For much of the past half-century, robotics was a narrow discipline, confined largely to the sealed environments of automotive plants and industrial assembly lines. It was capital-intensive, highly specialized, and incremental by nature.

That era is now giving way to something broader and more consequential.

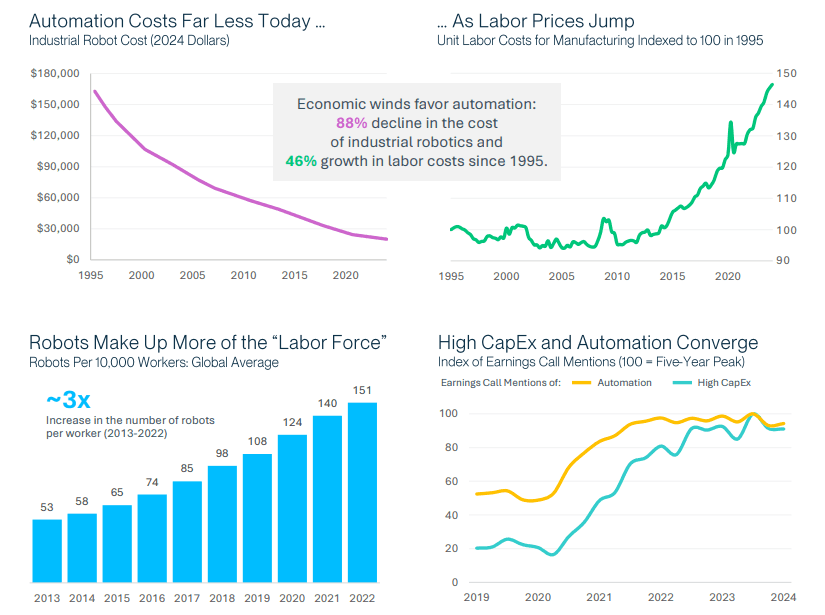

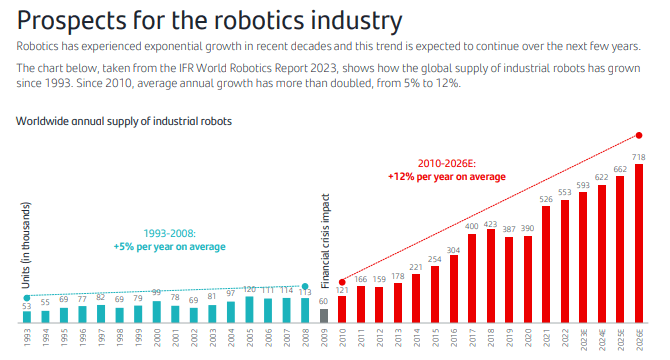

The global robotics market, presently estimated at roughly $65 billion, is projected to approach $375 billion by 2035, a growth rate that speaks not merely to cyclical recovery, but to structural adoption.

What matters more than the headline figures is the widening of the use case. Robotics is no longer a factory-floor curiosity.

Adoption is not uniform, but it is persistent and increasingly irreversible.

The machines themselves have changed.

Today’s robots are mobile rather than fixed, collaborative rather than isolated, and increasingly humanoid in form. Tesla’s Optimus has captured public attention, but it is better viewed as a signal than a singular breakthrough.

Across the sector, robots are evolving from programmable tools into adaptive systems capable of operating alongside humans, responding to unstructured environments, and learning through repetition.

For investors, this transition reshapes the opportunity set. Robotics exposure no longer resides solely in industrial cyclicals or capital-goods suppliers

The revenue models differ, but the common thread is durability: repeat usage, embedded infrastructure, and high switching costs.

As the calendar turns to 2026, robotics stands as a growth sector supported by three reinforcing forces: advances in artificial intelligence, steadily declining hardware costs, and persistent labor scarcity.

These are not short-term tailwinds; they are secular pressures that favor automation over time.

It is important, however, to distinguish robotics from artificial intelligence itself. Robots are physical machines programmable systems designed to execute tasks autonomously or semi-autonomously in the real world.

Artificial intelligence, by contrast, is an enabling layer: software models trained to perform functions that once required human cognition, such as vision, language, and decision-making. AI does not replace robotics; it animates it. The fusion of the two is what makes modern automation economically viable.

Demand is likely to remain strongest in logistics, warehousing, healthcare, and specialized manufacturing areas where autonomy, advanced vision systems, and edge-based AI measurably reduce costs and increase throughput. Mobile robots and collaborative systems should see the fastest rates of adoption, while traditional industrial robot installations are poised to recover alongside reshoring efforts and tighter supply chains.

From a capital-allocation perspective, the balance of value is shifting.

Software layers, perception stacks, and integrated service models are increasingly favored over standalone hardware.

The winners will not merely sell machines; they will bundle sensors, controls, analytics, and ongoing services into cohesive platforms. In that sense, robotics is no longer just about motion it is about systems, data, and duration.

Why Invest in Robotics Stocks?

To invest in robotics equities is not merely to speculate on faster machines or clever software. It is to take part in a slow-moving but profound industrial reordering one that spans labor markets, capital allocation, and the very structure of production across the global economy. The appeal of robotics lies less in novelty than in necessity.

Begin with labor. Demographics, not cycles, are now the dominant constraint. Aging populations in developed economies, shrinking workforces in key manufacturing regions, and chronic shortages in logistics and skilled trades have created gaps that cannot be filled by wage inflation alone.

Robotic systems address these shortages directly.

They do not simply substitute for human labor; they operate where humans cannot whether due to safety, precision, or the relentless demands of twenty-four-hour production. In this sense, robotics is not discretionary capital spending, but adaptive infrastructure.

Equally important is the convergence now underway.

Robotics no longer stands apart as a mechanical discipline. It has fused with machine learning, AI-driven mobility, advanced sensor arrays, and the internet of things. The result is a class of machines that can perceive, decide, and improve with use.

These systems are increasingly indispensable in sectors such as electric vehicles, aerospace, and healthcare, where complexity, reliability, and repeatability are paramount. Intelligence, once abstract and disembodied, is now embedded in physical capital.

Demand, accordingly, is institutional rather than speculative. Governments are commissioning robotics for defense, logistics, and infrastructure resilience.

Hospitals are integrating robotic-assisted surgery as standard practice rather than experimental adjunct. Industrial policy expressed through subsidies, public-private partnerships, and national AI strategies is accelerating deployment.

For investors, the opportunity set is broad and flexible.

Exposure can be obtained through individual companies, through thematic vehicles such as robotics and automation ETFs, or via diversified funds that capture the enabling layers semiconductor equipment, AI infrastructure, precision manufacturing systems, and commercial drone networks. The common denominator is participation in the build-out of automated capacity.

Finally, the fundamentals are increasingly persuasive.

Many robotics-oriented firms exhibit durable revenue growth, improving margins, and defensible market positions. As supply-chain resilience, inventory efficiency, and operational reliability move from aspiration to mandate in boardrooms, automation is no longer optional. Robotics, in this light, is not a speculative theme but a structural allocation capital invested in the tools that modern economies now require to function.

