This is a watchlist composed of the current stocks we are looking to trade none of these are alerts all alerts will be alerted upon entry just like the others on the weekly investment letter.

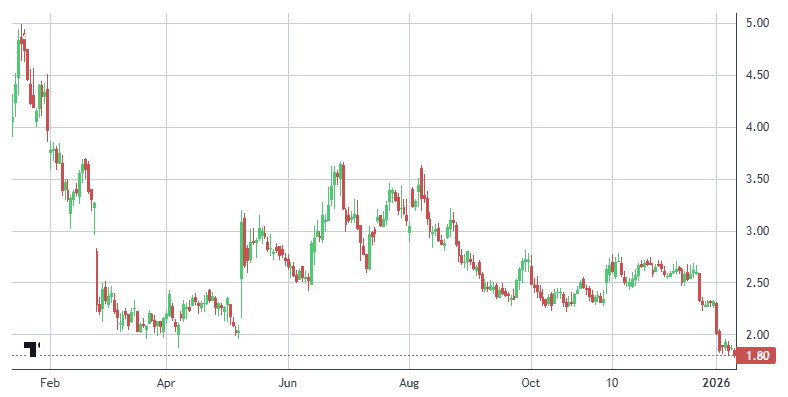

Company: Zevia PBC

Quote: $ZVIA

BT: $1.50-$2.00

ST: $3-$4

Sharks Opinion:

Zevia is a health-focused beverage company delivering double-digit revenue growth alongside expanding national distribution.

As consumer preferences continue to shift toward zero-sugar and better-for-you alternatives, Zevia has positioned itself as a recognizable brand in a category that’s still in the early innings.

The company remains unprofitable, largely due to elevated marketing and brand investment. However, the underlying model suggests a clear path to profitability if spending is moderated as the brand scales and distribution matures.

The broader beverage landscape also adds an important layer of optionality. The sector remains highly active on the M&A front, particularly once a product gains shelf space and proves consumer traction.

A recent example is Pepsi’s acquisition of Poppi after its rapid rise in popularity. We see a similar setup potentially developing for Zevia, which is a key reason it remains our top small-cap recommendation.

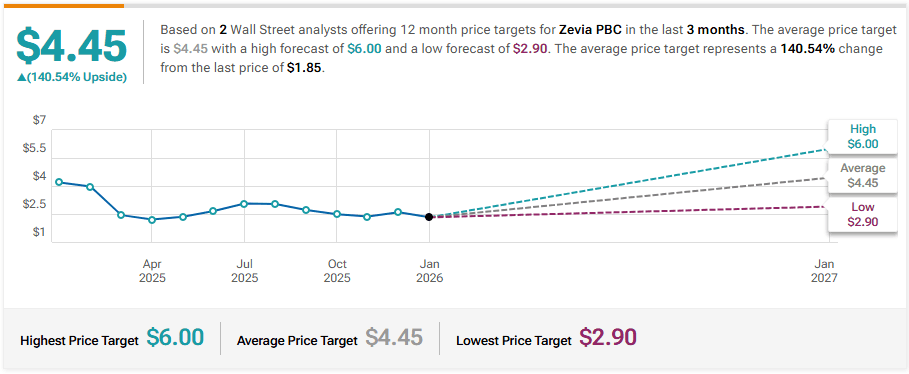

We rate ZVIA a Buy with a $4 price target, based on its discounted valuation, continued growth trajectory, and the dual upside of eventual profitability or strategic acquisition.

Description: Zevia PBC is a beverage company disrupting the liquid refreshment beverage industry through refreshing, zero-calorie, zero-sugar, naturally sweetened beverages that are all Non-GMO Project Verified. It offers a platform of products that include a variety of flavors across Soda, Energy Drinks, Organic Tea, Mixers, Kidz drinks, and Sparkling Water. Its products are distributed across the U.S. and Canada through a network of retailers in the food, drug, mass, natural, and e-commerce channels. The company derives a majority of its revenue from the United States.

