China-based Pony.ai jumped on Tuesday after releasing its third-quarter results, showing the company is rapidly scaling its autonomous driving business.

Revenue came in at $25.44 million, up 72% year-over-year, powered by strong momentum in its Robotaxi operations and continued growth in its licensing and applications segment.

The company also announced an expanded partnership with Sunlight Mobility, a next-generation transportation hardware provider in China, reinforcing Pony’s push toward commercial deployment at scale.

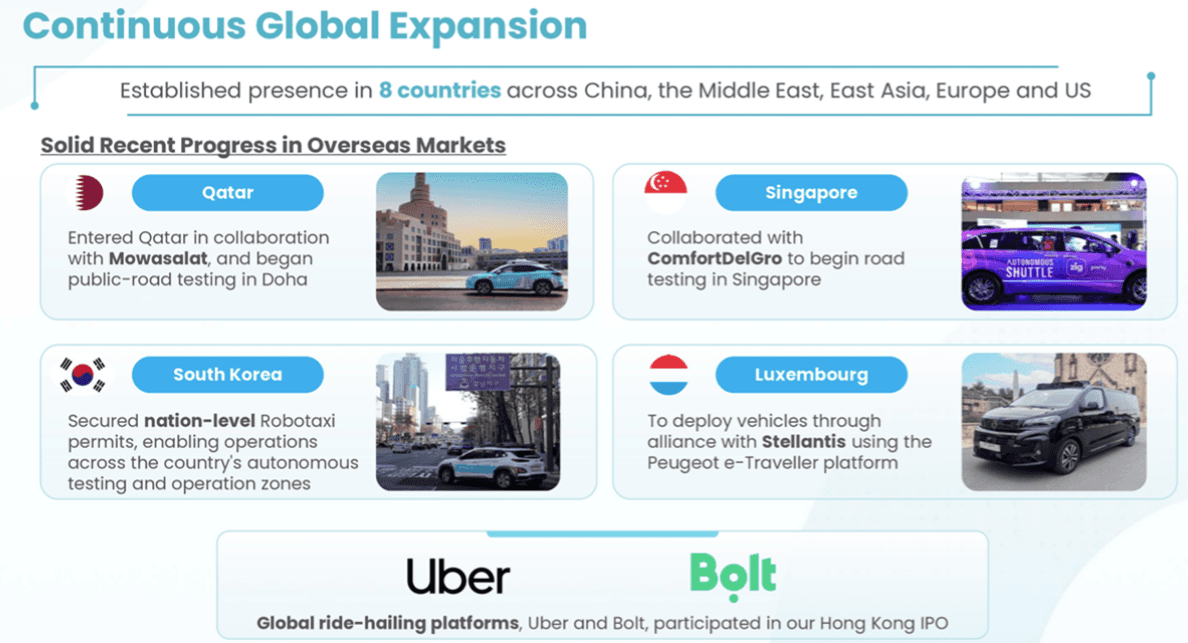

In addition, Bolt one of Europe’s largest ride-hailing platforms revealed a new collaboration with Pony.ai to begin integrating Level 4 autonomous vehicles into its network.

This marks one of Pony’s most significant steps toward international expansion.

This overview breaks down Pony’s latest quarter, the catalysts driving renewed interest, and the key reasons we re-entered the stock this week.

We re-entered Pony.ai today. And yes we should’ve bought the stock yesterday, but heading into earnings we stayed cautious.

Even so, Pony remains one of the most compelling AAV names in the market, and last night’s results made that clearer than ever. The quarter showed real strength across its core operating metrics, and today’s price action is a direct reflection of that shift in sentiment.

The story is moving again, and the market is beginning to reprice the stability of its growth trajectory.

We like our entry here and expect PONY to keep grinding higher into year-end as investors rotate back into quality autonomous vehicle plays and the market starts rewarding execution over speculation.

Pony.ai is one of the few companies in this category with real commercial traction, real partnerships, and a clear path toward scaled deployment.

The company is currently navigating a valuation reset, targeting roughly $4.5 billion down from its $8.5 billion private valuation peak in 2022.

