This is a watchlist composed of the current stocks we are looking to trade none of these are alerts all alerts will be alerted upon entry just like the others on the weekly investment letter.

Company: American Superconductor

Quote: AMSC

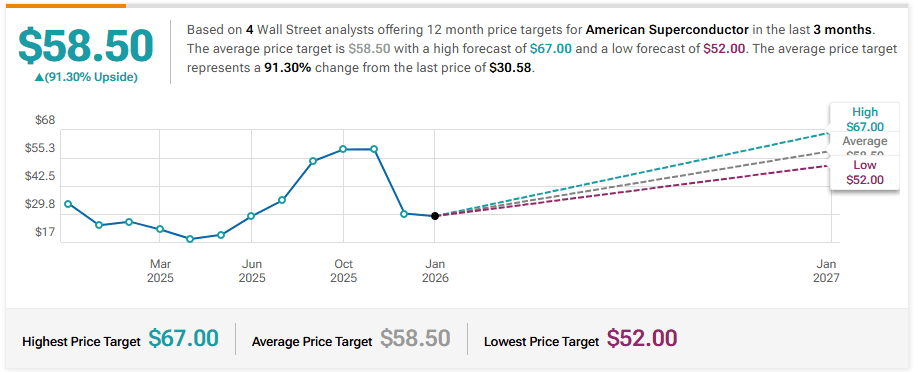

BT: $28-$32

ST: $64-$72

Sharks Opinion:

