The U.S. economy has shown notable resilience throughout 2025, navigating a complex mix of headwinds that would have derailed weaker cycles.

Chaotic tariff policy, escalating geopolitical tensions, persistently elevated inflation and mortgage rates, and early signs of labor market softening have all weighed on sentiment. Yet growth has held together better than many expected, underscoring the underlying strength of domestic demand and fiscal support.

Looking ahead to 2026, the surface-level outlook may appear more stable, but the underlying risk profile remains elevated. Geopolitical uncertainty is far from resolved, particularly as new rules governing trade, investment, and industrial policy continue to take shape. The United States remains the central architect of this evolving framework, while China presses ahead with its ambition to achieve technological self-sufficiency and global influence. The resulting tension between these two poles is likely to remain a defining feature of the macro landscape.

Trade conflicts, rising populism, and growing dependence on critical raw materials add further layers of fragility. These forces have the potential to reignite volatility with little warning, especially if supply chains or capital flows are disrupted. For investors expecting 2026 to offer a return to calm after the turbulence of 2025, disappointment is a real risk. The idea that markets will simply revert to a pre-2020 “normal” ignores the structural changes now firmly embedded in the global system.

The rules-based international order that underpinned decades of globalization continues to erode. Where 2025 was defined by the dismantling of long-standing assumptions, 2026 is likely to be shaped by the emergence of a new and still-uncertain set of rules.

What is clear, however, is that the U.S. will continue to leverage its economic, political, and military power to reshape both its domestic economy and the broader global landscape.

Throughout 2025, the U.S. demonstrated a growing willingness to integrate economic statecraft directly into policy decisions. Tariffs, subsidies, mandated domestic investment, and strategic military actions should not be viewed as isolated headlines, but as components of a coherent and deliberate approach.

It is tempting to look at consensus forecasts for 2026 and conclude that conditions will resemble business as usual. On paper, the outlook suggests moderate growth, easing inflation, lower energy prices, relatively stable exchange rates and bond yields, and a Federal Reserve delivering a handful of rate cuts while the ECB remains largely on hold.

But these projections sit atop a far more fragile reality, one that could give way to significant disruptions if geopolitical or policy shocks emerge.

Understanding this structural volatility is essential for both businesses and investors as they map risks and allocate capital. The macro environment may look calmer on the surface, but beneath it lies a system in transition.

Our message is simple and direct:

2026 may be different from 2025, but it is unlikely to be easier. Buckle up.