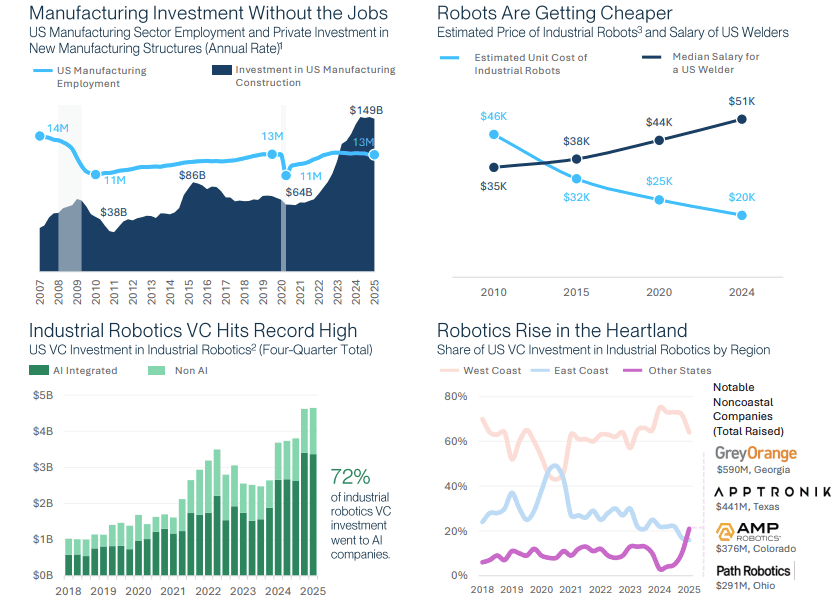

Beyond the headline growth rates, the economics of robotics have quietly but decisively turned favorable. Two forces are moving in opposite directions, and together they form the most powerful argument for sustained adoption:

the rising cost of human labor and the declining cost of machines.

Labor, once abundant and inexpensive in many regions, has become scarce and costly. Wage pressures are especially acute in highly specialized roles, where employers are forced into bidding wars for a shrinking pool of qualified workers

At the same time, the price of robots has been falling.

Advances in manufacturing scale, cheaper sensors, improved computing efficiency, and modular design have driven down unit costs.

The return on investment calculation increasingly favors automation, not in five or ten years, but now.

For enterprises, the appeal is straightforward: robots offer predictable costs, consistent output, and the ability to operate continuously without fatigue or attrition.

For consumers, falling prices have expanded the addressable market. Tasks once deemed too expensive or too trivial to automate cleaning, monitoring, assistance are now economically viable at the household level.

This inversion of relative costs marks an inflection point. When capital becomes cheaper than labor, adoption accelerates not gradually, but suddenly.

The outlook for robotics is no longer speculative; it is increasingly arithmetic.

Industry projections point to a market expanding at a compound annual growth rate in the mid-teens, with estimates ranging from roughly 14% to 17% annually and total market value surpassing $110 billion by the end of the decade.

Those figures matter less for their precision than for what they signify: robotics has moved from a niche capital-goods category into a sustained growth industry with broad economic relevance.

The engines of this expansion are structural rather than cyclical. Artificial intelligence has transformed robots from rigid, pre-programmed machines into adaptive systems capable of perception, learning, and autonomous decision-making. This has dramatically widened the set of tasks that can be automated and lowered the barriers to deployment across industries.

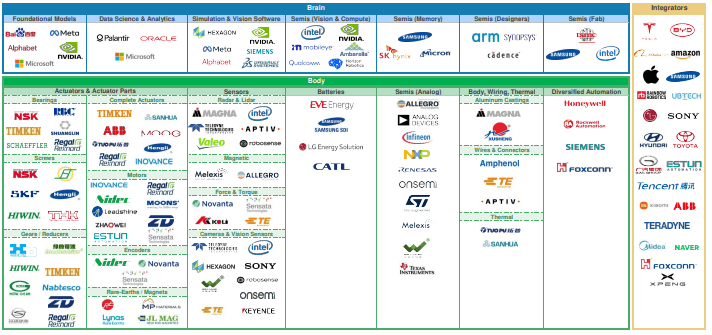

Investors examining the humanoid robotics landscape will immediately notice a striking geographic concentration: roughly 73% of companies engaged in humanoid development and 77% of integrators are based in Asia, with China accounting for 56% and 45% of those segments, respectively.

The relative scarcity of Western players beyond familiar names like Tesla [TSLA] and Nvidia [NVDA] is not merely a curiosity; it is a structural feature of the current ecosystem.

This concentration mirrors, in some ways, the West’s early experience with electric vehicles, where supply chain dominance and domestic industrial policy heavily favored Asia.

Chinese startups benefit not only from mature supply chains and local adoption opportunities, but also from significant government backing, which accelerates both technological development and commercial deployment.

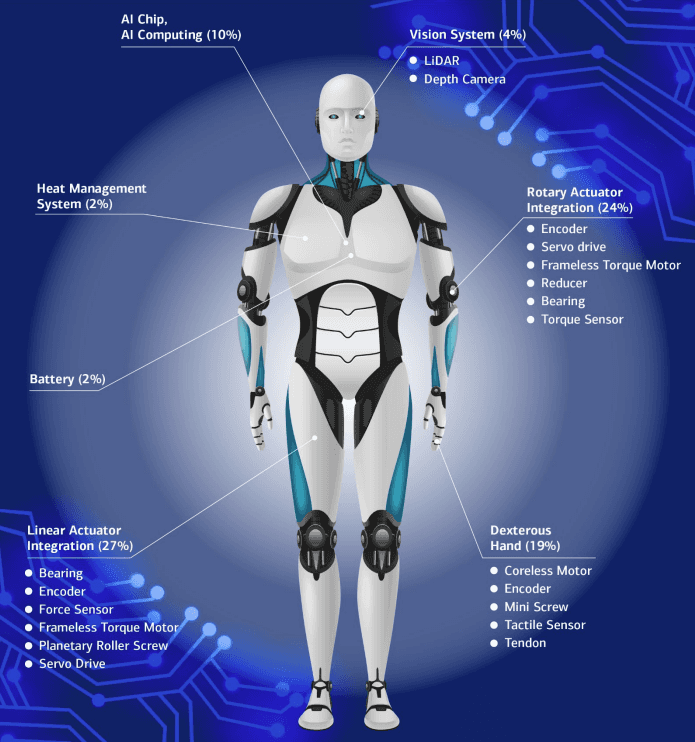

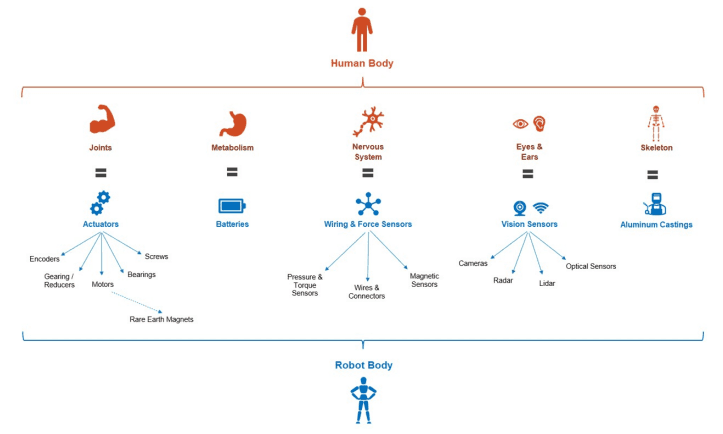

For investors seeking to construct a meaningful portfolio, a basic understanding of humanoid anatomy is essential. The “brain” of these machines combines semiconductors and software, with particular emphasis on foundational generative AI models that enable autonomy, alongside simulation platforms and digital twins for training and operational refinement.

