This is a watchlist composed of the current stocks we are looking to trade none of these are alerts, all alerts will be alerted upon entry just like the others on the weekly investment letter.

Company: Deckers Outdoor Corporation

Quote: $DECK

BT: $90-$105

ST: $150+

Sharks Opinion:

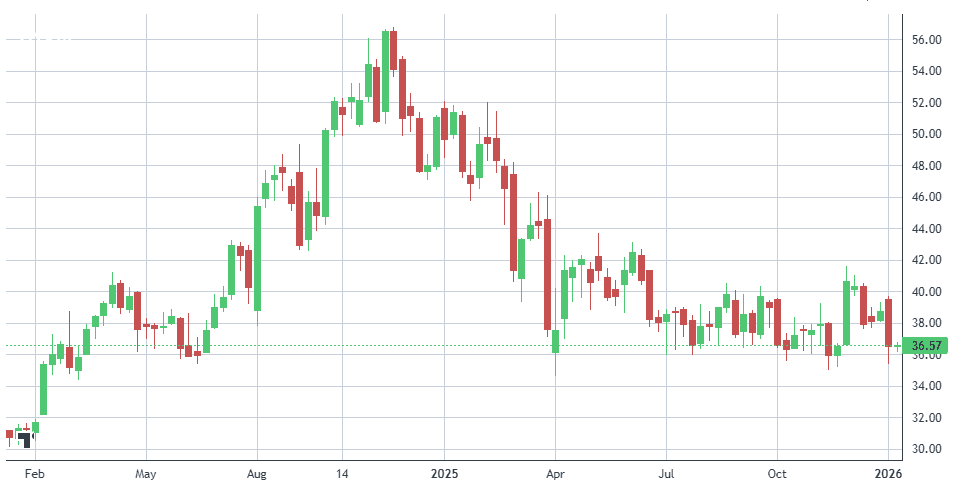

Deckers Outdoor (DECK) is emerging as a compelling dislocation story. The company behind Hoka, UGG, and other strong brands has built real momentum Hoka’s visibility and growth are everywhere yet the stock is down more than 50% year-to-date.

The selloff appears driven more by macro fear than fundamentals, with tariff concerns tied to China and Vietnam and weakening consumer sentiment pressuring the stock.

Long term, Hoka’s brand strength, product differentiation, fortress balance sheet, and growing direct-to-consumer mix position Deckers to weather near-term headwinds.

The setup resembles early Nike: strong execution, loyal customers, and a durable business trading at a discounted price.