Part 1: Volatility

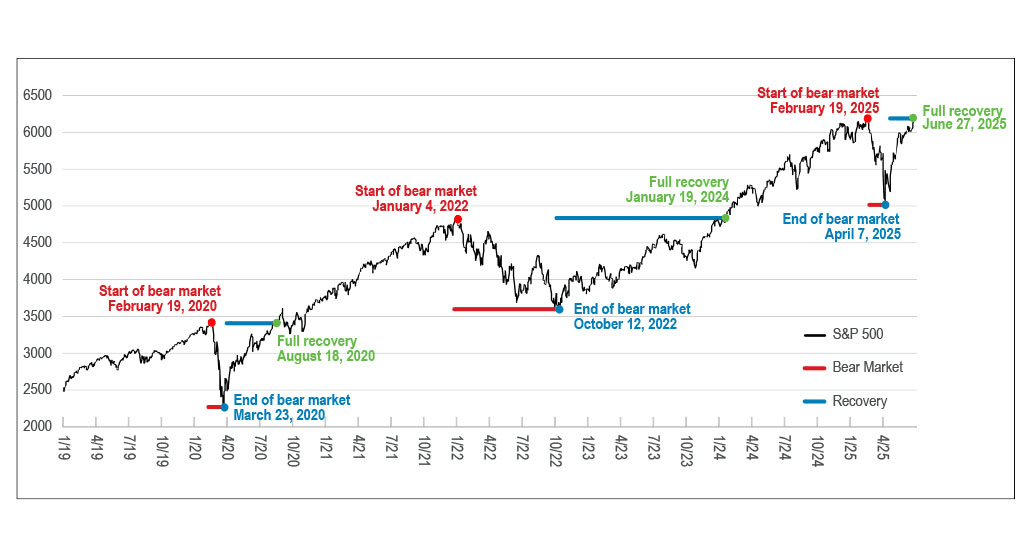

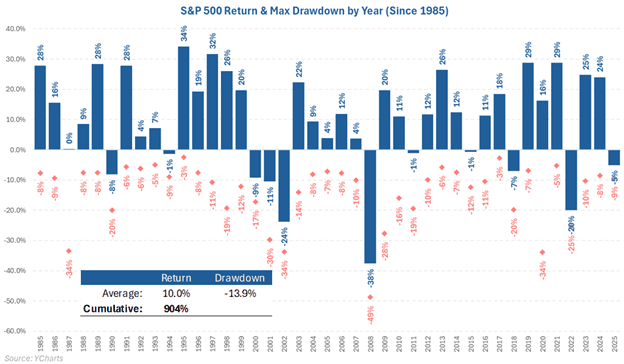

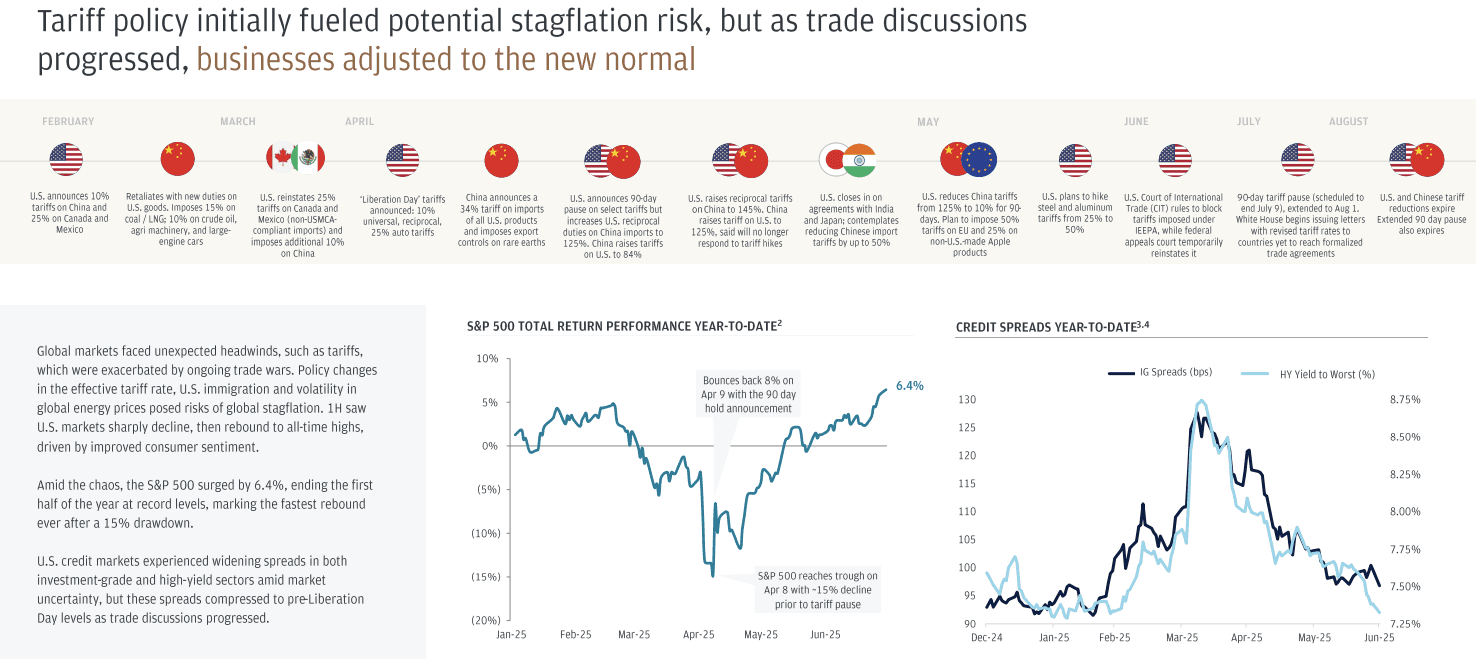

The first half of 2025 was defined by extraordinary volatility in U.S. equity markets, reflecting a rare convergence of shifting trade policy, rapid technological change, and highly reactive investor sentiment. What began as cautious optimism quickly gave way to sharp market swings, reminding investors that even in structurally strong economies, financial markets remain highly sensitive to policy shocks and narrative shifts.

At its core, the stock market often viewed as a long-term engine of wealth creation is inherently volatile. These fluctuations are not anomalies, but signals. Volatility serves as a critical barometer of risk perception and market psychology, and in 2025 it surged as tariff announcements, geopolitical developments, and disruptive technological headlines repeatedly reset investor expectations.

That dynamic was on full display in February and March, when a series of aggressive trade measures from President Trump’s administration moved to the forefront of the global economic agenda. Markets reacted swiftly and decisively.

On April 3–4, the S&P 500 then hovering near record highs suffered its steepest two-day decline since the pandemic-driven selloff of March 2020. By the end of March, the index had recorded its worst monthly performance since December 2022, pulling the Nasdaq and Russell 2000 sharply lower alongside it.

Market turbulence was further intensified by a sudden shift in the artificial intelligence narrative. AI had previously been the market’s dominant growth theme, powering outsized gains across mega-cap technology stocks and semiconductor names.

That confidence was shaken when China unveiled its low-cost DeepSeek AI model, challenging assumptions about U.S. technological supremacy and long-term pricing power. Concerns over rising competition, compressed margins, and diminishing barriers to entry sparked a rapid reassessment, triggering a selloff across AI-linked equities.

Despite the severity of the early-year drawdown, signs of stabilization began to emerge as spring turned to summer. In May, a key diplomatic breakthrough between the U.S. and China helped calm markets, with both sides agreeing to materially de-escalate tariffs. U.S. duties on Chinese imports were reduced from 145% to 30%, while China cut tariffs on U.S. goods from 125% to 10%. The move eased fears of a prolonged trade war and restored a measure of confidence to global risk assets.

By the end of June, equity markets had not only recovered their earlier losses but pushed to fresh record highs, with both the S&P 500 and Nasdaq setting new peaks. Policy focus shifted toward extending earlier tax cuts and debating new legislative initiatives aimed at strengthening domestic manufacturing, accelerating clean energy investment, and incentivizing U.S.-based electric vehicle production.

The turbulent first half of 2025 ultimately highlighted how deeply intertwined global trade policy and technological innovation have become and how quickly markets can pivot in response to geopolitical developments, policy recalibration, and competitive breakthroughs.

With year-to-date data nearing completion, 2025 is already on track to rank among the most volatile years of the past decade. Average volatility has exceeded that of six of the last eight years, with only 2020 when the onset of COVID-19 pushed volatility to a peak of 85.5 and 2022, marked by recession fears and a sharp technology-led selloff, posting higher readings.