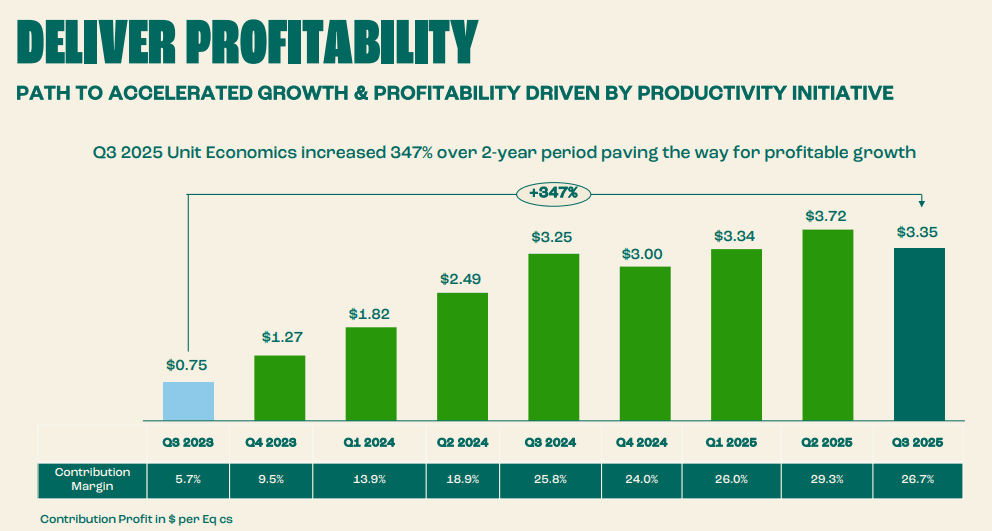

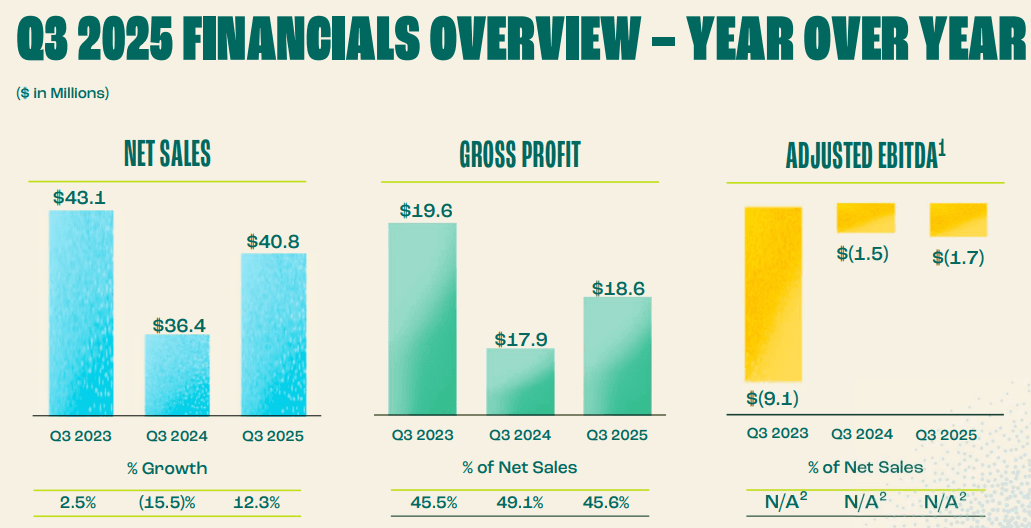

Zevia delivered a solid Q3 2025 report, coming in ahead of expectations on both revenue and earnings as distribution continued to expand.

The company posted a loss of $0.04 per share, beating consensus estimates of a $0.06 loss, while revenue reached $40.8 million up 12.3% year over year and above analyst forecasts of roughly $39.3 million.

While Zevia remains unprofitable, losses are narrowing at a measured pace. Net loss for the quarter was $2.8 million, and adjusted EBITDA loss came in at $1.7 million, only modestly wider than last year’s $1.5 million loss, reflecting continued investment in growth and brand awareness.

Management’s outlook remains constructive.

The company raised full-year 2025 net sales guidance to $162–$164 million and maintained a relatively tight range for full-year adjusted EBITDA losses of $5.0–$5.5 million.

Looking ahead, Zevia’s CFO reiterated the goal of reaching positive adjusted EBITDA in 2026, a key milestone as the business scales.

The next earnings report is expected around February 25, 2026, which should offer further clarity on the path to profitability.

Telsey Advisory Group Maintains Outperform on Zevia, Maintains $6 Price Target

Morgan Stanley Maintains Equal-Weight on Zevia, Raises Price Target to $2.7

Morgan Stanley Maintains Equal-Weight on Zevia, Raises Price Target to $2.7

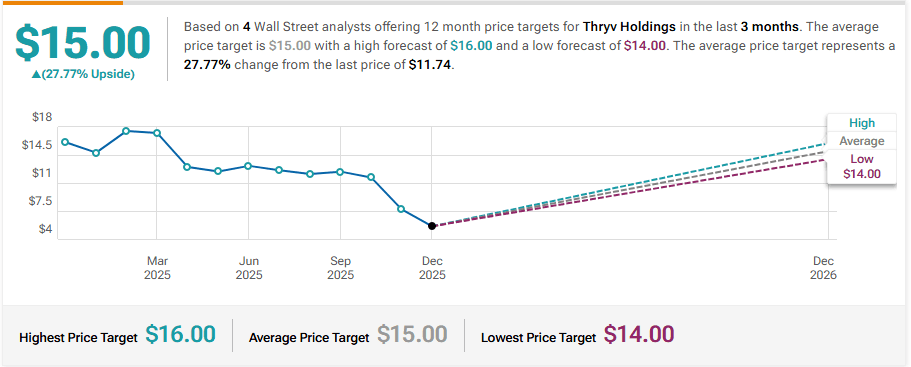

Company: Thryv Holdings

Quote: $THRY

BT: $5.00

ST: $12

Sharks Opinion:

Thryv is a new name for us, but its backstory is what initially caught our attention. It’s effectively the modern evolution of the Yellow Pages.