The “body” encompasses a sophisticated suite of sensors cameras, LiDAR, force and torque sensors, magnetic sensors alongside actuators built from motors, encoders, bearings, screws, and reducers. Power comes from a centrally mounted lithium-ion battery, while a tangle of wiring and connectors links all components.

The exterior is generally a lightweight composite of aluminum alloys and engineered plastics, balancing durability with mobility.

In short, humanoid robotics is an ecosystem defined by regional concentration, deep technical complexity, and a nascent but accelerating supply chain.

Understanding these dimensions is critical for anyone seeking to navigate or invest in this emerging sector.

Actuators form the muscular system of humanoid robots, converting electrical energy into controlled motion, either linear or rotary. The complexity of a humanoid’s movement is measured in degrees of freedom (DoF), with more actuators required as the DoF increases. Current humanoids span a range of roughly 16 to 60 DoF. Tesla’s Optimus Gen2, for instance, operates with 50 DoF powered by 28 actuators 14 linear and 14 rotary.

Bearings are critical to the smooth operation of moving components, reducing friction while maintaining precise rotational alignment. Humanoids employ various types, including ball bearings, roller bearings, and needle bearings. Leading providers in this space, include NSK (6471-JP), RBC Bearings (RBC), Regal Rexnord (RRX), Schaeffler (SHA0-DE), and Timken (TKR).

Screws play an equally essential role, transforming rotary motion from motors into linear motion within actuators. Both ball and planetary roller screws are currently used, though planetary rollers are limited by supply and cost. Over time, planetary roller screws are expected to dominate due to their superior performance in precision applications. Key suppliers include Hengli (601100-CN), Hiwin (2049-TW), NSK (6471-JP), SKF (SKF.b-SE), Shanghai Beiti (603009-CN), and THK (6481-JP).

Gearing and reducers whether harmonic or planetary are employed to modulate motor speed, boosting torque output and movement accuracy. These components are indispensable for rotary actuators, translating raw motor energy into usable mechanical power. Notable companies supplying these systems include Harmonic Drive System (6324-JP), Hiwin (2049-TW), Hota (1536-TW), LeaderDrive (688017-CN), Nabtesco (6268-JP), Regal Rexnord (RRX), Shuanghuan (002472-CN), Timken (TKR), and Zhongda Leader (002896-CN).

Together, actuators, bearings, screws, and reducers form the mechanical skeleton and muscles of humanoids. Understanding these components and their suppliers is crucial for investors, as they define the performance, reliability, and scalability of next-generation robots.

Electric motors are the heartbeat of humanoid robots, converting electrical energy into mechanical motion that drives every actuator.

Most rely on rare earth magnets, which interact with electrified coils to generate rotational force. Humanoids typically employ either frameless torque motors, favored for their lower technical complexity, or coreless motors, which offer greater precision but present higher technical barriers.

Key motor suppliers include Estun (002747-CN), Leadshine (002979-CN), Moons’ Electric (603728-CN), Nidec (6594-JP), Regal Rexnord (RRX), Sensata (ST), Shenzhen Inovance (300124-CN), Zhaowei (003021-CN), and Zhongda Leader (002896-CN).

The magnets themselves critical for efficiency and torque generation—come from specialized rare earth providers, including JL Mag (6680-HK), Lynas Rare Earths (LYC-AU), MP Materials (MP-US), and Northern Rare Earth (600111-CN).

These materials are the invisible force behind precise motion control, underpinning the mechanical performance of every actuator.

Encoders act as the humanoid’s proprioceptive system, monitoring motor speed, position, and torque.

By sending feedback to control units, encoders enable fluid and accurate movement. Leading encoder suppliers include Nidec (6594-JP), Novanta (NOVT), and Sensata (ST).

Sensors, meanwhile, give humanoids their eyes, ears, and environmental awareness. A sophisticated array of cameras and vision sensors allow robots to perceive their surroundings, capture images, and interpret light properties essential for navigation, object recognition, and interaction.

Companies contributing to these sensory systems include Analog Devices (ADI), Hexagon (HEXA.B-SE), Intel (INTC), Keyence (6861-JP), Onsemi (ON), Robosense (2498-HK), Sony Group (SONY), TE Connectivity (TEL), Teledyne Technologies (TDY), and Will Semiconductor (603501-CN).

For investors, understanding these components and the companies that supply them is crucial for evaluating the performance, scalability, and potential of the next generation of humanoids.

Most Notable Robotics Stocks

Most Notable Robotics Stocks

This is a list of the most notable "robotics" companies soley focused on making the complete robot and not just being a supplier of parts.

You will notice the ovbious names like Nvidia,Google & Apple missing from this list however we wanted to focus soley on the companies approaching the sector as a whole not a large congolermate with many parts

Company: ABB LTD

Quote: $ABBNY

Sharks Opinon:

ABB is a venerable European industrial franchise, long associated with electrification, power systems, and factory automation.

Within that broad empire sits ABB Robotics, one of the world’s most recognizable suppliers of industrial robots and machine-automation systems.

By scale and reputation, it has stood among the global leaders, serving automotive, electronics, and general manufacturing customers across continents.

Yet scale does not guarantee strategic fit.

ABB recently announced it will sell its robotics division to SoftBank for approximately $5.4 billion, abandoning an earlier plan floated in April to spin off and publicly list the business.

The robotics unit accounts for roughly 7% of ABB’s group sales, and the transaction is expected to close in mid- to late 2026.

On the surface, the divestment is logical. Robotics, while technologically adjacent, has long sat somewhat awkwardly inside ABB’s broader electrification and power-focused portfolio. Profitability has lagged best-in-class peers, most notably Fanuc, whose singular focus on robotics and CNC systems has translated into superior margins and capital efficiency.

That brings us to ATS our top recommendation. ATS operates a sophisticated automation division with many of the same economic characteristics: complex systems integration, mission-critical deployments, and long-term customer relationships. Yet unlike ABB’s robotics unit, ATS benefits from tighter integration across its platforms and a clearer path to margin expansion as automation intensity increases.

In that light, the ABB–SoftBank transaction does more than tidy up ABB’s balance sheet. It provides a benchmark—and in our view, a conservative one. If a global robotics leader can change hands at this valuation, then the market’s appraisal of ATS appears not merely cautious, but mispriced. close in mid- to late 2026.

Description: ABB is a supplier of electrical equipment and automation products. Founded in the late 19th century, the company was created out of the merger of two old industrial companies: ASEA and BBC. Its products include electrical equipment, industrial robots, and equipment used for industrial automation that are sold via approximately 19 business divisions. ABB is the number one or two supplier in two thirds of its product segments.