Volatility in 2025 was particularly influenced by President Trump’s reciprocal tariff announcements in early April, which sent the VIX surging to a high of 60.1 as markets grappled with the potential economic fallout and second-order effects. Since that spike, volatility has steadily cooled, with the VIX now hovering near 16.6 implying expected daily market moves of roughly 1.05% over the next 30 days.

While markets appear to have grown more accustomed to rapid-fire policy announcements, the first half of 2025 stands as a clear reminder: in an era defined by geopolitical leverage and accelerating technological change, volatility is no longer the exception.......it is the baseline.

Despite elevated volatility, several underlying indicators point to a more constructive backdrop than recent market swings might suggest. One notable example is the housing market, where mortgage rates have eased from roughly 7.0% at the start of the year to about 6.6%. That decline has already translated into improved activity. While still subdued by historical standards, the pickup suggests that lower rates are beginning to unlock pent-up demand.

More broadly, the volatility seen in 2025 has been driven less by deteriorating fundamentals and more by uncertainty around what could change, rather than what has changed. Recession concerns have resurfaced in headlines and market narratives, yet those fears have not been confirmed by hard economic data or by downward revisions to corporate earnings expectations. Labor markets remain resilient, consumer balance sheets are relatively healthy, and profit forecasts have largely held up.

As a result, we continue to focus on tangible evidence that policy shifts particularly around trade, rates, and fiscal measures are filtering into real economic outcomes. Until that occurs, the recent turbulence appears more like a normalization of market behavior following two exceptionally strong years for equity investors, rather than the start of a sustained downturn.

From a longer-term perspective, the drivers of equity returns have also evolved in a constructive way. While multiple expansion was the dominant force behind market gains through the middle of 2020, leadership has since shifted decisively toward earnings growth. Since mid-2020, corporate profits have surged at a historically rapid pace, supported by strong demand across key industries and enhanced pricing power among well-positioned companies. That dynamic has allowed margins to expand meaningfully, even in the face of rising input costs and wage pressures.

FactSet data highlights the magnitude of this earnings acceleration. For the third quarter of 2021, the earnings growth rate approached 40%, far exceeding the five-year average of 11.8% and coming just shy of the post-financial-crisis peak recorded in Q2 2010.

Financials, Health Care, Information Technology, and Energy were the largest contributors to the rise in index-level earnings growth during this period. Financials delivered the most significant increase in earnings, while Energy saw the strongest upward revisions to revenue estimates, reflecting both higher prices and improving demand conditions.

More recently, volatility has been amplified by positioning dynamics within the hedge fund community. According to a Goldman Sachs analysis, hedge funds have sharply reduced exposure, with net leverage falling to one-year lows. This shift toward a risk-off stance is particularly notable given strong year-to-date performance across many strategies. With gains already on the books, many funds appear focused on capital preservation, reducing risk into periods of uncertainty, and engaging in year-end tax-loss harvesting.

Taken together, these factors suggest that while volatility has returned to markets, it is not necessarily signaling a breakdown in the underlying investment case. Instead, it reflects a market recalibrating expectations amid policy uncertainty, crowded positioning, and elevated sensitivity to macro headlines. For disciplined investors, this environment reinforces the importance of separating noise from fundamentals and recognizing that volatility, in many cases, is the price of long-term returns rather than a reason to abandon them.

Sharks Opinion:

Volatility is a permanent feature of financial markets, not an anomaly. It is something every investor must learn to live with, which is why disciplined fundamentals matter far more than short-term reactions.

There is rarely a need to use leverage during uncertain market conditions, just as there is little justification for aggressively overweighting an entire sector in hopes of a single favorable announcement. Those approaches tend to amplify risk precisely when patience is required.

We strongly recommend against overreacting to the current bout of market volatility. Instead, investors should remain focused on maintaining a well-diversified portfolio that includes a healthy mix of high-quality equities, bonds, and cash. While market turbulence may persist in the near term, periods like this often create opportunities to steadily accumulate the right types of assets rather than retreating to the sidelines.

From our perspective, the most attractive equities in this environment share several defining characteristics: high barriers to entry that confer durable competitive advantages, strong balance sheets with low or manageable debt levels, and the ability to generate consistent and growing cash flows that support long-term dividend growth.

History has repeatedly shown that companies with these traits are better positioned to generate outsized returns over extended periods, while also providing a degree of downside protection during challenging market environments such as the one investors are navigating today.

Part 2: Trade

You cannot discuss trade in 2025 or 2026 without mentioning tariffs.

After a year of nonstop debate, the more important question is no longer what tariffs are, but why they are being used and what they mean for the broader economy and financial markets.