The company was formed through a 2017 transaction between Dex Media and YP Holdings, the owner of YP.com and publisher of The Real Yellow Pages for AT&T.

The combined entity was first called DexYP before rebranding to Thryv in 2019, marking a strategic shift away from directories and toward SaaS-based business management software.

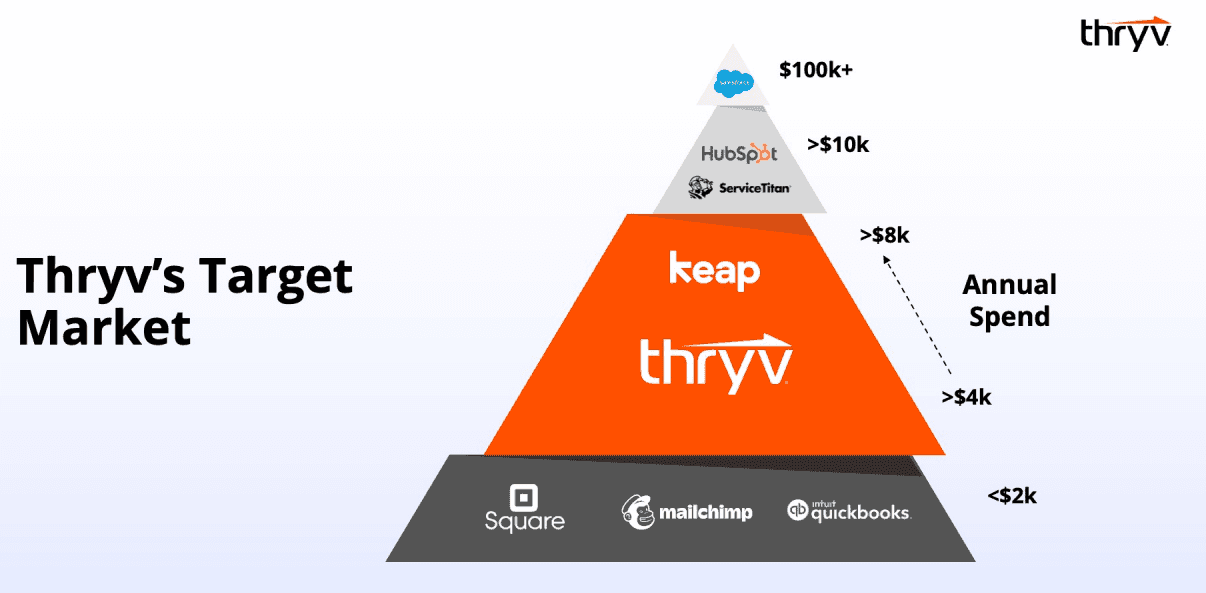

Today, Thryv is best viewed as a small, focused version of Salesforce, targeting small and mid-sized businesses with an integrated software platform.

Revenues and customer counts continue to grow, and the business has successfully transitioned from a legacy media model to a recurring, software-driven one.

We believe the company can continue to grow organically, but its platform, customer relationships, and recurring revenue profile also make it a logical acquisition candidate.

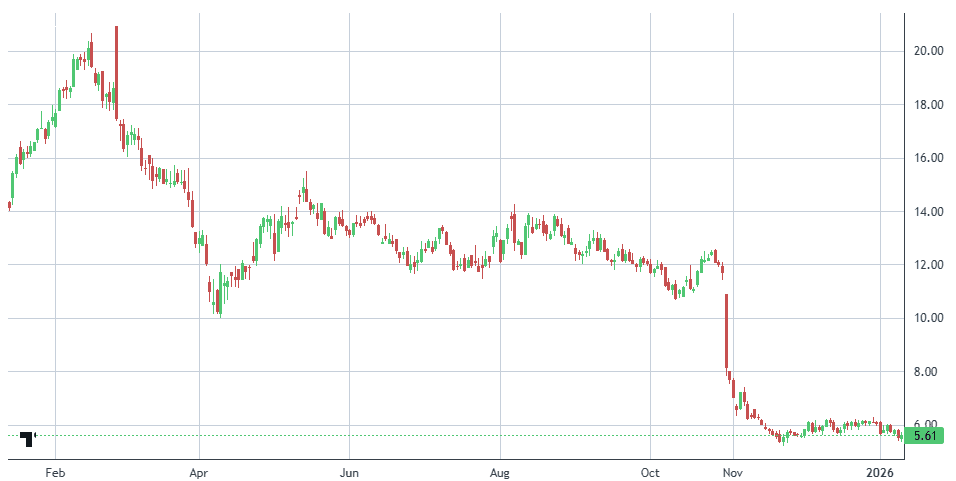

Despite this transformation, the market has largely ignored the story. Thryv now trades at a significant discount, with shares around $5.32 as of January 13, 2026 down roughly 61% over the past year.