That reset is strategic: it’s designed to test the appetite of U.S. institutional investors for Chinese technology stories at a moment when geopolitical risk is being priced aggressively across the space. But the capital plan is straightforward.

Every dollar raised is being directed into mass production of Level 4 autonomous vehicles, specifically the Toyota Sienna Autono-MaaS (S-AM), which remains central to Pony’s upcoming large-scale rollout.

Pony.ai is not new to us. We’ve traded it successfully through previous cycles of volatility, and once again it sits at the center of an inflection point.

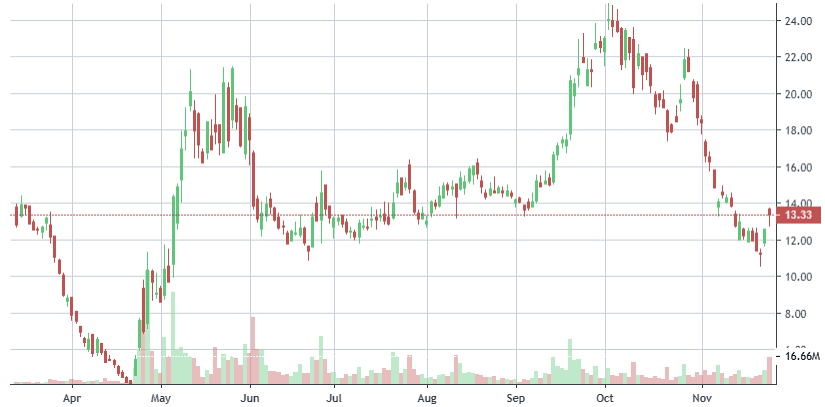

The stock has been under pressure for weeks part of a broader downturn in EV, robotics, and high-capex innovation names but that compression has reset expectations into the next earnings print, set for release two weeks from now.

Trading in the $13–$14 range, the stock is down nearly 29% over the past month. That decline is significant, but it has also created the kind of asymmetric setup we look for: compressed sentiment, lowered expectations, and a catalyst approaching.

We maintain a price target of $28 for PONY a level that reflects both the company’s improving fundamentals and the likelihood that the market begins repricing the AAV sector as capital rotates back into high-conviction growth stories heading into the end of the year.