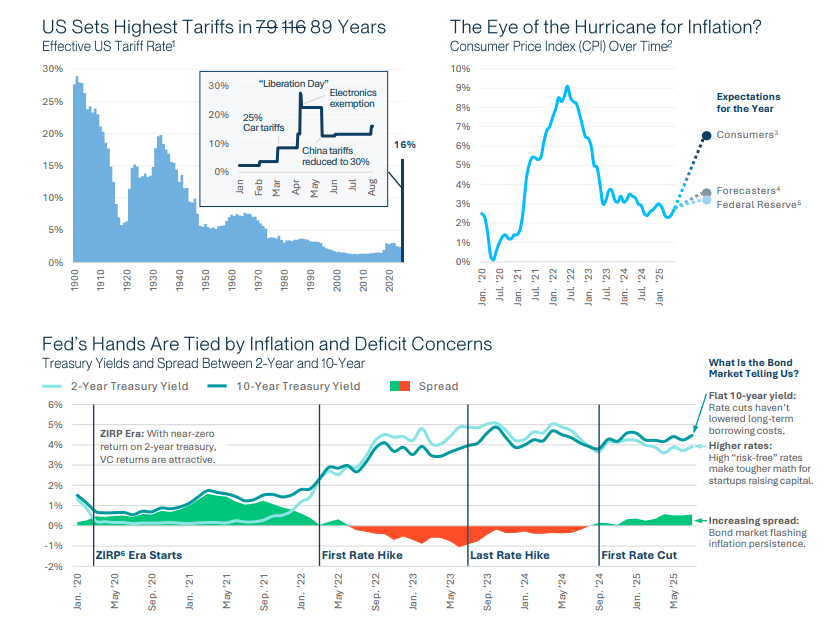

The U.S. budget deficit now sits near 6% of GDP, roughly double the average level seen from 1980 through the pre-COVID period. Larger deficits force the government to issue more Treasury debt. If demand for those bonds does not keep pace, the imbalance puts upward pressure on longer-term interest rates, all else equal.

That is where tariffs quietly enter the equation. While tariff revenue alone will not solve the deficit, it can modestly reduce the amount of new bond issuance required.

By slightly easing Treasury supply, tariffs can help limit upward pressure on yields at the margin, making them not just a trade policy tool, but a subtle part of the broader fiscal and rate management framework.

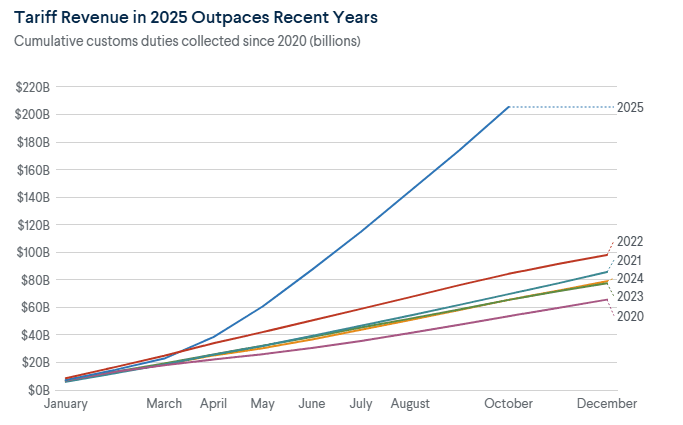

Tariff rates have surged to roughly 16%, the highest level since 1935, driving a sharp increase in tariff-generated revenue. In fiscal year 2025, the federal government collected $195 billion in customs duties more than 250% higher than the prior fiscal year.

Even with that windfall, the U.S. budget deficit still reached approximately $1.8 trillion, underscoring the scale of the underlying fiscal imbalance.

If tariffs remain at current levels, the Congressional Budget Office estimates they could reduce cumulative U.S. budget deficits by about $3 trillion through 2035, though this projection does not account for potential impacts on economic growth. T

Those assumptions remain fragile. Legal challenges loom, with the Supreme Court potentially striking down some or all tariffs imposed under the International Emergency Economic Powers Act (IEEPA). Separately, the “One Big Beautiful Bill” introduces the risk of materially higher long-term deficits. According to the Yale Budget Lab, a rollback of IEEPA tariffs could cut tariff revenue roughly in half.

Against this backdrop, the Treasury has begun adjusting its debt issuance strategy. In November, officials signaled that issuance would tilt more heavily toward the front and intermediate portions of the yield curve over the coming quarters, a move aimed at managing borrowing costs amid shifting demand dynamics.

The Trump administration’s trade strategy has created a temporary fiscal cushion, but it has also injected uncertainty into the Treasury market. While elevated tariff revenues may modestly reduce bond issuance and ease upward pressure on yields, they are not a structural fix. Persistent deficits, legal risks around tariff authority, and new spending commitments limit their effectiveness. Combined with evolving demand from foreign investors and emerging buyers such as stablecoin issuers, these forces point to continued bouts of Treasury market volatility.

Looking ahead, maintaining long-term stability in the Treasury market will require a more balanced approach refining tariffs to minimize stagflationary spillovers, strengthening oversight of new demand sources, and making credible progress toward fiscal sustainability.

Without those steps, the interaction between trade policy and Treasury dynamics risks amplifying volatility and pushing long-term yields higher, with consequences that extend well beyond U.S. borders.

After the Treasury Department announced in the summer of 2023 that it would need to issue substantially more debt than previously expected in the third quarter, the U.S. government’s credit rating was downgraded by Fitch.

The market response was swift. The 10-year Treasury term premium jumped, bond yields surged toward 5%, and equities fell roughly 3.3% over the quarter underscoring how sensitive markets are to changes in fiscal expectations.

Fast forward to fiscal 2025, and tariffs have emerged as a meaningful revenue source. U.S. Customs and Border Protection collected $216.7 billion in tariff revenue during FY 2025, a 146% increase from 2024. The momentum has continued into fiscal 2026, with $34.3 billion collected in the first month alone nearly double the average monthly intake seen last year.

But how does raising revenue through tariffs actually affect the broader economy and financial markets? At its core, a tariff is a tax specifically, a tax paid by importers for the right to bring goods into the country. And like all taxes, tariffs distort behavior. When you tax an activity, you typically get less of it. In some cases, that distortion is intentional, such as taxes on cigarettes designed to discourage smoking. In most cases, however, policymakers aim to raise revenue while minimizing economic disruption.

This is where broad-based tariffs fall short.

First, tariffs reduce imports and erode the gains from trade. Consumers face higher prices or reduced access to preferred goods, while businesses are forced to pay more for inputs or abandon supply chains they have built over decades. In extreme cases, prohibitive tariffs can halt trade altogether, pushing the U.S. to domestically produce goods that are far cheaper to source abroad.