In our view, this disconnect presents an opportunity to gain exposure to a high-quality SaaS business that is being priced as if its legacy past still defines its future.

Description: Thryv Holdings Inc is dedicated to supporting local, independent service-based businesses and emerging franchises by providing a cloud-based software platform, and marketing solutions to entrepreneurs. Its company is built upon a rich legacy in the marketing and advertising industry. The group are provider of SaaS all-in-one small business management software in addition to providing print and digital marketing solutions to SMBs. Its solutions enable SMB clients to attract and generate new business leads, manage their customer relationships efficiently with artificial intelligence (AI) tools and automation, and run their day-to-day operations to save time, compete and win in today's SMB environment. The group has two business segments; Thryv SaaS and Thryv Marketing Services.

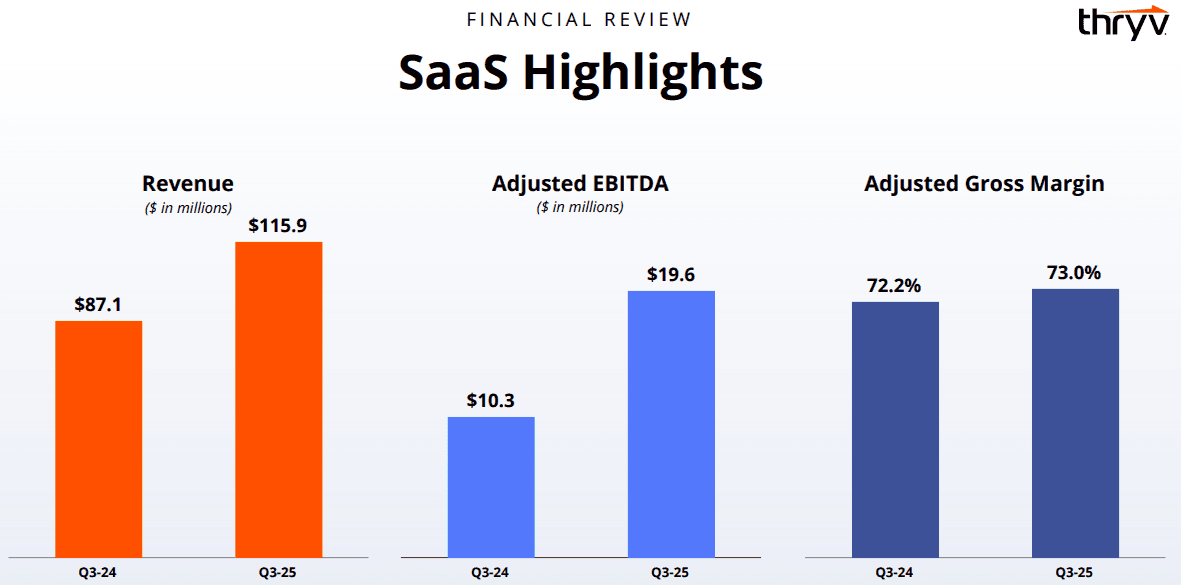

Thryv (THRY) is a roughly $243 million market-cap company in the middle of a multi-year transformation, operating across two segments: legacy Marketing Services and a fast-growing SaaS platform.

The Marketing Services segment still represents the historical Yellow Pages business.

This includes both printed directories and digital properties like YellowPages.com, along with search engine marketing services.

While this division remains cash-generative, it is clearly in runoff mode and exists primarily to fund the company’s transition. Print directories are now published on extended 12- to 24-month cycles, reflecting the gradual wind-down of the legacy model.

The more important story is SaaS. Thryv’s software platform is built for small and mid-sized businesses, offering tools for appointment scheduling, CRM, document management, email marketing, and other daily operational needs. This is where the company’s future value is being created.

In Q3 2025, Thryv reported total revenue of $201.6 million, up 12.1% year over year. While EPS of $0.13 came in below expectations, the underlying mix shift was far more telling. SaaS revenue surged 33.1% to $115.9 million and now represents 58% of total company revenue, marking a clear inflection point in the business model.

Profitability also showed meaningful improvement. Net income swung to a $5.7 million profit versus a $96.1 million loss in the prior year, while adjusted EBITDA reached $40.8 million, representing a solid 20.3% margin. Subscriber growth remained healthy, with SaaS customers rising 7% to 103,000, and ARPU increasing 19% to $365 evidence that customers are both sticking around and spending more.