Operationally, the business is well prepared for life on its own. It is capitalized conservatively, throws off dependable cash flow, and operates a “local-for-local” manufacturing footprint that mitigates geopolitical and logistical risk.

Regional hubs in Sweden, China, and the United States allow ABB Robotics to serve customers close to demand, shorten supply chains, and adapt offerings to local market requirements.

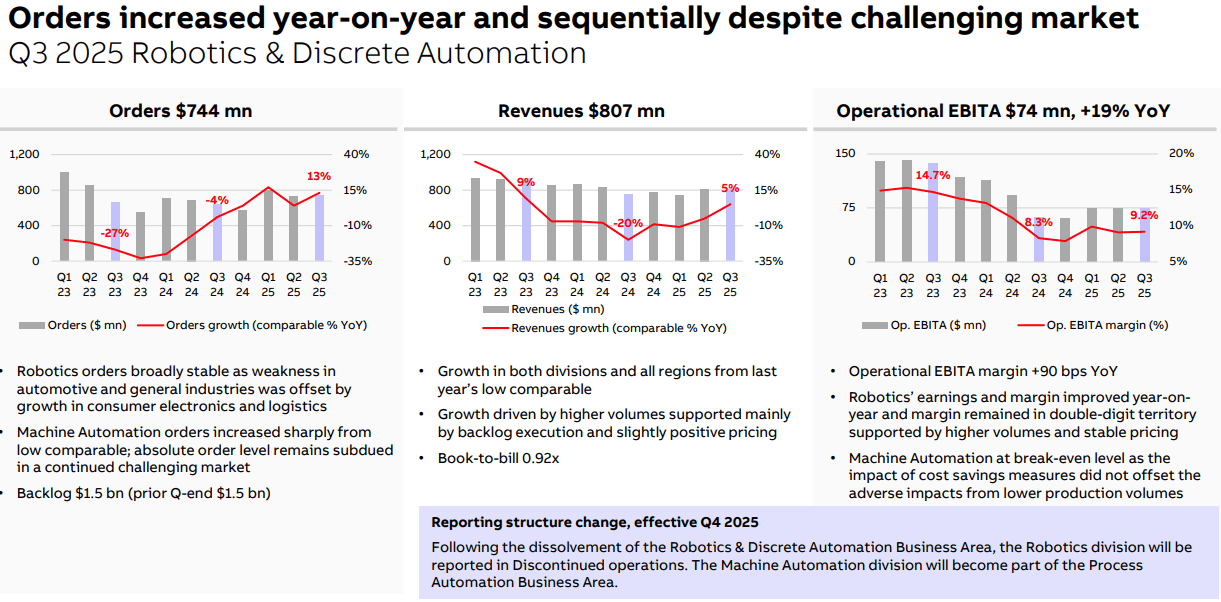

With roughly 7,000 employees and 2024 revenues of $2.3 billion about 7% of ABB Group salesthe division posted an Operational EBITA margin of 12.1%, a respectable figure in a competitive and capital-intensive industry.

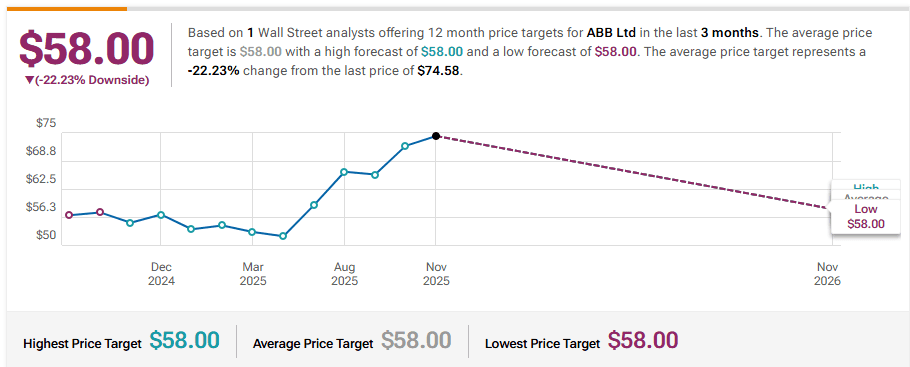

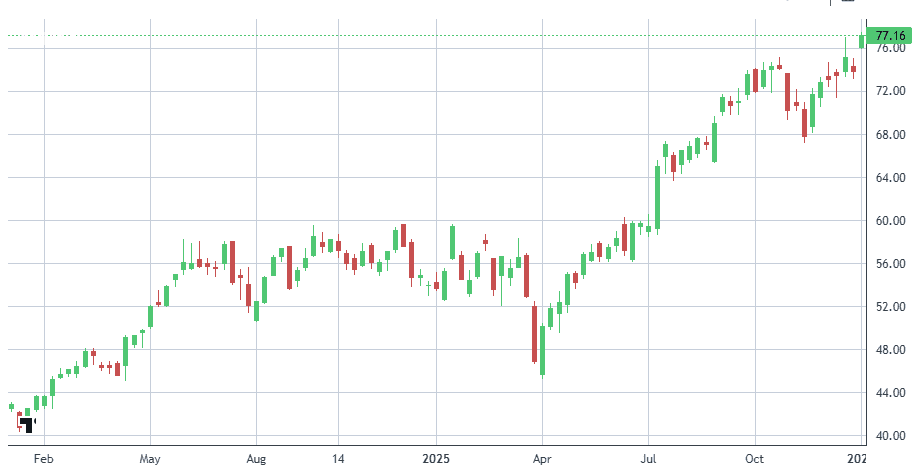

Where the arithmetic grows less forgiving is at the parent-company level. ABB shares currently trade at roughly 29 times estimated 2025 earnings, a multiple about 15% above the company’s three-year average and the highest among its Europe-listed industrial peers.

That valuation assumes a growth trajectory that, in our judgment, may prove optimistic. ABB’s exposure to the fastest-growing automation end markets most notably data centers and AI-driven infrastructure is comparatively limited.

In the language of the market, ABB is priced for excellence while offering moderation. The robotics division is sound, profitable, and strategically coherent. The equity, however, reflects a generosity of expectations that leaves little margin for error. As history reminds us, paying a premium for stability can still be hazardous when growth is the scarce commodity.

