment where uptime is revenue, customer retention, and brand trust, PagerDuty’s ability to respond at machine speed has kept it highly relevant despite its modest growth profile.

Strategic Acquisitions: Building the Operations Cloud

Over the last several years, PagerDuty has used acquisitions to expand its capabilities beyond simple incident alerting and toward a full operations automation suite:

Jeli (2023): Added advanced incident analysis and security incident response tooling, strengthening post-incident workflows and enterprise-grade operations insights.

Catalytic (2022): Brought a no-code automation engine into PagerDuty’s ecosystem, enabling automated workflows and deeper operational automation.

Rundeck (2020): A pivotal acquisition that expanded PagerDuty into DevOps runbook automation—allowing teams to execute automated remediation tasks directly from PagerDuty during an incident.

These acquisitions collectively created what PagerDuty now markets as its “Operations Cloud” a platform that unifies incident response, automation, and AIOps under one umbrella.

Where the Platform Sits Today

PagerDuty may not be the fastest-growing SaaS company, but its role remains mission-critical in an economy where even minutes of downtime carry financial consequences. The company’s challenge is execution scaling usage-based pricing, expanding automation adoption, and retaining large customers while the market increasingly questions its long-term standalone trajectory.

PagerDuty sits at the core of a company’s digital infrastructure. It’s the quiet engine that keeps platforms like Zoom, Scribd, Okta, Twilio, and Datadog running smoothly, ensuring their customers never feel a disruption.

When something breaks, slows, or signals trouble, PagerDuty is the system that detects it, prioritizes it, and triggers the right teams to fix it immediately.

The business model is straightforward and strong: recurring subscription revenue. Companies pay for access to a platform that is both easy to adopt and scalable across any size organization, from small teams to global enterprises. As digital operations grow more complex, customers naturally upgrade into higher tiers, expanding their usage over time.

PagerDuty ends up becoming a sticky, mission-critical tool once it’s integrated across engineering, security, and IT workflows, it’s hard to replace. That combination of essential functionality, seamless adoption, and predictable recurring revenue makes the model both durable and attractive.

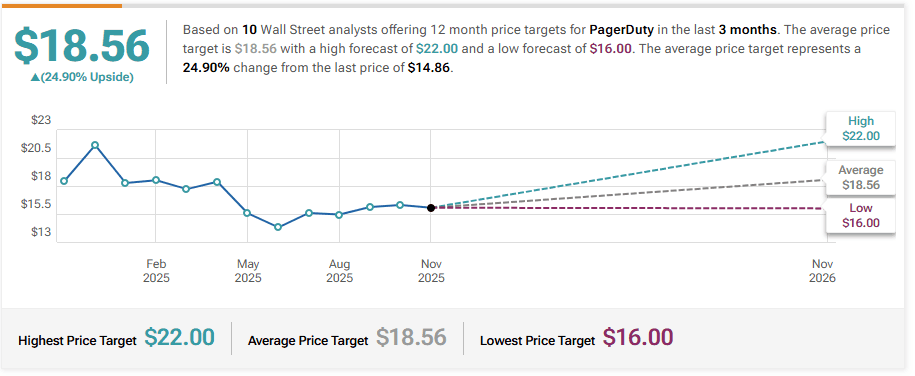

Truist Securities Maintains Buy on PagerDuty, Lowers Price Target to $20

Baird Maintains Neutral on PagerDuty, Lowers Price Target to $16

Canaccord Genuity Maintains Buy on PagerDuty, Lowers Price Target to $19

RBC Capital Maintains Outperform on PagerDuty, Lowers Price Target to $20

JP Morgan Maintains Underweight on PagerDuty, Lowers Price Target to $18