Looking ahead, management expects full-year SaaS revenue between $460 million and $463 million, with Q4 2025 earnings expected around February 26, 2026. Most importantly, Thryv plans to fully exit the legacy Marketing Services business by 2028, positioning itself as a pure-play SaaS company.

In our view, the market continues to anchor on Thryv’s Yellow Pages past rather than its SaaS future. As the revenue mix continues to shift and the legacy segment is phased out, we believe THRY has the potential to be re-rated as a software company rather than a declining media business.

B. Riley Securities Maintains Buy on Thryv Holdings, Lowers Price Target to $15

RBC Capital Maintains Sector Perform on Thryv Holdings, Lowers Price Target to $13

Needham Maintains Buy on Thryv Holdings, Lowers Price Target to $20

Company: Electrovaya

Quote: ELVA

BT: $6.50-$7.00

ST: $12-$14

Sharks Opinion:

Electrovaya is a company we’ve followed for years and have long viewed as one of the more credible small-cap battery plays in Canada, supported by real fundamentals rather than hype.

Historically, the stock has flown under the radar, but that appears to be changing as average trading volumes have risen meaningfully year over year and the share price has pushed toward the double-digit range signs that broader market awareness is beginning to build.

Beyond improving market interest, Electrovaya is actively expanding its operational footprint.

The company is investing in a new manufacturing facility in Japan, positioning itself closer to key customers and strengthening its global presence.

At the same time, Electrovaya is extending its battery solutions into new end markets, including robotics, which opens up an additional growth vector beyond its core applications.

We view ELVA as a higher-risk name, but one with asymmetric upside. If execution continues to improve and demand from industrial, logistics, and robotics applications accelerates, Electrovaya could transition from a niche small-cap battery supplier into a much more widely followed growth story.

Description: Electrovaya Inc is a technology-focused lithium-ion battery company engaged in designing, developing and manufacturing battery cells, modules and systems based on its proprietary Infinity Battery Technology, which provides high safety performance, long cycle life and durability. The Company supplies low-voltage and high-voltage battery systems for industrial and transportation markets, including material-handling equipment, robotic vehicles, electric buses and trucks, and energy-storage installations, and its products are suitable for mission-critical applications. it maintains an expanding intellectual-property portfolio, develops next-generation solid-state and hybrid solid-state battery technologies, and sells its products through OEM relationships, dealer networks and direct sales.

Electrovaya continues to deepen its vertical integration while scaling its U.S.-based manufacturing footprint, with construction and ramp-up of the Jamestown, New York facility serving as a key catalyst.

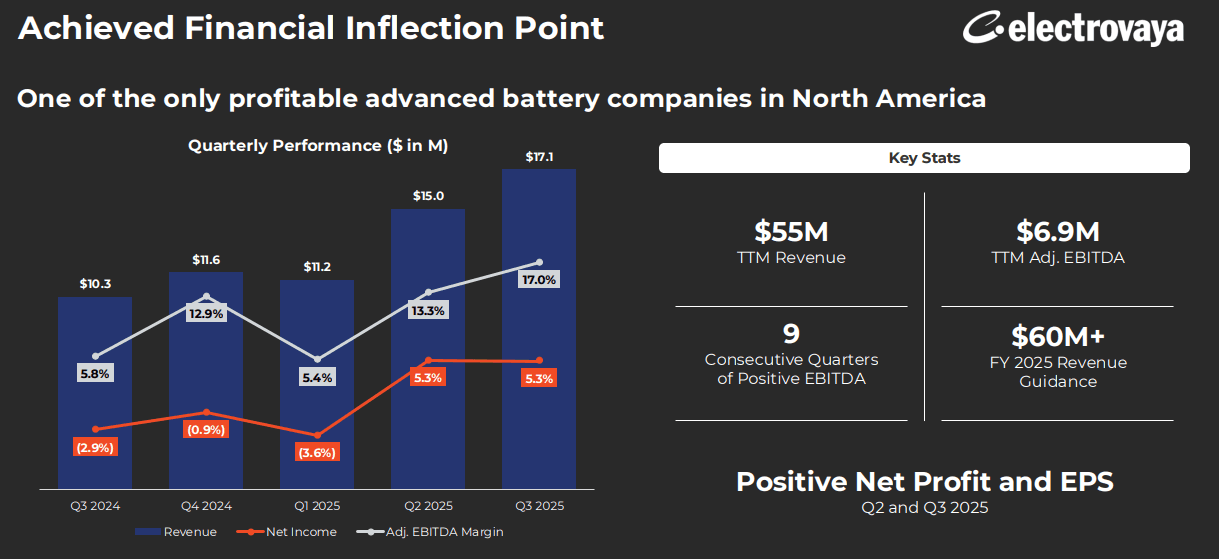

The company achieved profitability for the first time last year, marking an important inflection point, and we believe 2026 has the potential to build meaningfully on that momentum.

Strategically, Electrovaya is targeting two high-growth end markets: autonomous robotics and stationary energy storage.