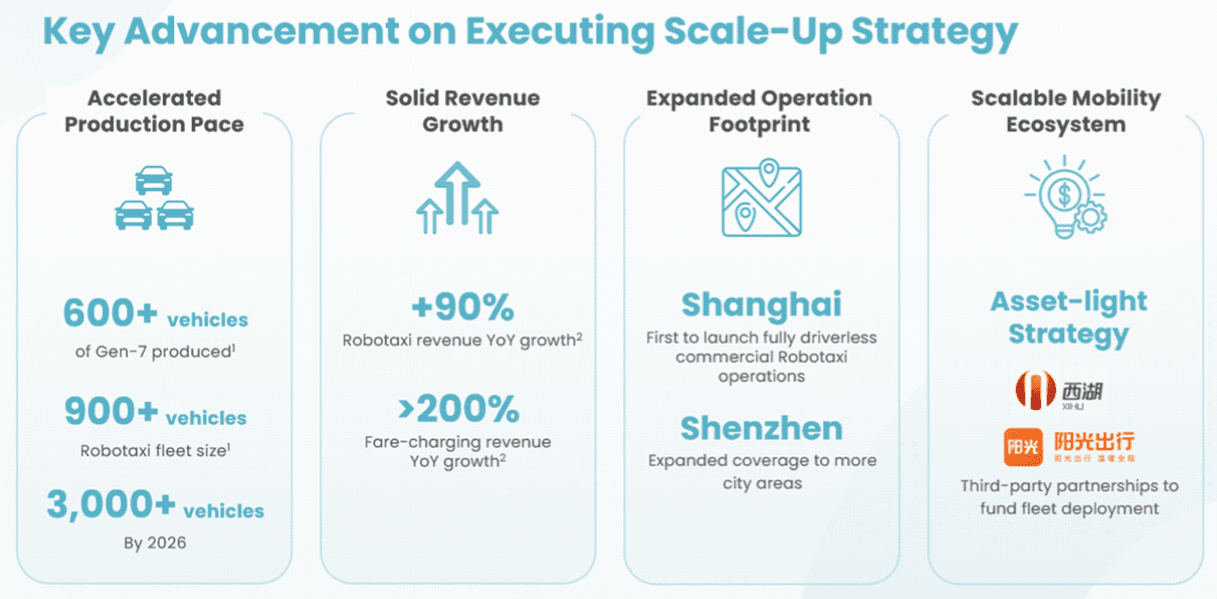

Pony.ai reported another major step forward in scaling its commercial fleet. The company now operates 961 Robotaxis, including 667 Gen-7 vehicles, putting it firmly on track to cross the 1,000-vehicle milestone by year-end. Management also reaffirmed their longer-term target of exceeding 3,000 vehicles by the end of 2026 an aggressive but increasingly realistic expansion plan given the pace of deployment.

The bigger development, however, is unit economics. Pony’s Gen-7 Robotaxis have officially reached city-wide breakeven, a milestone that confirms the viability of the model and fundamentally changes the conversation around commercial autonomy.

Breakeven at city scale is exactly what separates science projects from real businesses. It signals that Pony isn’t just deploying cars it’s deploying a business model that can scale inside China and eventually across international markets.

Cost structure is improving at the same time. Pony reduced its Gen-7 ADK bill-of-materials costs by another 20% for the 2026 production cycle compared to the 2025 baseline. That level of cost compression paired with rising deployment density creates the conditions for margin expansion as the fleet grows.

This combination of fleet scale, improving unit economics, and cost efficiency is why we are paying close attention. Pony’s strategy hinges on the convergence of Toyota’s manufacturing scale and its own software maturity.

If that partnership can outrun the regulatory headwinds and geopolitical friction working against them, the move to 600 vehicles becomes the opening stage of a fleet that could number in the thousands.

If the strategy fails, Pony risks becoming a case study in high-tech decoupling: a company with world-class autonomous technology but limited pathways to global commercialization due to political barriers.

Beyond the geopolitical noise surrounding autonomous driving, the real challenge for Pony.ai remains the same: finding a credible path to profitability. Robotaxis are a notoriously difficult business to scale.

The economics are burdened by expensive hardware, high-maintenance sensor stacks, costly operations centers, and meaningful insurance exposure.

Today, Pony operates just over 190 robotaxis across Beijing, Guangzhou, Shenzhen, and Shanghai. Those vehicles generate revenue enough to validate demand but not enough to offset the high cost per mile, which still trails the economics of human-driven ride-hailing.

The decision to triple the fleet is an intentional push for scale. Pony’s strategy is simple: increase vehicle density in China’s tier-1 markets, lift utilization, and drive down operational cost per ride. At scale, autonomy becomes less about the car and more about the network route density, service frequency, and efficient dispatch. Pony is now leaning heavily into that network effect.

A key shift underpinning this expansion is the company’s transition into an asset-light model. Following its initial partnership with Xihu Group in June, Pony recently expanded its strategy with a new partnership with Sunlight Mobility. Both collaborations follow the same thesis: third-party partners fund the fleet, Pony supplies the technology. This dynamic represents growing market confidence in Pony’s business model and, importantly, allows the company to accelerate future deployment without carrying the full capital burden on its own balance sheet.

Additionally, partnerships with global ride-hailing platforms including shareholders like Uber and Bolt open the door for broader integration as regulations evolve.

On the commercial trucking side, Pony launched its fourth-generation Robotruck platform, engineered specifically for mass production at the thousand-unit scale. Initial deployment is expected in 2026. The company has strengthened cooperation with SANY Group and expanded its manufacturing relationship with Dongfeng Liuzhou Motor, signaling that its autonomous freight ambitions are moving closer to industrial deployment rather than prototype experimentation.

Pony’s roadmap from here is clear: scale the fleet through partnerships, expand internationally through deepening alliances, and push its Robotruck platform toward mass commercialization. Whether this strategy ultimately bends the cost curve and unlocks sustainable profitability is the next major test but the infrastructure and momentum are now being built.