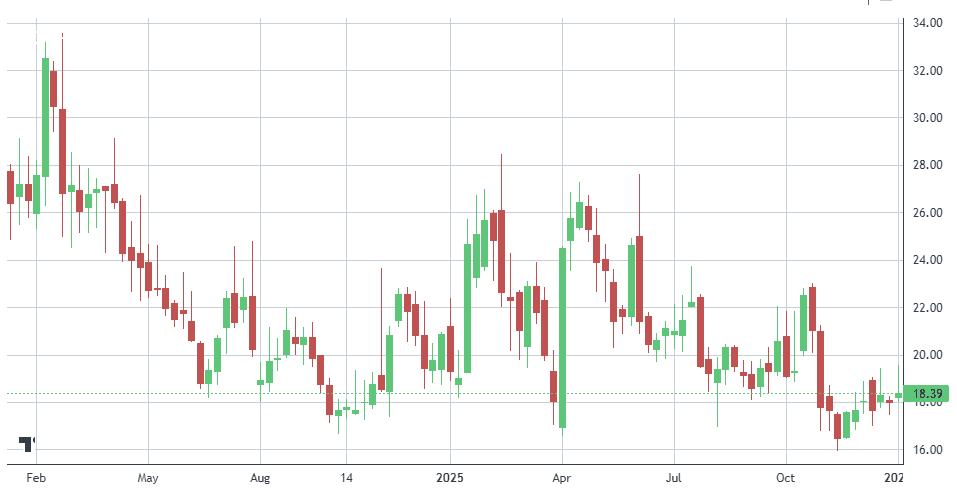

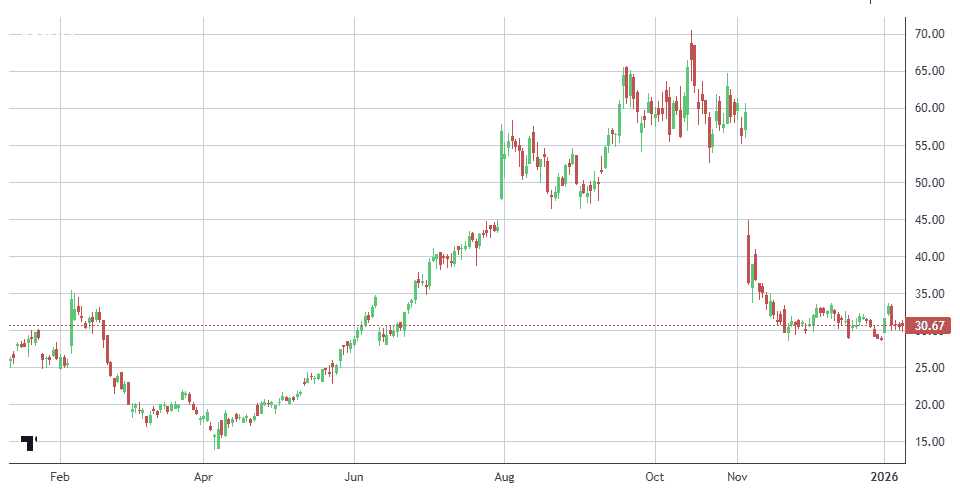

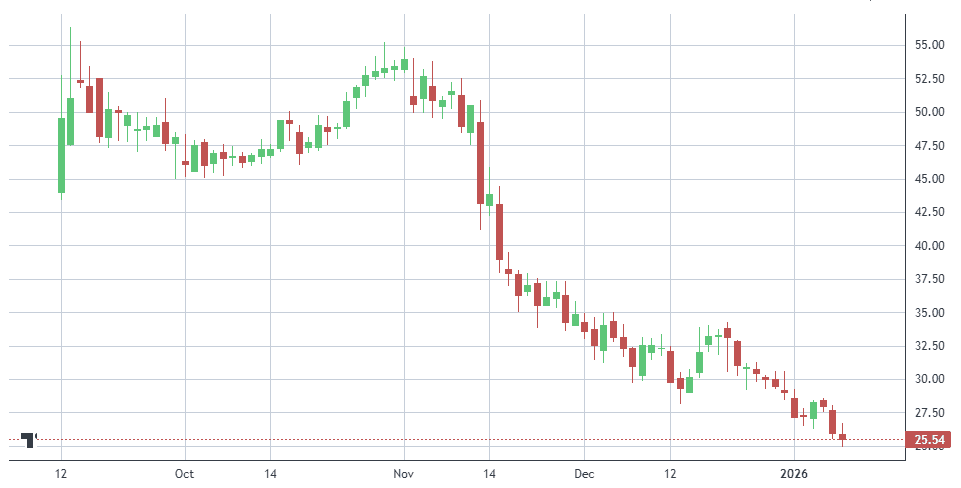

AMSC is a name we traded successfully last year, though admittedly we exited far too early. After we sold, the stock went on to rally another 100%. That said, before year-end, AMSC came back down to earth and is now trading near the same levels where we last exited.

Following a strong run earlier this year that pushed shares close to $70, AMSC has retraced sharply after its most recent earnings report and broader market weakness. With the stock now hovering around $30, the pullback has reset expectations and reopened the door for a more attractive entry.

While the recent decline may shake out momentum-driven traders, we see this as an opportunity to revisit the broader AMSC thesis.

At current levels, the risk-reward looks far more compelling for investors willing to look beyond near-term volatility.

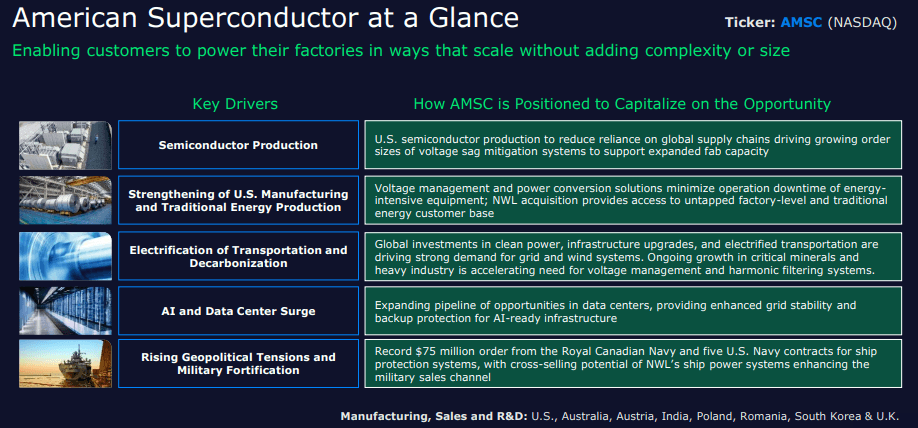

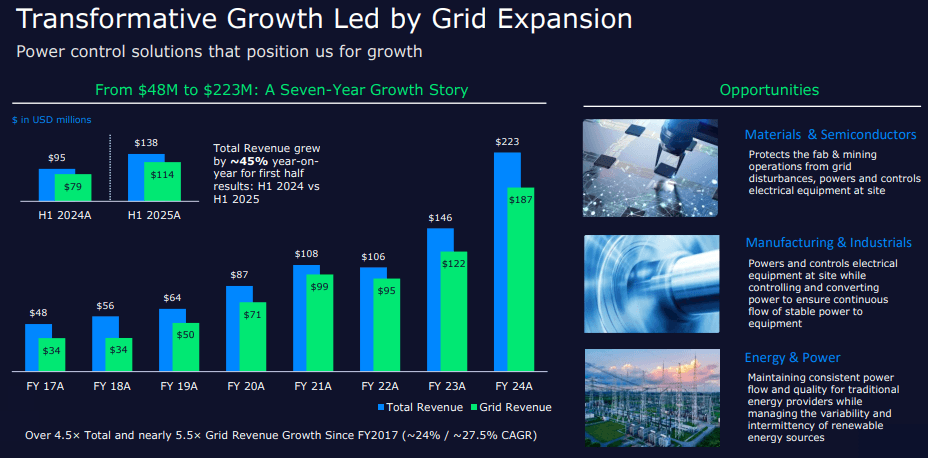

Description: American Superconductor Corp generates the ideas, technologies, and solutions that meet the world's demand for smarter, cleaner, and energy. Through its Windtec Solutions, the company enables manufacturers to launch wind turbines quickly, effectively, and profitably. Through its Gridtec Solutions, the company provides engineering planning services and grid systems that optimize network reliability, efficiency, and performance. The company's segment includes Grid and Wind. It generates maximum revenue from the Grid segment.