If the company can replicate the market leadership it has already established in materials handling, the upside could be substantial. In forklift and warehouse applications, Electrovaya is widely regarded as the premium battery solution, offering the lowest total cost of ownership and the only battery designed to last the full life of the vehicle.

While competition in robotics and energy storage is intense, it is no more crowded than the forklift market once was and Electrovaya has already proven it can win there.

Financially, the turnaround is now clearly visible. For the fiscal year reported on December 10, 2025, revenue reached $63.8 million, up 43% year over year. The company generated a net profit of $3.3 million, or $0.09 per share, reversing a net loss in 2024. Adjusted EBITDA climbed 115% to $8.8 million, while gross margins held steady at approximately 31%, underscoring improving operational efficiency.

Looking ahead to 2026, management expects revenue to exceed $83 million, representing more than 30% growth. Profitability should be further supported by increased production from the Jamestown facility and continued expansion into robotics and energy storage. Electrovaya is expected to report Q1 2026 results around February 12, 2026, with analysts forecasting modest but positive earnings.

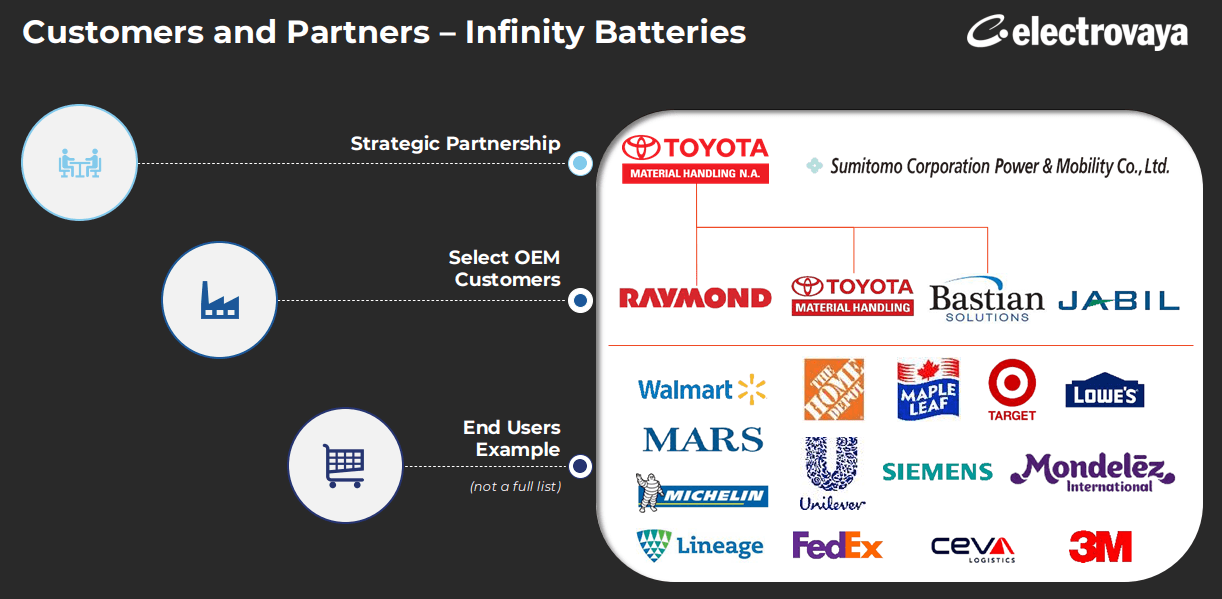

Importantly, Electrovaya’s growth is underpinned by long-term relationships with some of the world’s largest logistics and retail operators.

Its largest end user widely believed to be Amazon has deployed over 2,800 Infinity battery systems across more than 50 distribution centers globally.

Walmart remains a long-standing customer, while the company’s exclusive supply agreement with Raymond (Toyota Material Handling North America) provides a powerful OEM sales channel. Additional repeat customers include Home Depot, Mondelez, Mars, and a major discount retailer operating close to 1,500 Electrovaya batteries.

Taken together, Electrovaya is transitioning from a niche small-cap battery supplier into a profitable, scaling platform with exposure to multiple secular growth trends. Execution risk remains, but if management delivers on its expansion plans, ELVA has the potential to become a significantly larger and more widely followed name over the coming years.