RBC Capital Upgrades ABB to Outperform

JP Morgan Upgrades ABB to Neutral

Company: Symbotic Inc

Quote: $SYM

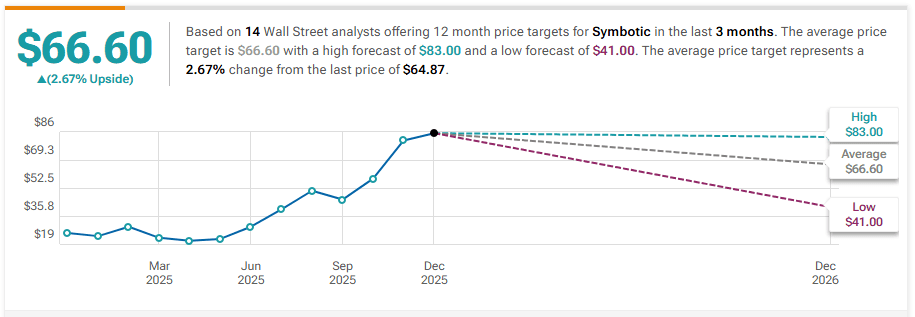

BT: $50-$60 (would be a great dip buy if timed correctly)

ST: $90-$95

Sharks Opinon:

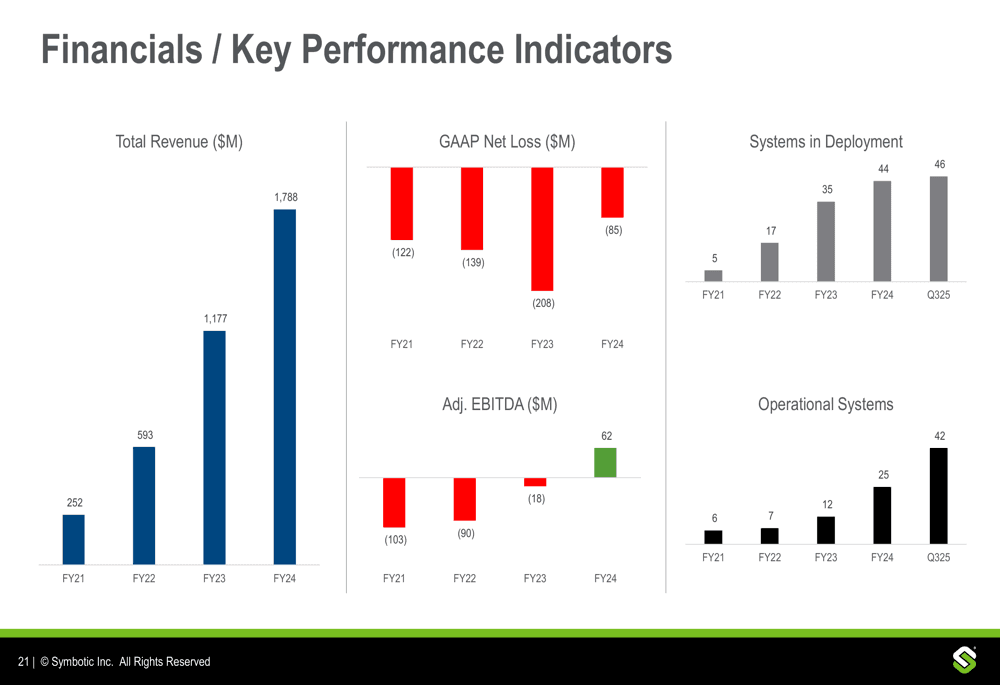

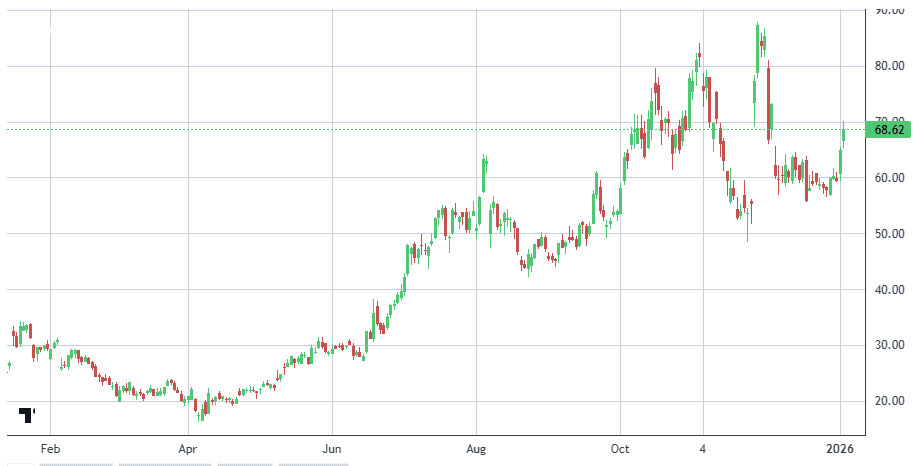

The market’s renewed fascination with automation and robotics has lifted many boats, but few as dramatically as Symbotic. The stock has more than tripled since the start of the year, a performance that reflects not mere speculative froth but a genuine enthusiasm for the company’s position at the intersection of logistics, software, and large-scale automation.

Symbotic’s appeal begins with its customer roster. The company supplies automated warehouse and fulfillment systems to some of the most formidable names in North American retail and grocery Walmart, Target, and Albertsons among them.

That said, the market’s affection is already capitalized liberally so into the share price. At an implied valuation north of $50 billion, Symbotic trades at more than 22 times trailing sales and roughly 50 times free cash flow.

In effect, investors are paying today for a future in which Symbotic’s systems become indispensable infrastructure across retail supply chains, and in which operating leverage eventually transforms revenue growth into durable profitability. That may yet occur. Automation in distribution remains a secular theme, and Symbotic’s technology addresses real pain points in labor, efficiency, and throughput.

The stock’s recent ascent leaves little room for disappointment, execution missteps, or slower-than-expected margin expansion. Symbotic may well justify its exalted status over time, but at present prices the market is assuming not only success, but a near-flawless translation of technological promise into accounting reality. As ever in periods of enthusiasm, the question is not whether the story is compelling it is whether the price already tells it in full.

Description: Symbotic Inc. is an automation technology company that develops solutions to improve operating efficiencies in modern warehouses. The group designs, commercializes, and deploys end-to-end technology systems that significantly enhance supply chain operations. The company automates the processing of pallets, cases, and individual items within warehouse environments. Its systems strengthen operations at the front end of the supply chain and provide benefits to all supply partners downstream. The company operates in two geographical regions: the United States and international markets, with the majority of its revenue generated in the United States.

Symbotic’s story is not merely one of steel, sensors, and conveyor belts; it is increasingly a story of software. The company’s integration of artificial intelligence into its robotics platform allows warehouse systems to think, not just move. Algorithms dynamically assign tasks, optimize travel paths, and rebalance workloads in real time. The result is higher throughput, faster order processing, and a measurable reduction in labor intensity—precisely the variables that dominate boardroom discussions in modern supply chains.

This intelligence layer is what separates automation from mechanization. Rather than hard-coded routines, Symbotic’s robots adapt to changing demand patterns, inventory flow, and operational constraints. In an environment where margins are thin and service levels unforgiving, such adaptability can be the difference between a cost center and a strategic advantage.

The recent acquisition of Walmart’s advanced systems and robotics business deepens this proposition. By absorbing technology developed inside the world’s most demanding retailer, Symbotic extends its reach beyond traditional warehouse automation into automated eCommerce fulfillment. This move is as much about credibility as it is about capability. Walmart does not divest lightly, and its decision to fold these assets into Symbotic suggests a long-term partnership rather than a transactional exit.

For Symbotic, the numbers are beginning to tell a story that the market is eager to believe. Revenue advanced 10% year over year to $618 million in the quarter ended September 27, while the installed base of operating systems nearly doubled to 48. That combination rising sales alongside tangible expansion in deployed assets matters far more than headline growth alone. It suggests not merely demand, but adoption.