American Superconductor (AMSC) continues to stand out as a long-term play on next-generation energy infrastructure.

Unlike many suppliers in the space, AMSC delivers full-system solutions directly to end customers, cutting out intermediaries and strengthening both margins and customer relationships.

One of the company’s key advantages is scalable growth with relatively low incremental cost. Its proprietary manufacturing processes for electrical control systems—particularly in wind turbine applications allow the business to expand without requiring heavy capital investment, creating meaningful operating leverage as volumes grow.

AMSC is also well aligned with the structural forces reshaping global energy systems: grid modernization, the rise of distributed energy resources, and the increasing strain renewable energy places on legacy infrastructure. While near-term political or policy shifts could introduce volatility, the long-term need for more resilient, intelligent power grids remains intact.

Taken together, AMSC’s direct-to-customer model, capital-light scalability, and exposure to durable energy trends position it as a compelling long-term infrastructure investment rather than a short-term trade.

Clear Street Reiterates Buy on American Superconductor, Maintains $52 Price Target

Oppenheimer Maintains Outperform on American Superconductor, Raises Price Target to $39

Roth MKM Reiterates Buy on American Superconductor, Maintains $29 Price Target

Craig-Hallum Reiterates Buy on American Superconductor, Maintains $33 Price Target

Company: Via Transportation

Quote: $VIA

BT: $18-$20

ST: $28-$40

Sharks Opinion:

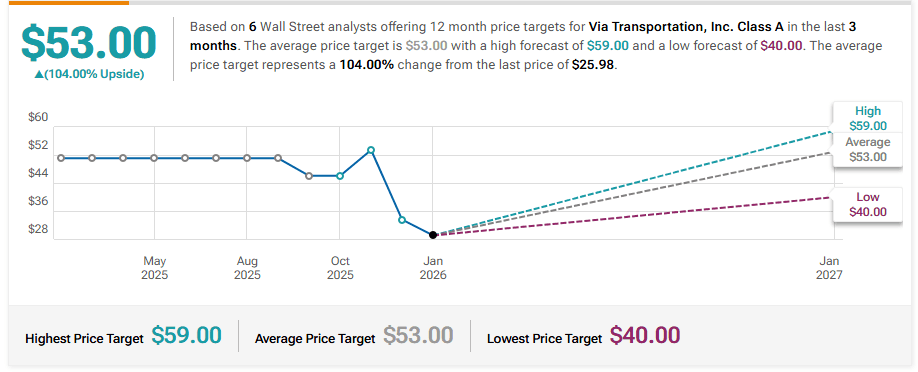

Via is a new name for us and, more broadly, a new name for public markets after going public near the tail end of 2025. Since the IPO, the stock has been cut roughly in half, and we’re starting to pay close attention. When a newly public company reprices this aggressively, it often creates opportunity for those willing to step in while fear dominates sentiment.

We see Via as a potential software monopolization story, with echoes of early Tyler Technologies mission-critical systems, high switching costs, and deep integration with public-sector customers. Via provides a flexible, software-driven transit platform that cities rely on to modernize and optimize transportation networks, and it’s already been adopted by many of the most high-profile destination cities across the U.S.

This is not a long-term conviction position yet, but it is a name we’re looking to swing trade over the coming weeks and months as price action stabilizes and the market reassesses the business post-IPO.

Description: Via Transportation Inc transforms antiquated and siloed public transportation systems into smart, data-driven, and efficient digital networks. The company is organized into one reportable segment, the Platform segment. Geographically, it operates in United States, Germany and Other countries, of which it derives maximum revenue form United States.