That re-shoring is rarely efficient. Producing winter vegetables domestically, for example, makes little economic sense when imports from countries with opposite growing seasons are far less costly.

Second, the current tariff regime is applied unevenly, compounding inefficiencies. Rates vary widely across both products and countries, distorting sourcing decisions and incentivizing firms to optimize around policy rather than productivity.

Instead of capital flowing to its most efficient use, it is redirected toward avoiding tariffs an outcome that weakens overall economic efficiency.

In short, while tariffs can temporarily boost federal revenue and ease near-term borrowing needs, they do so at the cost of higher prices, disrupted supply chains, and reduced economic efficiency. That tradeoff becomes increasingly problematic when tariffs are used not as targeted tools, but as broad fiscal instruments layered onto an already complex and fragile global trade system.

Timeline of Tariff headlines:

April 9: President Trump pauses tariff hikes

April 9: Tariffs on China hit 104%

April 9: Growth forecasts are cut outside of North America

April 3: President Trump enacts sweeping tariffs on all trading partners

May 8: The US and the UK agree to a trade framework

May 13: The US and China announce a 90-day reprieve

June 3: The average effective tariff rate should eventually settle around 15-18%

June 18: 50% aluminum tariffs are paralyzing the MWP market

July 2: The US and Vietnam agree on a trade deal

July 8: Copper prices surge after President Trump imposes 50% tariffs

July 8: Tariffs deadline pushed to August 1

July 9: President Trump imposes 50% tariffs on Brazil

July 14: A surprise 30% tariff for the EU?

July 14: The total effective tariff rate could now be close to 17%

July 24: US–Japan trade deal could be supportive of Japanese stocks and the yen

July 27: The US and EU agree on a trade deal

July 31: US tariff rates move toward 20%

August 1: Tariffs on South Korea leave Q3 GDP growth forecast unchanged at 2%

August 1: The effective US tariff rate now stands at 15.8%

September 25: The impact of new pharma tariffs will likely be limited

October 14: The US threatens new tariffs on China due to rare earths export controls

October 27: The Trump administration raises tariffs on Canadian goods

October 29: The US and China reach a temporary trade truce

Sharks Opinion:

We expect trade policy to remain largely more noise than substance.

The so-called “TACO” trade Trump Always Chickens Out has played out repeatedly, and recent developments only reinforce that view. Allowing Nvidia to continue selling into China as the year winds down is a clear signal of where this is headed. While trade headlines will continue to grab attention, we do not see upcoming announcements materially altering market conditions beyond the volatility that is already priced in.

That said, trade still matters. Even when outcomes are muted, the process itself can create short-term volatility and periodic shockwaves across markets. Traders should be prepared for sharp reactions around headlines, but at this stage we see little evidence that trade policy will deliver a new, sustained downside catalyst for risk assets.

Looking ahead to 2026, trade policy is likely to remain turbulent, even if the economic impact proves manageable. A key inflection point will be the Supreme Court’s ruling on President Trump’s authority to impose tariffs under the International Emergency Economic Powers Act (IEEPA).

That decision will shape trade strategy for the remainder of the administration. If IEEPA-based tariffs are struck down, it would not mark the end of protectionism or elevated tariff levels. Instead, it would force the administration to rely on more formal tariff authorities processes that take longer, require public input, and impose clearer legal constraints.

Another major trade risk on the horizon is the renegotiation or potential expiration of the United States–Mexico–Canada Agreement (USMCA). As the flagship trade deal of Trump’s first term, any changes to USMCA would carry real implications for North American supply chains, particularly in manufacturing, energy, and agriculture.

Bottom line: trade will remain a headline-driven volatility source in 2026, but unless policy shifts become more concrete and sustained, we view it as a tactical trading factor rather than a structural threat to markets.

Part 3: Monetary Policy

The year 2025 will be remembered as a structural reset a period in which the rules governing economic growth, capital allocation, and institutional behavior fundamentally changed.

This shift did not stem from a single shock, but from the convergence of policy realignment, institutional change, and rapid technological acceleration.

Markets digested a disruptive tariff regime, persistent political and fiscal uncertainty, historically extreme concentration in equity leadership, and the largest capital-expenditure cycle in modern history. Despite these pressures, resilience was extraordinary. Equities rebounded from a bear-market-level drawdown at one of the fastest recovery rates on record.

This adjustment was not passive. Federal economic policy under President Trump actively reshaped trade, industry, and regulation.

At the same time, capital allocation began rotating away from narrow leadership toward productivity, balance-sheet quality, and operational execution setting the foundation for 2026.