Management’s outlook reinforces that impression. For fiscal Q1 2026, Symbotic guides to revenue of $610–$630 million, implying growth of roughly 25%–29%, alongside adjusted EBITDA of $49–$53 million. In an industry where profitability is often deferred indefinitely in the name of scale, even adjusted earnings carry signaling power. They imply a business that is inching closer to economic gravity rather than perpetually floating above it.

Yet the market’s enthusiasm is not rooted solely in growth rates or margin trajectories. It is rooted in concentration and, more importantly, the prospect of escaping it. Symbotic still derives the overwhelming majority of its revenue from automating Walmart’s distribution infrastructure. That relationship has been transformative, but it has also cast a long shadow over the equity. A single customer, no matter how formidable, is not a durable investment thesis.

This is why investors have reacted so favorably to the company’s first meaningful step beyond retail. The recent signing of Medline marks Symbotic’s entry into healthcare logistics, a sector with more than 500 distribution centers in the United States alone.

So favorably to the company’s first meaningful step beyond retail. The recent signing of Medline marks Symbotic’s entry into healthcare logistics, a sector with more than 500 distribution centers in the United States alone.

Goldman Sachs Downgrades Symbotic to Sell, Maintains Price Target to $47

Baird Maintains Neutral on Symbotic, Raises Price Target to $58

Barclays Maintains Underweight on Symbotic, Raises Price Target to $41

DA Davidson Maintains Neutral on Symbotic, Maintains $47 Price Target

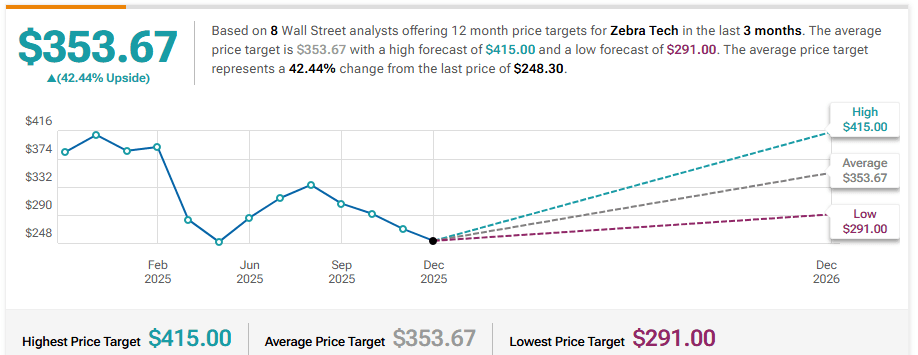

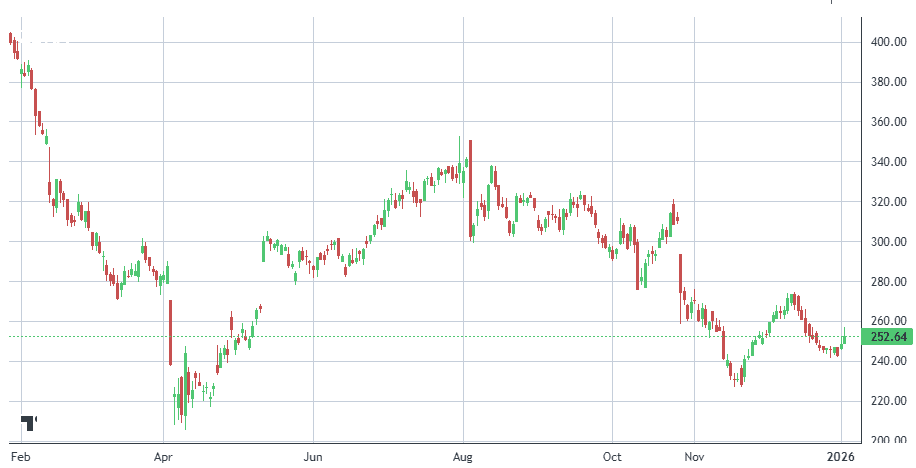

Company: Zebra Technologies

Quote: $ZBRA

BT: $220

ST: $320-$350

Sharks Opinon:

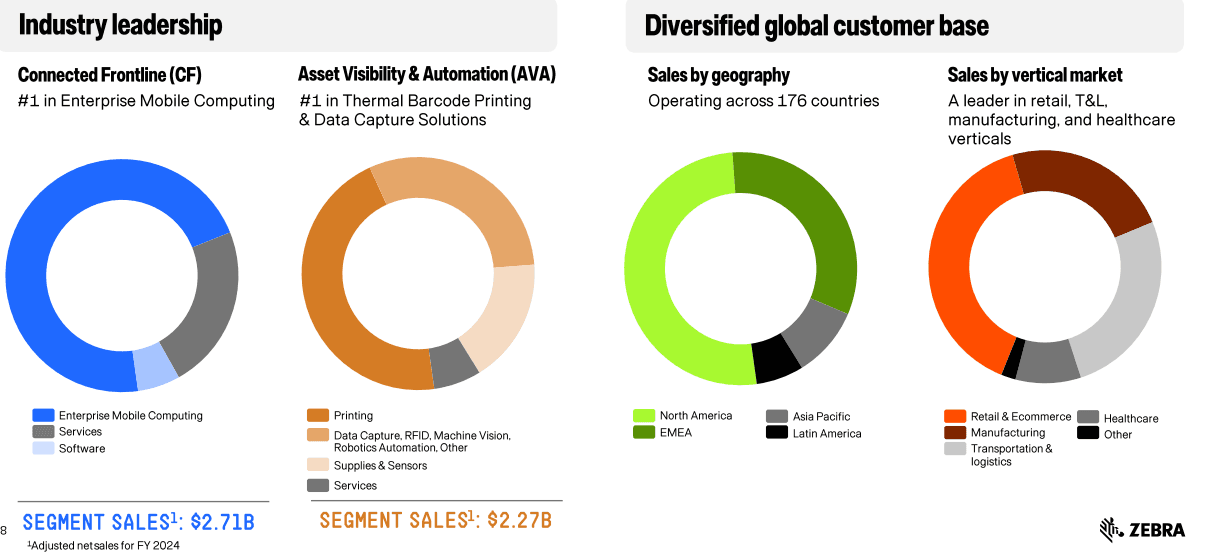

Zebra Technologies sits at the intersection of the physical and digital economy, supplying the core hardware and software that allow warehouses, factories, and retail environments to operate with increasing autonomy.

Its ecosystem of sensors, scanners, machine-vision systems, and handheld devices enables real-time data capture across physical operations, effectively linking on-the-ground activity with digital decision-making.

While Zebra also develops mobile robots for manufacturing and warehouse use, the company’s strength is not in headline-grabbing humanoid robotics, but in practical automation.

These systems focus on navigation, scanning, inventory movement, and process optimization tools that directly improve throughput, accuracy, and labor efficiency across large-scale industrial environments. In many cases, these less visible technologies deliver more immediate and measurable returns than experimental robotics concepts.

From an investment perspective, Zebra Technologies (ZBRA) appears positioned as a high-quality automation play supported by strong cash generation and resilient fundamentals. The company provides mission-critical solutions that are deeply embedded in customer operations, creating high switching costs and recurring demand across economic cycles.