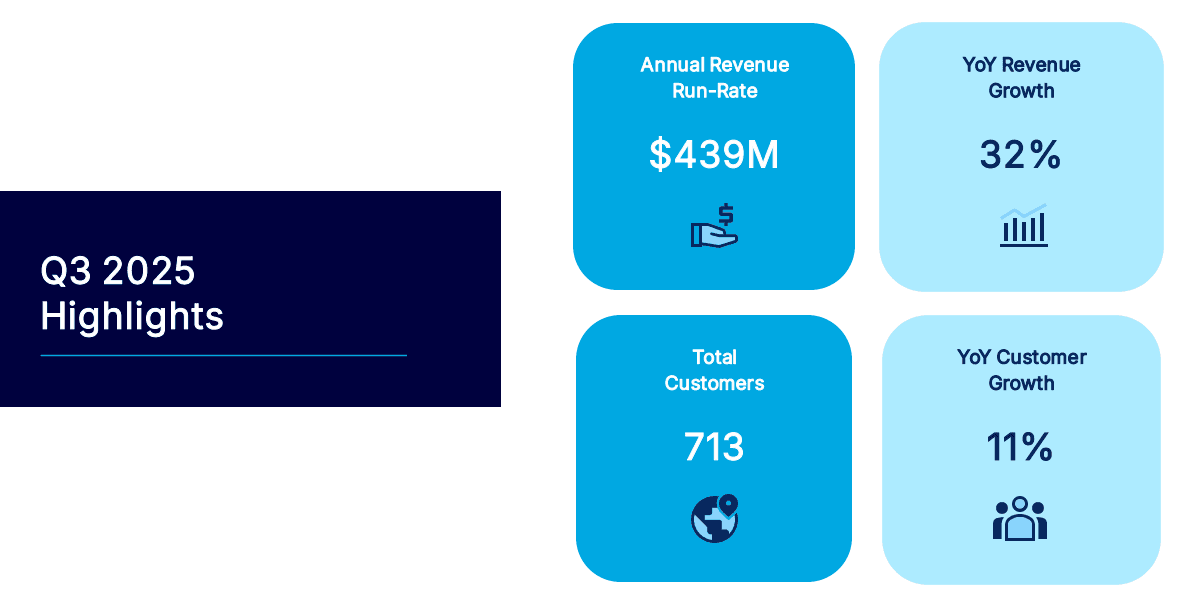

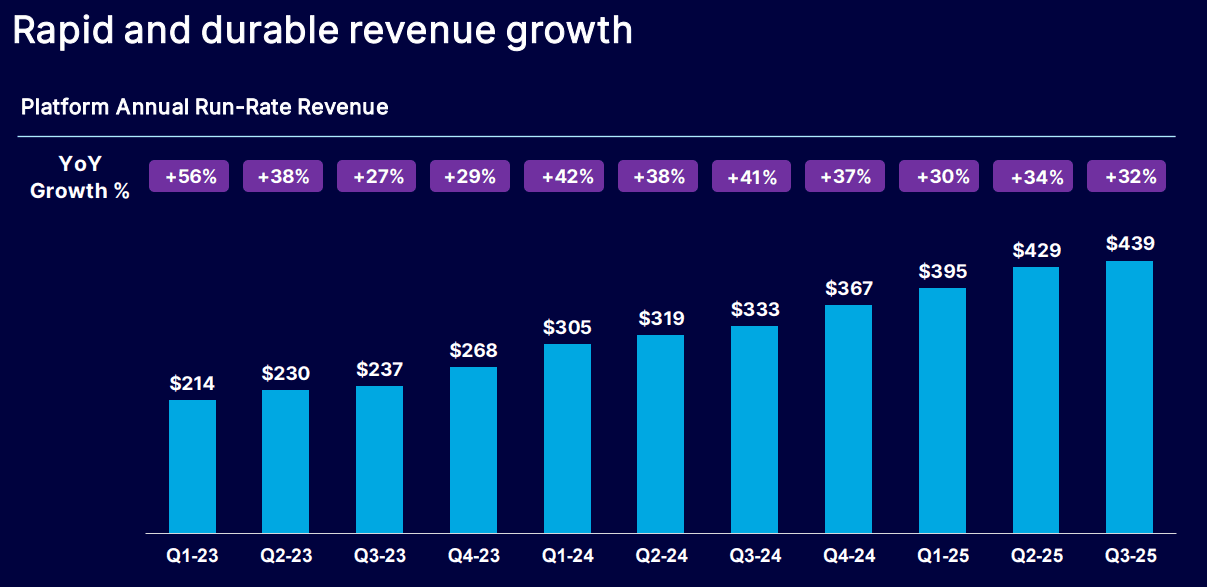

Via Transportation just reported its first earnings as a public company, and the market reaction was predictably harsh. Following the release of its Q3 FY2025 results, the stock fell roughly 15%, reinforcing the post-IPO volatility that has defined the name since September.

Operationally, the numbers were stronger than the price action suggests. Via posted quarterly revenue of $110 million, up 32% year over year, and now operates in roughly 30 countries globally. Growth remains healthy, and the company continues to expand its footprint as a core software provider for public transit systems.

Losses did widen at the net level, with a $36.9 million loss versus $21.3 million a year ago, but much of that increase was driven by financing-related items, including an $11 million loss tied to convertible bonds. Importantly, operating losses actually improved, narrowing to $18.9 million from $20.6 million last year—an early signal of improving underlying efficiency.