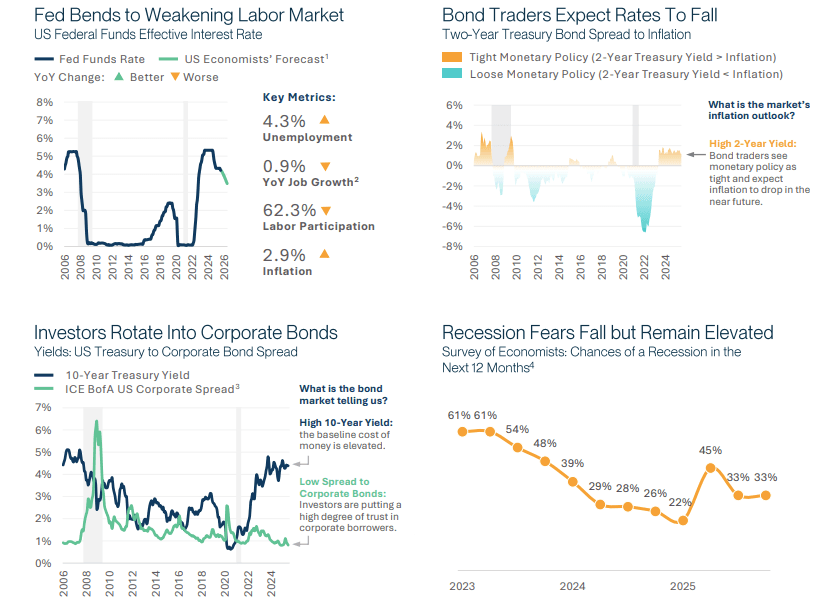

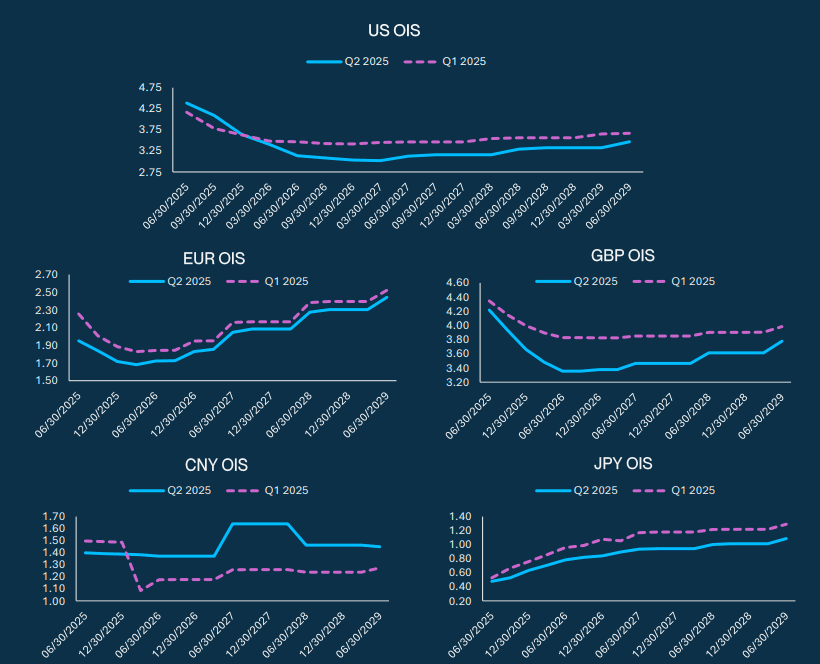

Monetary policy also marked a turning point. The Federal Reserve’s pivot signaled the end of tightening and the start of recalibration.

From September 2024 through December 2025, cumulative rate cuts of 175 basis points brought policy into a range consistent with slowing, but still resilient, growth.

The December 2025 meeting stood out less for the expected 25-basis-point cut and more for its messaging and liquidity actions. Chair Powell ruled out near-term hikes, acknowledged softening labor conditions, lowered inflation projections for 2025 and 2026, and announced $40 billion per month in Treasury-bill purchases to support market functioning.

While not formal quantitative easing, these measures carry similar marginal effects on financial conditions, reinforcing the Fed’s transition from restraint toward balance.

Many investors entered 2025 with optimism expecting cooling inflation, resilient consumer spending, and multiple Fed rate cuts. That optimism soon gave way to a more complex landscape. Tariff-driven inflationary pressures, a gradually cooling labor market, and unpredictable monetary policy repeatedly reset expectations.

Layered on top was the rapid rise of artificial intelligence (AI), fueling long-term enthusiasm for productivity gains while generating intermittent bursts of short-term market volatility.