Description: Zebra Technologies is a leading provider of automatic identification and data capture technology to enterprises. Its solutions include barcode printers and scanners, mobile computers, and workflow optimization software. The firm primarily serves the retail, transportation logistics, manufacturing, and healthcare markets, designing custom solutions to improve efficiency at its customers.

Zebra’s technology footprint spans retail, logistics, manufacturing, and healthcare, embedding the company directly into the infrastructure of global commerce. This broad exposure aligns Zebra with long-term trends in automation, asset tracking, and supply-chain digitization, where demand is driven less by discretionary spending and more by operational necessity.

Strategically, the company continues to deepen its capabilities. At the end of FY24, Zebra announced its intention to acquire Photoneo, a specialist in 3D machine vision. This technology enhances the ability of industrial robots to perceive and interact with their environments, expanding Zebra’s role from data capture into more advanced robotic execution. The move strengthens its positioning within higher-value automation workflows rather than standalone hardware.

Operationally, underlying momentum is beginning to improve, even if it is not yet fully reflected in the share price. In Q3 2025, Zebra delivered 4.8% organic sales growth, supported by a 10.6% increase in revenue from the Asset Intelligence & Tracking segment. Growth in this segment was driven by rising adoption of RFID solutions, a key enabler of real-time inventory visibility and automation at scale.

Financially, the company stands out for its balance of yield and profitability. Zebra generates a free cash flow yield of approximately 6.4%, maintains a trailing twelve-month operating margin of 15.3%, and has delivered 12.9% revenue growth over the past year.

While growth remains measured, the investment case emphasizes durable cash generation and margin strength—attributes that position Zebra as a steady compounder within the industrial automation landscape.

Truist Securities Maintains Hold on Zebra Technologies, Lowers Price Target to $291

Citigroup Maintains Neutral on Zebra Technologies, Lowers Price Target to $311

Barclays Maintains Overweight on Zebra Technologies, Lowers Price Target to $360

Morgan Stanley Maintains Equal-Weight on Zebra Technologies, Raises Price Target to $300

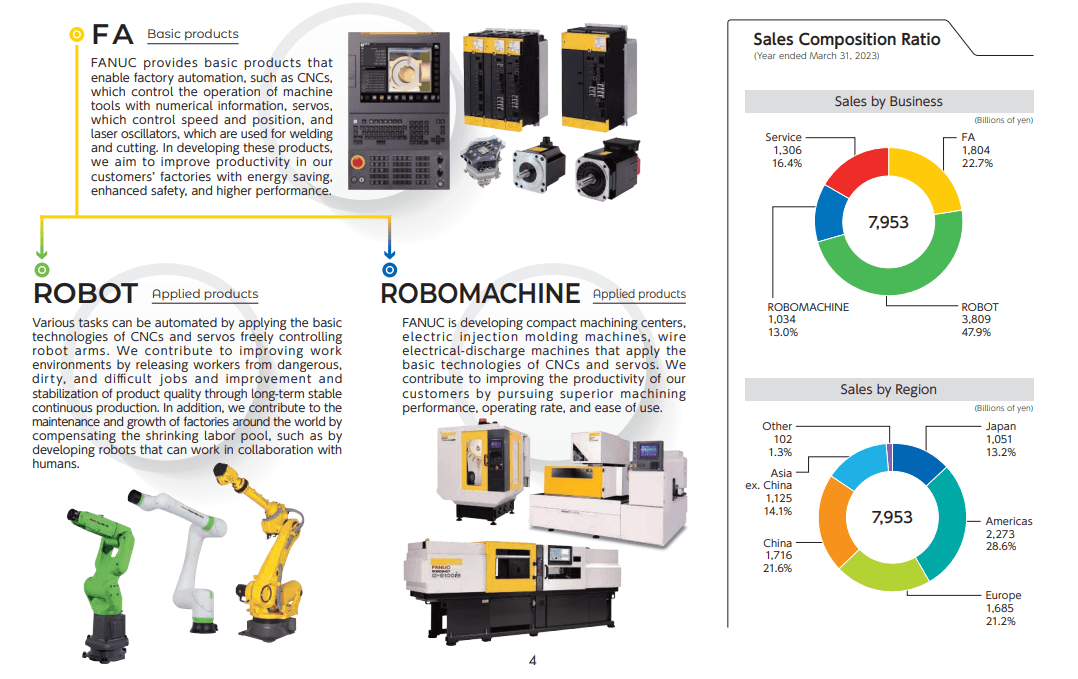

Company: FANUC CORP

Quote: $FANUY

BT: N/A

ST: N/A

Sharks Opinon:

FANUC is a cornerstone of global factory automation, supplying CNC systems, industrial robots, and control platforms that are deeply embedded across manufacturing operations worldwide. Its open automation architecture has become a standard within the industry, allowing manufacturers to integrate FANUC systems across a wide range of applications and production environments.

While the company has faced year-over-year revenue contraction in recent quarters, this softness reflects cyclical pressures rather than structural erosion. End markets tied to capital spending have slowed, weighing on near-term results, but underlying demand within FANUC’s factory automation segment remains resilient. This division, which provides critical control equipment and automation systems for manufacturing processes, continues to see solid order activity as manufacturers prioritize efficiency, precision, and labor substitution.

The disconnect between recent revenue trends and underlying demand highlights FANUC’s position as a leveraged play on an eventual recovery in industrial spending. As capital investment cycles normalize, the company’s entrenched installed base and mission-critical role in production lines position it to benefit disproportionately from renewed automation investment.

Description: Fanuc's primary products include industrial robots, computerized numerical control systems (CNC), and compact machining centers (Robodrills) globally. The company had its beginnings as part of Fujitsu developing early numerical control systems and commands the top global market share with its CNC systems and industrial robots.

FANUC’s Robodrill product line has become a core tool across global manufacturing, supporting milling, drilling, and tapping applications that require precision and reliability. International demand for these systems has continued to expand, prompting the company to increase exports to meet overseas orders. While U.S. tariffs remain a potential headwind, the purchasing dynamics of these tools limit the impact. Robodrills are typically acquired infrequently and in relatively small quantities, supporting long-term production needs, which allows manufacturers to absorb higher prices when the productivity benefits justify the cost.

At the center of FANUC’s growth strategy is its factory automation equipment business, encompassing CNC systems, industrial robots, and intelligent machine tools. This integrated offering positions FANUC as a global leader in both industrial robotics and CNC technology, with deep penetration across manufacturing verticals. The company’s collaboration with NVIDIA signals an important strategic evolution, extending its capabilities beyond traditional automation toward a more advanced “physical AI” platform where robotics, perception, and compute converge.

Financial performance is beginning to reflect this strategic shift. FANUC’s second-quarter net profit, reported in October, exceeded market expectations, and management responded by meaningfully raising its earnings forecast for fiscal year 2026. Together, improving profitability and a clearer long-term technology roadmap reinforce FANUC’s position as a critical enabler of next-generation industrial automation.