Via raised $493 million in its September IPO at a $3.7 billion post-money valuation. As with many newly public software names, the market is currently focused on losses and near-term optics rather than revenue growth and long-term positioning, creating the kind of dislocation we’re watching closely.

Wells Fargo Maintains Overweight on Via Transportation, Lowers Price Target to $40

Guggenheim Initiates Coverage On Via Transportation with Buy Rating, Announces Price Target of $58

JMP Securities Initiates Coverage On Via Transportation with Market Outperform Rating, Announces Price Target of $59

Needham Reiterates Buy on Via Transportation, Maintains $55 Price Target

Wolfe Research Initiates Coverage On Via Transportation with Outperform Rating, Announces Price Target of $60

Company: ARS Pharmaceuticals

Quote: SPRY

BT: $8-$12

ST: $18-$30

Sharks Opinion:

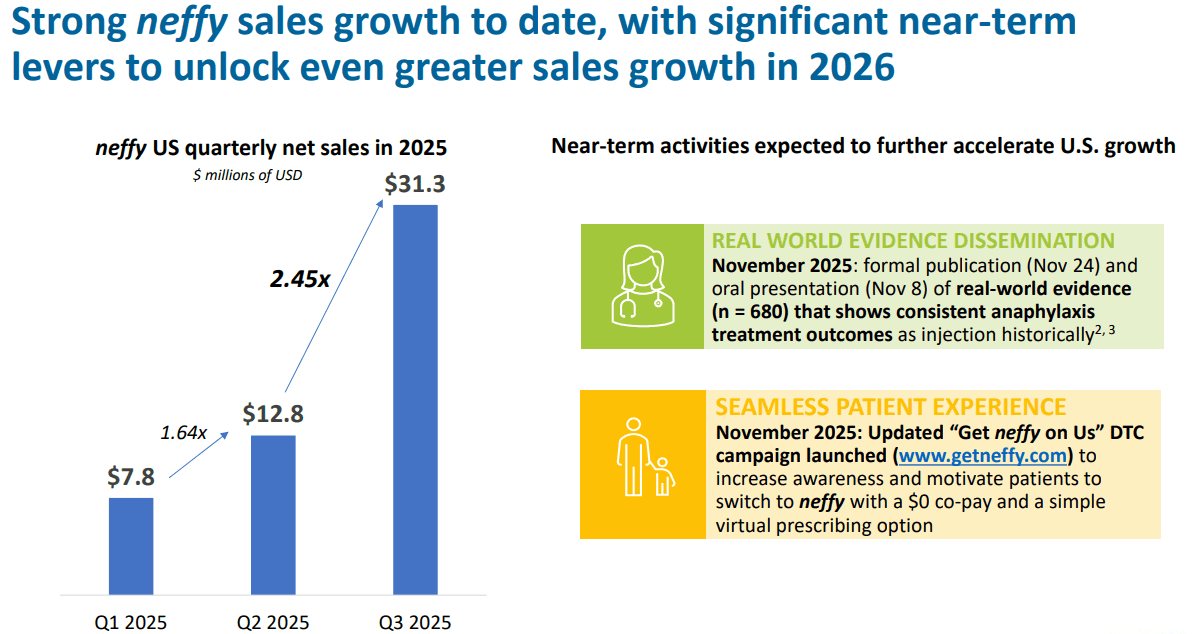

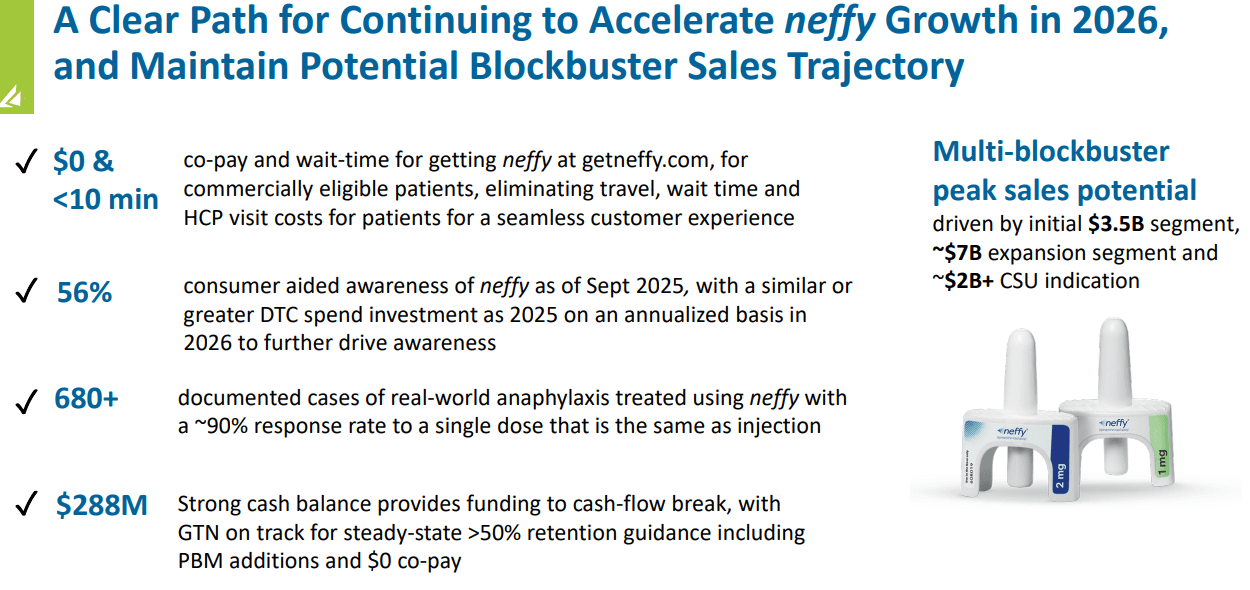

ARS Pharma has long been on our radar, but until recently we stayed on the sidelines given the inherent risk profile of biotech and pharma names. That changed to start the year.

The company’s lead product received approval for use in China, triggering a sharp move in the stock, and strengthening its global commercial outlook. Adding to that momentum, ARS’s main competitor was just rejected by the FDA, widening ARS’s competitive moat at a critical moment.

We view ARS as a strong candidate for both organic growth and a potential takeover, given its differentiated product and improving regulatory position.

The setup is further supported by the broader landscape SPRY still has an experienced management team that once captured roughly 95% market share, but that success came in an environment with far less competition than exists today.