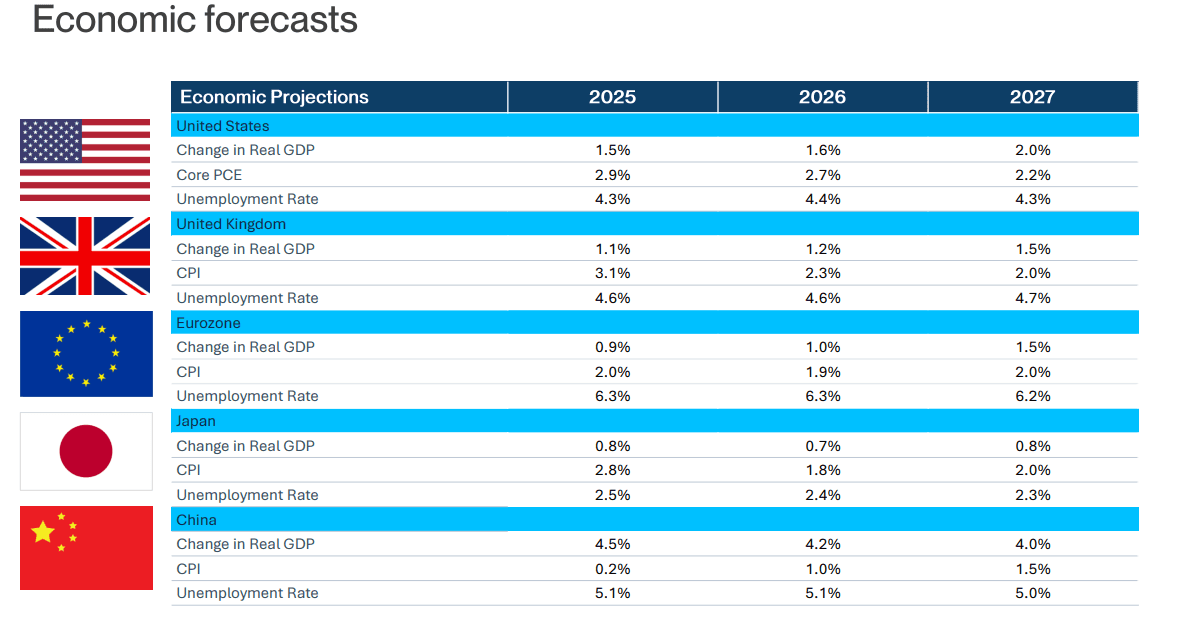

As the U.S. moves into 2026, the economy is experiencing a late-cycle slowdown rather than a contraction. Real GDP growth decelerated to 1.7% in 2025 and is forecast to rise modestly to 2.3% in 2026, reflecting a transition from policy-induced restraint to a more balanced growth profile. This improvement is underpinned not by new fiscal or monetary stimulus, but by productivity gains from technology adoption, automation, and capital deepening partially offsetting the drag from higher interest rates and slower hiring.

The labor market is cooling, but in an orderly fashion. Unemployment rose to 4.5% in 2025 and is expected to modestly decline to 4.4% in 2026, signaling normalization rather than deterioration. Job creation has slowed, but the absence of a sharp rise in layoffs indicates that businesses are adjusting through attrition, efficiency improvements, and productivity gains rather than mass workforce reductions. This dynamic reinforces the Fed’s confidence that labor-market rebalancing can occur without triggering a recession.

Inflation trends further support this constructive slowdown. Headline PCE inflation eased from 2.9% in 2025 to a projected 2.4% in 2026, reflecting normalization in goods prices and a gradual cooling of demand-driven pressures. Core PCE inflation is forecast to decline from 3.0% to 2.5%, indicating that underlying inflation momentum is slowing even as growth stabilizes. This trend suggests that restrictive monetary policy has largely achieved its objective without materially harming economic activity.

Taken together, these dynamics describe an economy cooling with control. Growth is moderating but stabilizing, unemployment is adjusting gradually, and inflation is moving decisively lower. This environment provides the Federal Reserve room to pivot from restraint toward calibration, framing 2026 as a year of rebalancing rather than retrenchment and laying the foundation for broader market leadership and durable, productivity-driven expansion.

At the start of 2025, the Fed’s policy trajectory appeared relatively straightforward. Inflation had eased through late 2024, economic growth remained steady, and investors broadly expected meaningful rate cuts by mid-year. Treasury yields drifted lower as markets positioned for a more accommodative stance.

During the first few FOMC meetings of the year, the Fed held rates steady while lowering growth projections and revising inflation forecasts higher. Policymakers emphasized that more definitive signs of cooling inflation were needed before implementing cuts. Investors increasingly believed that any shift toward lower rates would depend not only on moderating inflation but also on sustained easing in the labor market.

By December, those concerns remained central. At the December FOMC meeting, the Fed delivered its third consecutive 25-basis-point cut, lowering the target range to 3.50%–3.75%. Policymakers acknowledged some easing in inflation but stressed that the labor market was losing momentum and required support. The Fed reinforced that future moves would be data-dependent rather than pre-scheduled, leaving investors parsing every word for clues on the timing of potential rate adjustments.

Looking into 2026, the trajectory of Fed policy will largely hinge on how quickly inflation converges toward the 2% target and whether labor-market weakness intensifies. If inflation continues to moderate and employment softens further, the Fed may have room for additional cuts, potentially bringing the policy rate closer to 3.25%. Such a path would relieve credit markets and support a rebound in economic activity.

Equity markets may experience volatility, but strength is likely to remain concentrated in certain sectors. AI-driven companies should continue to attract capital and drive productivity narratives, while trade-sensitive sectors could face headwinds from ongoing tariff disputes and geopolitical uncertainty.

For the broader U.S. economy, 2026 is shaping up as a transitional year one in which Fed policy gradually shifts from combating inflation toward supporting growth.

The U.S. market remains one of America’s most powerful economic cards. It boasts the largest consumer base and the deepest, most liquid financial markets in the world.

Yet, these same strengths carry challenges. Confidence among U.S. consumers and businesses is waning. The Federal Reserve’s independence is under pressure, no plan exists to reduce the fiscal deficit, trade policy shifts almost weekly, and the new stablecoin regulations appear to be deployed as a geopolitical lever. The White House acknowledges these caveats after all, “America First” increasingly prioritizes political objectives over market stability.

Consequently, the dollar is no longer untouchable for many foreign investors. Currency diversification and hedging strategies are becoming more common, even as implied EUR/USD volatility has declined.

Across the Atlantic, the U.K. government successfully presented its Autumn Budget, but political uncertainty will continue to weigh on the economy in 2026.

The budget signals a focus on political survival rather than structural growth, with spending on healthcare and social services accelerated while tax increases are postponed until 2028. This “buy now, pay later” approach provides short-term relief but does little to restore household or business confidence, keeping economic growth subdued. Local elections in May could deliver significant losses for Labour, shifting attention toward Farage’s Reform UK, now leading in the polls, and the rising Greens.

Europe faces its own set of challenges. EUR long-term interest rates are rising, reflecting higher term premiums. While a stronger euro helps contain inflation, it creates headwinds for capital goods exporters and an already struggling industrial sector.

Meanwhile, China is playing a similar geopolitical and economic game, albeit with a different hand. President Xi believes an autocratic system can withstand economic pressure longer than a democracy, making Chinese retaliation more predictable: every U.S. or European tariff hike and export restriction is met with measured, tit-for-tat responses.