Company: Richtech Robotics

Quote: $RR

BT: $1-$2

ST: $5

Sharks Opinon:

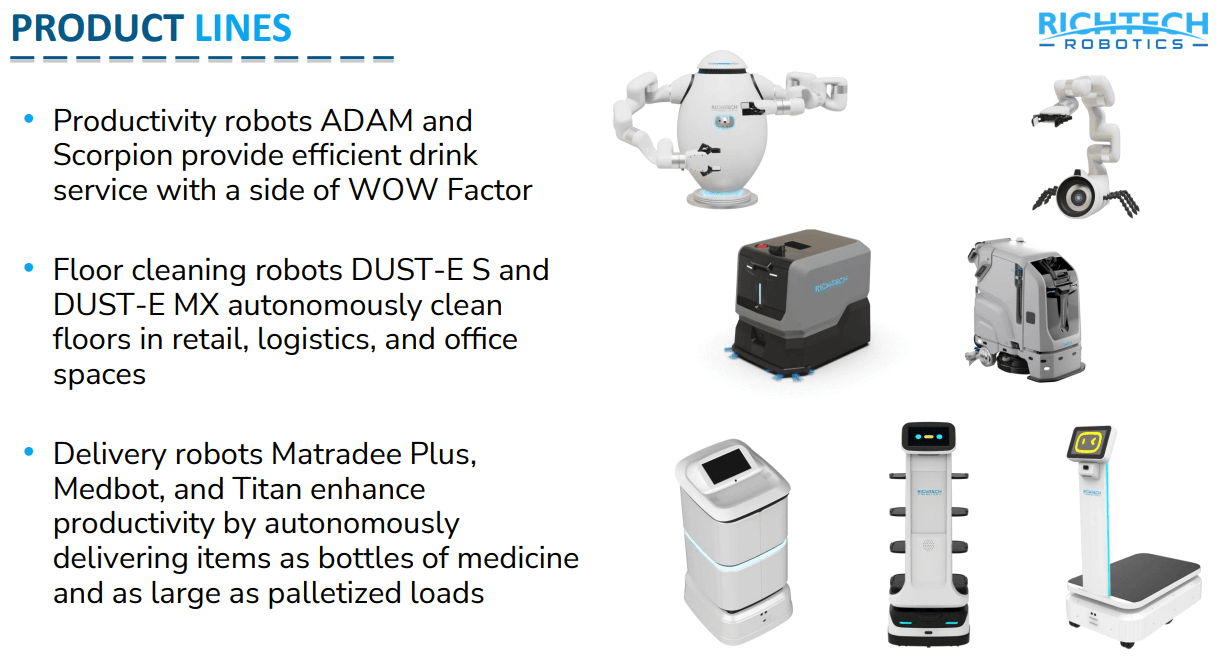

Wall Street remains highly receptive to artificial intelligence narratives, and Richtech Robotics fits squarely within that theme. Its service robots, powered by NVIDIA chips, are already being deployed in restaurants and hospitals, performing repetitive and labor-intensive tasks that operators increasingly want automated. The concept is compelling, but like many early-stage robotics companies, Richtech faces the core challenge of converting pilot deployments into recurring, scalable revenue while keeping cash burn under control.

Valuation highlights this tension. Richtech trades at roughly 7.8 times book value, a demanding multiple for a company with limited revenue visibility. That premium reflects investor expectations that service robotics adoption will accelerate and that Richtech can establish a meaningful foothold in the market. However, robotics hardware remains a structurally difficult business. Manufacturing costs, field servicing, ongoing software development, and customer support place persistent pressure on margins, making scale both essential and difficult to achieve.

Recent capital actions have added to investor scrutiny. The company announced a fivefold increase in authorized Class B shares, expanding the count from 200 million to 1 billion. While dilution fears often trigger immediate reactions, the size and timing of this authorization raise broader questions about capital strategy. Issuing on the order of 100 million shares over an 18-month period is more commonly associated with companies under financial stress than with firms entering a self-sustaining growth phase.

Taken together, Richtech remains a high-conviction, high-risk proposition. The long-term robotics opportunity is real, but the path from compelling demonstrations to durable shareholder value depends on execution, capital discipline, and proof that early deployments can evolve into profitable, repeatable business lines.

Description: Richtech Robotics Inc is a developer of new robotic technologies focused on transforming labor-intensive services in hospitality and other sectors currently experiencing unprecedented labor shortages. The company designs, manufacture and sells robots to restaurants, hotels, senior living centers, casinos, factories, movie theaters and other businesses. Its robots perform a variety of services including restaurant running and bussing, hotel room service delivery, floor scrubbing and vacuuming, and beverage and food preparation. The company designs its robots to be friendly, customizable to client environments, and extremely reliable.

Richtech designs and manufactures a range of service robots, spanning indoor delivery systems, cleaning automation, food-and-beverage platforms such as the ADAM beverage robot, and heavier-duty Titan units aimed at industrial use cases. The company also operates Clouffee & Tea, a robotic café concept that functions both as a commercial venture and as a live demonstration of its technology in real-world environments.

From an investment standpoint, Richtech offers direct exposure to the convergence of labor shortages and AI-driven automation. If the company can successfully convert pilot programs into recurring contracts and scale its China joint venture, revenue growth could accelerate. Partnerships with NVIDIA and inclusion in select market indices add a degree of external validation that many early-stage robotics firms lack.

That said, the risks remain material. Revenue traction is limited, losses continue to widen, and the current valuation implies a high level of execution in a sector where scaling hardware-driven businesses has historically been difficult. The gap between technological promise and financial performance remains significant.

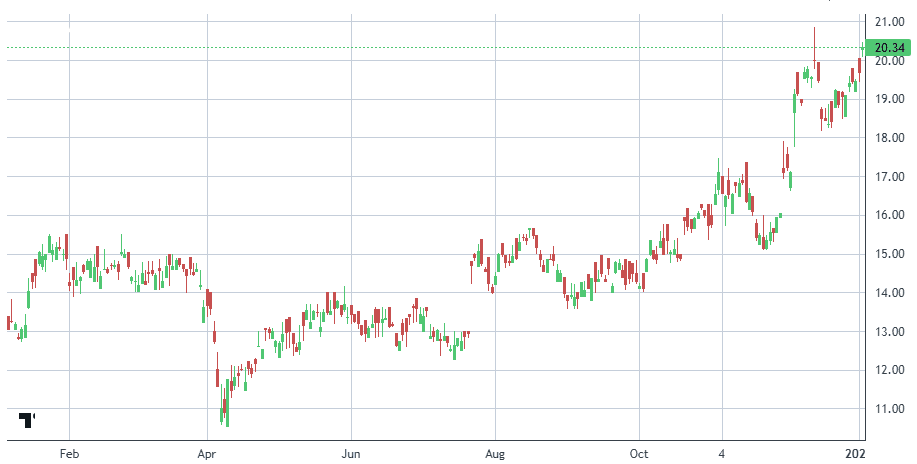

Financial results underscore this challenge. Revenue declined from $8.8 million in 2023 to $4.2 million in 2024 as the company transitioned toward a Robotics-as-a-Service model. In the third quarter of 2025, Richtech reported a net loss of $4.1 million alongside a 16% year-over-year revenue decline, marking its fourth consecutive earnings miss.

While gross margins of approximately 70% suggest strong unit economics at scale, substantial operating losses highlight the difficulty of reaching that scale in practice.