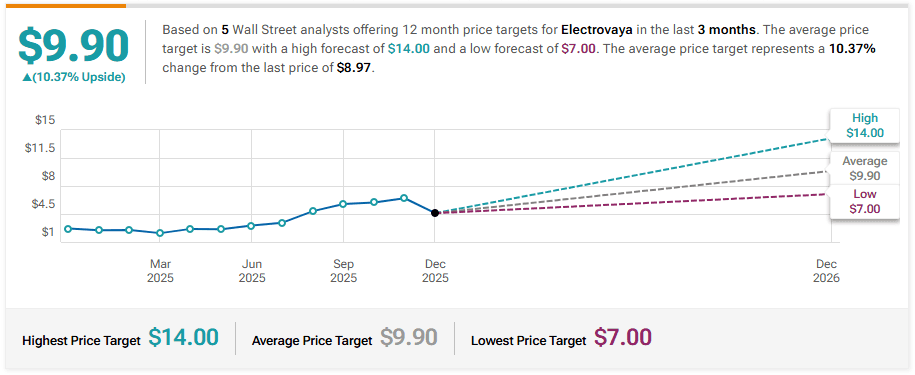

Oppenheimer Initiates Coverage On Electrovaya with Outperform Rating, Announces Price Target of $14

Roth MKM Reiterates Buy on Electrovaya, Raises Price Target to $5

HC Wainwright & Co. Reiterates Buy on Electrovaya, Maintains $10 Price Target

Company: Byrna Technologies

Quote: BYRN

BT: $10

ST: $28

Sharks Opinion:

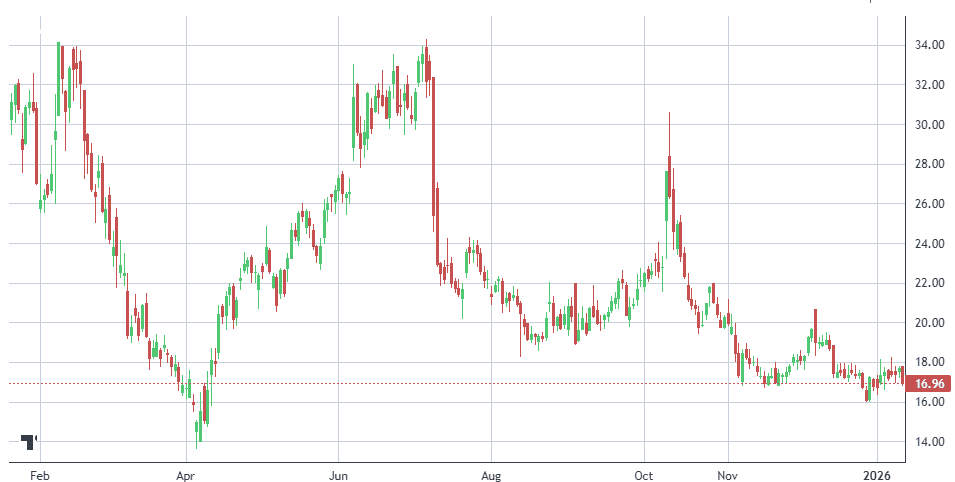

Byrna was a name we identified early, back when it was still trading as a penny stock, but ultimately never pulled the trigger.

Since then, the stock delivered an explosive two-year run before cooling off and entering a consolidation phase.

Seasonally, Q4 is typically Byrna’s weakest quarter, and we see that softness as a potential near-term catalyst that could pressure shares toward our preferred buy range.

Fundamentally, Byrna is the clear market leader in non-lethal personal defense launchers. The company is still in the early stages of penetrating what could become a very large total addressable market, not only in the U.S. but internationally as well, as consumer and institutional adoption continues to evolve.

The business model is particularly attractive. Byrna generates high-margin sales from its launchers, complemented by recurring revenue from CO₂ cartridges and projectiles. Additional upside comes from newer initiatives such as the compact launcher, Byrna Care, and its developing chipset ecosystem.

While the growing mix of brick-and-mortar retail distribution may apply some pressure to margins over time, it also significantly expands brand visibility and customer reach.

Overall, we view Byrna as a long-term growth story that has matured past its early hype phase and is now approaching levels where risk-reward could once again become compelling.

Description: Byrna Technologies Inc is a designer, manufacturer, retailer, and distributor of technological solutions for security situations that do not require the use of lethal force. The company generates its revenue from the United States, South Africa, Europe, South America, Asia, and Canada.

Byrna’s core offering centers on its line of less-lethal personal defense launchers, designed to neutralize threats without causing permanent injury or loss of life. The technology is built around its patented “first-shot pull-pierce” CO₂ system, which ensures the launcher is immediately ready when deployed a key differentiator in high-stress self-defense scenarios.

The Byrna SD remains the company’s flagship product and most widely adopted model. It is a compact, pistol-sized launcher intended for everyday carry, powered by an 8g CO₂ cartridge, with an effective range of up to 60 feet and projectile speeds around 280 feet per second.

For professional use, the Byrna LE offers increased power and capacity. This mid-sized launcher delivers higher muzzle velocity of up to 330 feet per second, utilizes 12g CO₂ cylinders, and is tailored for law enforcement and private security applications where reliability and stopping power are critical.

The newest addition, the Byrna CL, represents a meaningful product evolution. Despite being smaller and more concealable than the SD, it delivers impact energy comparable to the LE model, firing proprietary .61 caliber rounds at speeds of up to 400 feet per second. This product significantly broadens Byrna’s addressable market by combining discretion with performance.