Description: ARS Pharmaceuticals Inc is a biopharmaceutical company focused on the development of novel, potentially first-in-class product candidate, neffy for the emergency treatment of Type I allergic reactions, including anaphylaxis. neffy is a proprietary composition of epinephrine with an absorption enhancer called Intravail, which allows neffy to provide injection-like absorption of epinephrine at a low dose, in a small, easy-to-carry, easy-to-use, rapidly administered and reliable nasal spray.

ARS Pharmaceuticals has built a meaningful moat around its epinephrine nasal spray platform, with patents covering composition of matter, formulation and dosing, methods of treatment, and proprietary delivery devices.

These protections extend through 2039 and center on a nasal spray that pairs epinephrine with a companion agent designed to enhance absorption through the nasal membrane eliminating the need for an injection.

The market opportunity is substantial. Roughly 40 million Americans suffer from severe allergies, with about 20 million formally diagnosed and under physician care. That has translated into approximately 6.5 million epinephrine prescriptions, yet only 3.2 million patients actually fill them.

Needle hesitation remains a major friction point. A needle-free alternative like Neffy has the potential to expand both prescribing behavior and adherence. If Neffy were to meaningfully penetrate the U.S. EpiPen market at roughly $199 per dose, the opportunity could approach $600 million annually, excluding incremental demand from first responders, schools, and clinical inventory.

International markets add another layer of upside. While pricing outside the U.S. is typically lower, global allergy prevalence and expanding regulatory approvals still represent a meaningful growth vector over time.

Company: Schrodinger, Inc

Quote: SDGR

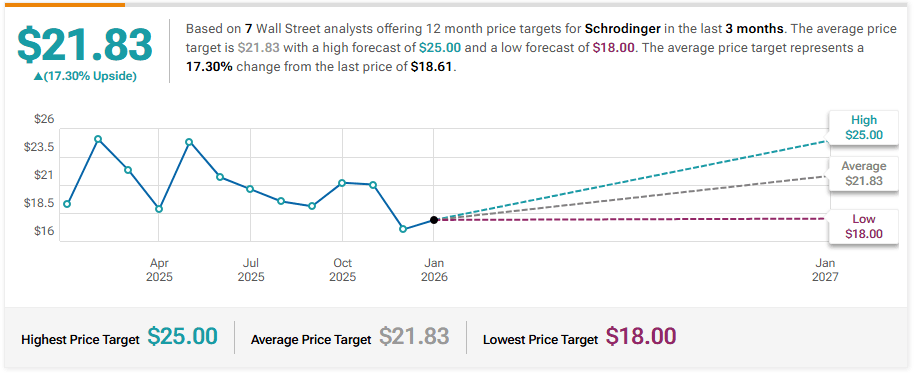

BT: $18

ST: $34

Sharks Opinion:

SDGR is a name many Sharks members will recognize, as it’s a stock we’ve traded successfully in the past.

What’s changed and why it’s back on our radar is the company’s evolution in 2025 into a much cleaner, more focused healthcare AI story.