Pony.ai reported a strong third quarter of 2025, highlighted by robust growth across its autonomous mobility segments and meaningful improvements in unit economics. Total revenues reached $25.4 million (RMB 181.1 million), up 72.0% from $14.8 million in the same period last year, driven by continued adoption of its Robotaxi services, expansion in Licensing and Applications, and steady momentum in its Robotruck business.

Robotaxi Services:

Robotaxi revenues climbed 89.5% year-over-year to $6.7 million (RMB 47.7 million), reflecting growing user adoption, increased demand in tier-one Chinese cities, and an expanded fleet. Fare-charging revenues surged over 200% YoY as the company optimized fleet operations and pricing strategies. By November 2025, Gen-7 Robotaxis reached city-wide unit economics breakeven in Guangzhou, with daily average orders per vehicle hitting 232—evidence of both strong demand and operational efficiency. This marks a critical milestone in Pony.ai’s path to scalable, profitable autonomous mobility.

Robotruck Services:

Revenues from Robotruck operations totaled $10.2 million (RMB 72.5 million), up 8.7% from $9.4 million a year ago. The launch of the Gen-4 Robotruck, featuring a 70% reduction in ADK bill-of-materials costs compared to the previous generation, sets the stage for scalable growth and enhanced capital efficiency. This cost advantage supports Pony’s broader push into autonomous freight, complementing the company’s asset-light strategy.

Licensing & Applications:

Licensing and applications revenues soared to $8.6 million (RMB 61.0 million), a remarkable 354.6% increase from $1.9 million in Q3 2024. Demand remains robust for Pony.ai’s autonomous domain controller (ADC), particularly among robot-delivery clients, signaling that its technology is gaining traction beyond direct fleet operations.

Margins & Profitability:

Total cost of revenues came in at $20.8 million (RMB 147.9 million), up 54.7% YoY. Gross profit rose to $4.7 million (RMB 33.2 million), improving from $1.4 million in Q3 2024. Gross margin expanded to 18.4%, compared to 9.2% a year prior, driven primarily by a more favorable revenue mix and a higher contribution from higher-margin Robotaxi operations. Adjusted EPS loss narrowed to $0.14 per share, versus a loss of $3.50 per share in the prior year, reflecting operational leverage and the ongoing benefits of scaled deployments.

Operating Expenses:

Operating expenses rose to $74.3 million (RMB 529.2 million), an increase of 76.7% from $42.1 million a year ago, driven by continued investment in fleet expansion, technology development, and operational infrastructure. Non-GAAP operating expenses were $67.7 million (RMB 482.3 million), up 63.7% YoY, reflecting the company’s strategic focus on building out a foundation for long-term growth while maintaining control over capital allocation.

Liquidity Position:

As of September 30, 2025, Pony.ai maintained a strong liquidity profile with $587.7 million in cash, cash equivalents, short-term investments, and restricted cash. This balance provides the company with flexibility to fund fleet expansion, technology R&D, and international growth initiatives without immediate capital constraints.

Key Takeaways:

Pony.ai continues to demonstrate that its Robotaxi and Robotruck services can scale both operationally and economically. Achieving city-wide unit economics breakeven for Gen-7 Robotaxis validates the viability of its core business model, while licensing and partnerships continue to bolster revenue streams without requiring large capital outlays. Looking ahead, the company is well-positioned to leverage fleet expansion, asset-light partnerships, and ongoing international deployments to drive top-line growth and move steadily toward sustainable profitability

Cash and cash equivalents, short-term investments, restricted cash and long-term debt instruments for wealth management were US$587.7 million (RMB4,184.0 million) as of September 30, 2025, compared to the balance as of June 30, 2025 of US$747.7 million.

Citigroup Initiates Coverage On Pony AI with Buy Rating, Announces Price Target of $29

UBS Initiates Coverage On Pony AI with Buy Rating, Announces Price Target of $20

Deutsche Bank Initiates Coverage On Pony AI with Buy Rating, Announces Price Target of $20

B of A Securities Initiates Coverage On Pony AI with Buy Rating, Announces Price Target of $18