At the same time, Beijing is doubling down on technological self-sufficiency, aiming for dominance in critical production chains such as rare earths, batteries, AI, robotics, and clean energy. For those reliant on these resources, bypassing China is not a feasible option. China’s guiding principle remains clear: prioritize production over consumption.

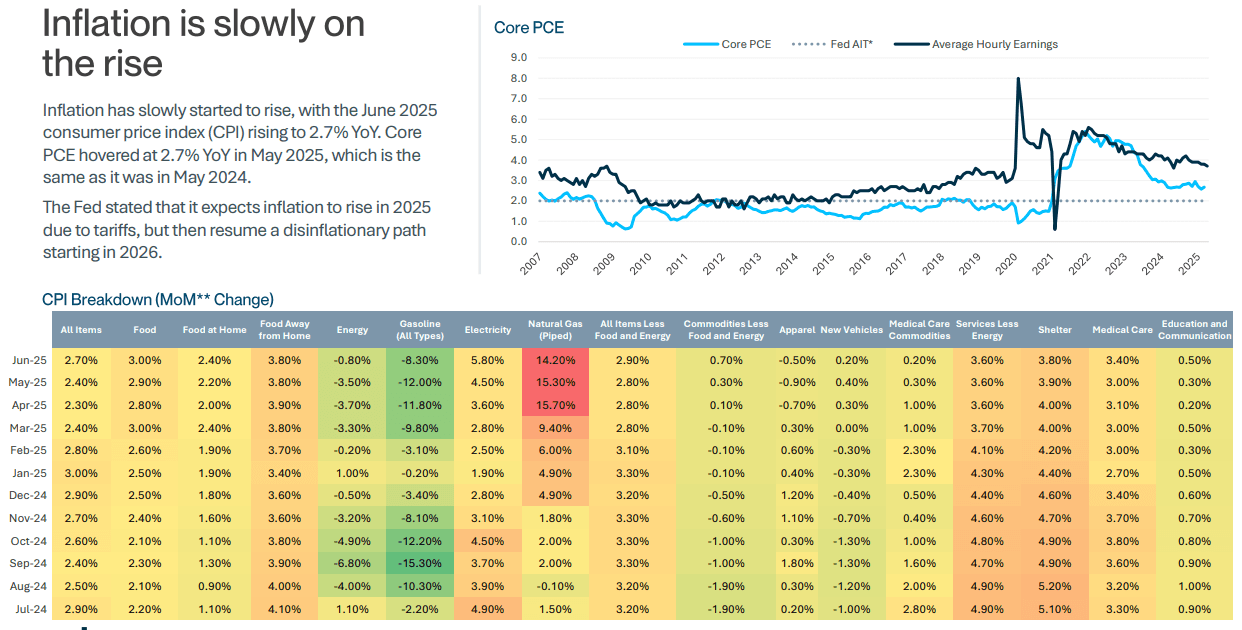

Measured inflation is easing, but it is still experienced and judged psychologically, not just statistically. This gap between actual and perceived inflation is now a key driver of economic confidence as the U.S. enters 2026.

Technically, inflation trends are moving in the right direction. Headline pressures have waned, energy prices are negative year-over-year, goods inflation has normalized, and even shelter inflation is slowing. Both CPI and PCE indicate that the 2021–2022 peak is behind us. Core PCE, the Federal Reserve’s preferred measure, is trending lower, reflecting the effectiveness of restrictive policy in cooling price growth.

However, import tariffs introduced under the Trump administration, combined with strict migration and deportation policies, are producing a stagflationary effect. The labor market shows signs of faltering. Federal data remain partial due to a partial government shutdown, but job growth has nearly stalled.

Inflation remains above the Fed’s 2% target. A sharp spike has been avoided because higher goods prices are partially offset by lower housing costs. Core inflation is largely sideways, hovering around 3%, but the full effects of the import tariffs have yet to materialize. Initially, importers absorbed the burden, but exporters and consumers are increasingly affected. This delayed pass-through suggests that a notable decline in core inflation may not occur until the second half of 2026.

Meanwhile, the AI boom has provided a positive demand shock, offsetting some of the stagflationary pressures from trade policy. However, the peak in AI investment appears to have passed, suggesting slower economic growth ahead in 2026. This raises the potential risk of a tech-driven correction in U.S. equity markets. Over the longer term, AI may deliver a positive supply shock by boosting productivity.

For the Federal Reserve, managing inflation in 2026 will involve more than adjusting interest rates—it requires managing expectations and restoring trust. Chair Powell has emphasized that the Fed must remain “data dependent, patient, and focused on bringing inflation sustainably back to 2%.” A decline in measured inflation alone may not be sufficient if households do not feel tangible relief in their everyday expenses.

Sharks Opinion:

Looking ahead to 2026, the strategic landscape is best framed through a probability-weighted approach, reflecting the inherent asymmetries in the economy. Predicting outcomes is challenging, especially given shifting administration priorities and uncertainty over who will lead the Federal Reserve by mid-year.

That said, we believe the most likely path for Fed policy in 2026 is a gradual reduction in rates from the current 3.50%–3.75% range closer to 3% over the course of the year.

Ultimately, Fed decisions will hinge on economic data, particularly inflation and labor-market trends. The expiration of Chairman Jay Powell’s term in May 2026 adds an additional layer of uncertainty, as a potential new chair could shift policy tone or timing.

Given this expected trajectory, investors may find opportunities in the belly of the yield curve, manage interest rate risk through bond laddering, and pursue higher income outside of core bonds.

Taken together, these scenarios reveal a central truth: 2026 is defined not by fragility, but by choice.

The distribution of outcomes favors resilience over recession and opportunity over contraction but success will rely on disciplined positioning and adaptability.