Schrödinger’s strategic refocus on its core software operations has simplified the business materially, reducing both operational complexity and cash burn that previously stemmed from its clinical development programs.

This shift matters. By prioritizing its high-margin software platform over capital-intensive drug development, Schrödinger is positioning itself as a pure-play healthcare technology company rather than a hybrid biotech with uneven risk exposure. The result is a more predictable revenue profile and a clearer path to scalability as pharmaceutical companies increasingly lean on computational tools to cut costs and shorten development timelines.

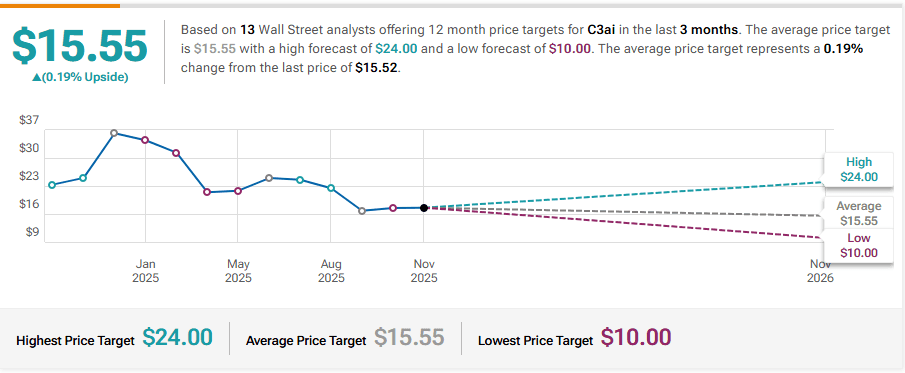

From a valuation perspective, we view SDGR as compelling. The stock is trading at roughly three times 2026 consensus revenue estimates, which we believe understates the long-term value of its platform given its strategic importance to modern drug discovery. For investors looking for exposure to AI in healthcare without taking on binary clinical trial risk SDGR stands out as one of the most attractive options in the space.