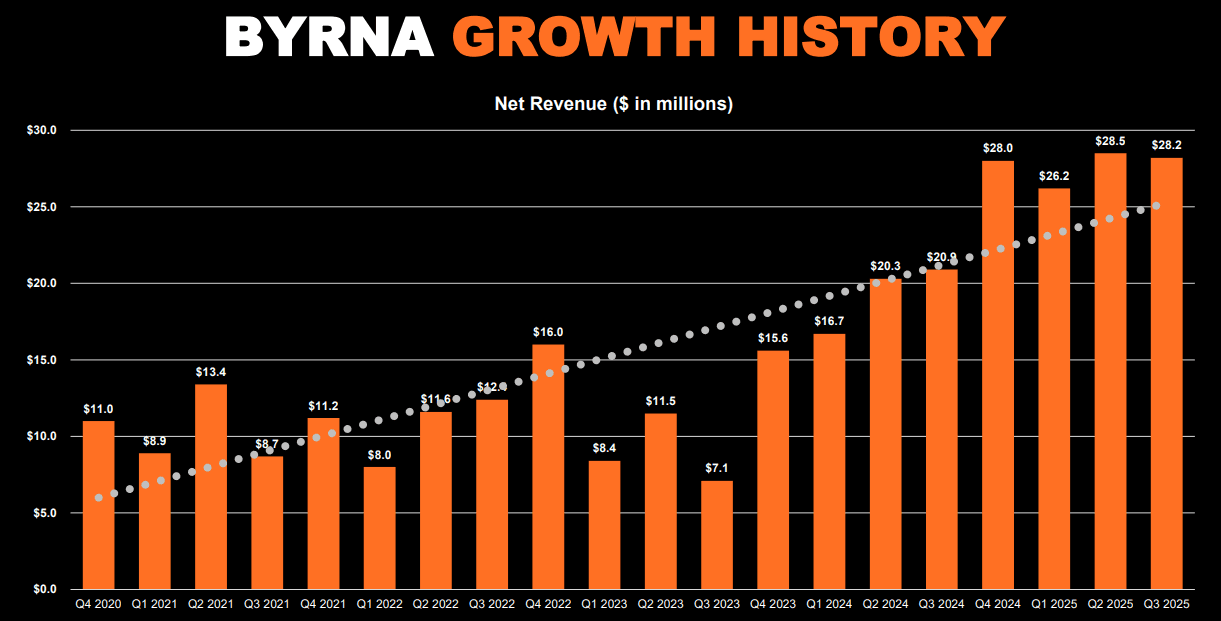

From a financial standpoint, Byrna continues to execute. Preliminary Q4 2025 results released on December 8, 2025 pointed to record quarterly revenue of $35.1 million, representing 26% year-over-year growth, and record full-year revenue of $118.0 million, up 38% year-over-year.

Profitability trends remain strong. Net income for Q3 2025 reached $2.2 million, more than double the prior year period, while adjusted EBITDA increased to $3.7 million from $1.9 million a year earlier. On a trailing twelve-month basis, Byrna generated approximately $16.0 million in net income as of August 31, 2025.

The balance sheet further strengthens the investment case. As of November 30, 2025, the company held more than $15 million in cash and cash equivalents and carried no long-term debt, providing both financial flexibility and downside protection as it continues to scale.

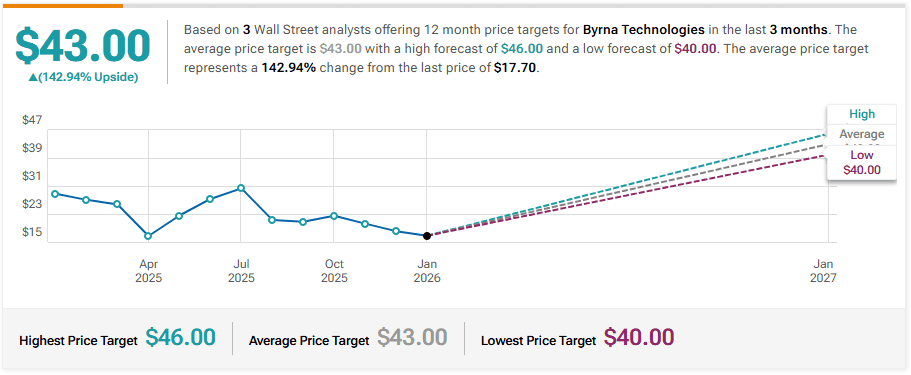

B. Riley Securities Maintains Buy on Byrna Technologies, Raises Price Target to $46

Roth Capital Maintains Buy on Byrna Technologies, Raises Price Target to $37

Ladenburg Thalmann Maintains Buy on Byrna Technologies, Raises Price Target to $16.25