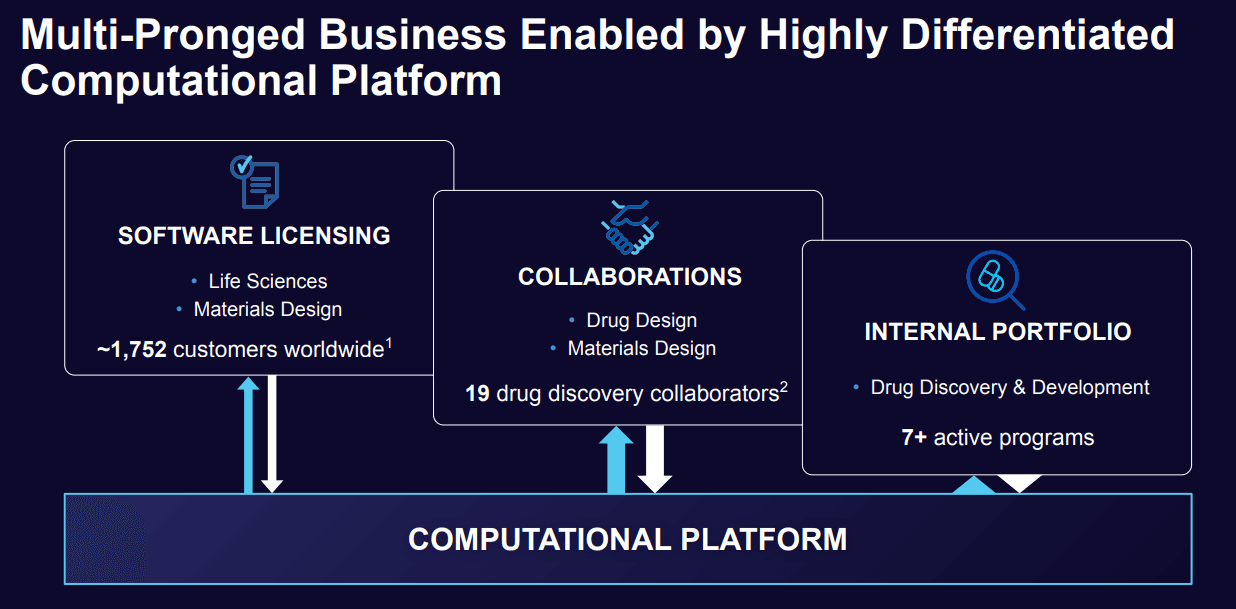

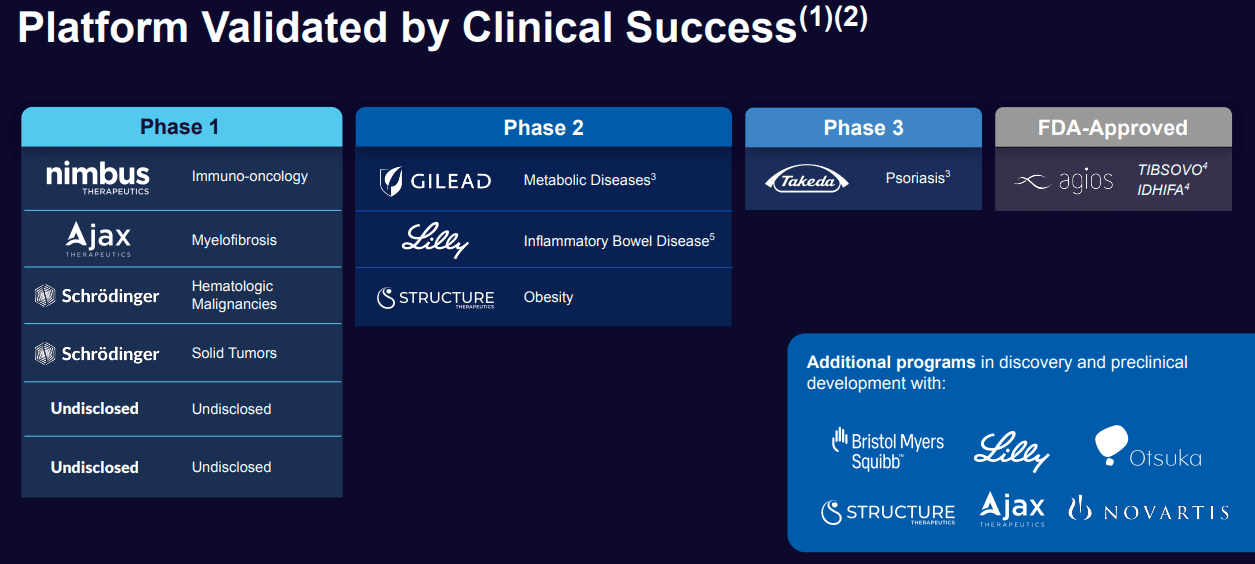

At its core, Schrödinger develops advanced computational platforms that combine physics-based molecular modeling with artificial intelligence to accelerate drug discovery. As AI adoption shifts from experimentation to necessity across pharma, tools like Schrödinger’s are becoming embedded in R&D workflows, positioning the company as a quiet but critical beneficiary of the AI healthcare buildout.

Description: Schrodinger Inc is a healthcare-based software company. Its operating segments are Software and Drug discovery. Through the Software segment, the company is focused on selling software to transform drug discovery across the life sciences industry and customers in materials science industries. In the Drug discovery segment, it is engaged in generating revenue from a portfolio of preclinical and clinical programs, internally and through collaborations. It generates revenue from the sales of software solutions and from research funding and milestone payments from its drug discovery collaborations.

Schrödinger is ultimately aiming at one of the largest and most entrenched spending pools in the world: the $100–$150 billion in annual pharmaceutical R&D.

The company’s core thesis is straightforward but powerful. Instead of physically synthesizing and testing thousands of molecules in a lab, Schrödinger enables pharma companies to generate and evaluate billions of molecules in a physics-based simulation environment.

Artificial intelligence then narrows that universe down to a small set of the most promising candidates, allowing laboratories to synthesize and test only a few dozen high-probability molecules. The potential cost and time savings for drug development are enormous, which is what gives Schrödinger such a large and durable total addressable market.

Rather than relying solely on a traditional enterprise sales cycle to penetrate Big Pharma, Schrödinger took a more aggressive and strategic approach. The company began using its own platform internally to generate drug candidates and form partnerships.

This strategy has already produced tangible results. One of the most notable examples is Morphic, which was acquired by Eli Lilly and generated approximately $48 million in revenue for Schrödinger, while also embedding potential long-term royalty streams tied to drugs now sitting inside Lilly’s pipeline.

Over time, management’s vision is for Schrödinger to evolve into a hybrid model: part high-margin, recurring software revenue and part royalty-driven cash flows from partnered or licensed drug programs.

The royalty component is not expected to move the needle overnight. Management has been clear that it will likely take six to seven years for these royalty streams to meaningfully compound. But if successful, this structure could create a powerful long-term flywheel, combining predictable software revenue with asymmetric upside from drug commercialization.

TD Cowen Maintains Buy on Schrodinger, Lowers Price Target to $24

Keybanc Maintains Overweight on Schrodinger, Lowers Price Target to $25

UBS Initiates Coverage On Schrodinger with Neutral Rating, Announces Price Target of $18

B of A Securities Upgrades Schrodinger to Buy, Maintains Price Target to $24

Keybanc Maintains Overweight on Schrodinger, Lowers Price Target to $28