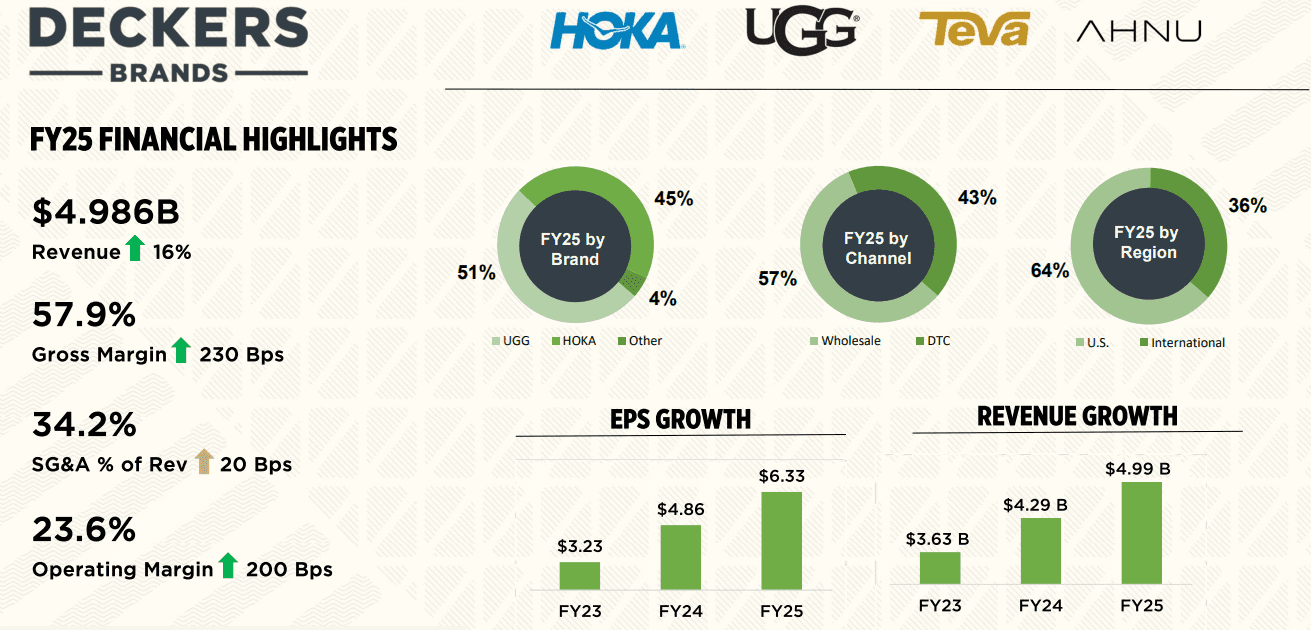

Description: Founded in 1973, California-based Deckers designs and sells casual and performance footwear, apparel, and accessories. In fiscal 2025, Ugg and Hoka accounted for 51% and 45% of total sales, respectively. The firm also markets niche brands Teva and Ahnu. Deckers produces most of its sales through wholesale partnerships but also operates e-commerce in more than 50 countries and has nearly 200 company-operated stores. It generated 64% of its fiscal 2025 sales in the United States.

Deckers Brands operates in over 50 countries through a diversified mix of wholesale, direct-to-consumer, company-owned stores, and online channels, with a portfolio that includes UGG, HOKA, Teva, Koolaburra, and AHNU.

Fundamentally, the business remains very strong. Deckers has delivered consistent profitability, a solid balance sheet, and durable growth, even through the pandemic.

Fiscal 2025 marked its fifth straight year of double-digit revenue and EPS growth, with five-year CAGRs of 19% for revenue and 32% for earnings.

Growth is being driven primarily by its two powerhouse brands. UGG continues to expand steadily, while HOKA has become the engine of the company, posting nearly 47% growth.

Despite this, the stock fell close to 20% after management issued cautious guidance tied largely to tariff uncertainty rather than demand weakness.

To underscore confidence, Deckers authorized an additional $2.25 billion share buyback, equivalent to roughly 12% of its market cap at the time.

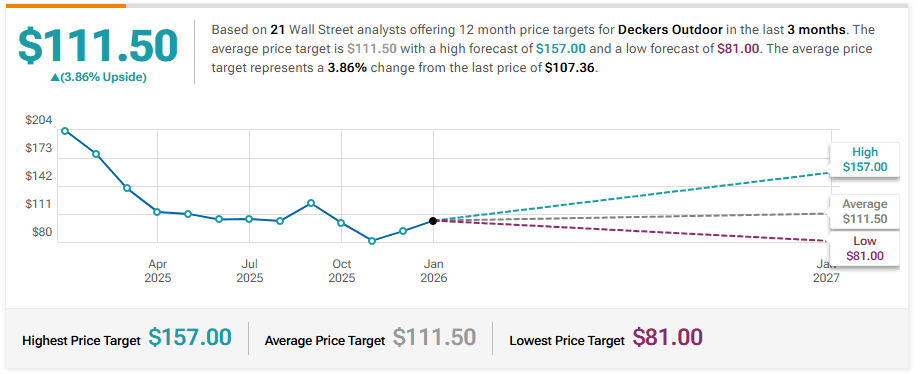

Jefferies Assumes Deckers Outdoor at Hold, Announces Price Target of $102

Piper Sandler Downgrades Deckers Outdoor to Underweight, Lowers Price Target to $85

Baird Downgrades Deckers Outdoor to Neutral, Maintains Price Target to $125

Stifel Upgrades Deckers Outdoor to Buy, Maintains Price Target to $117

Company: Fiserv, Inc.

Quote: $FISV

BT: $60-$70

ST: $120-$140

Sharks Opinon:

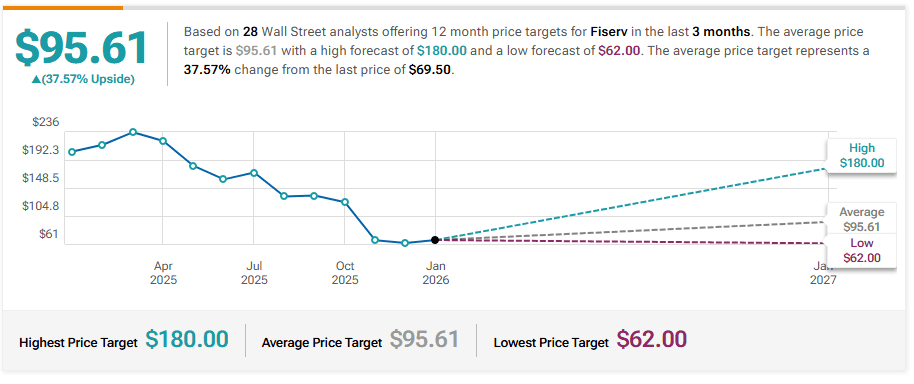

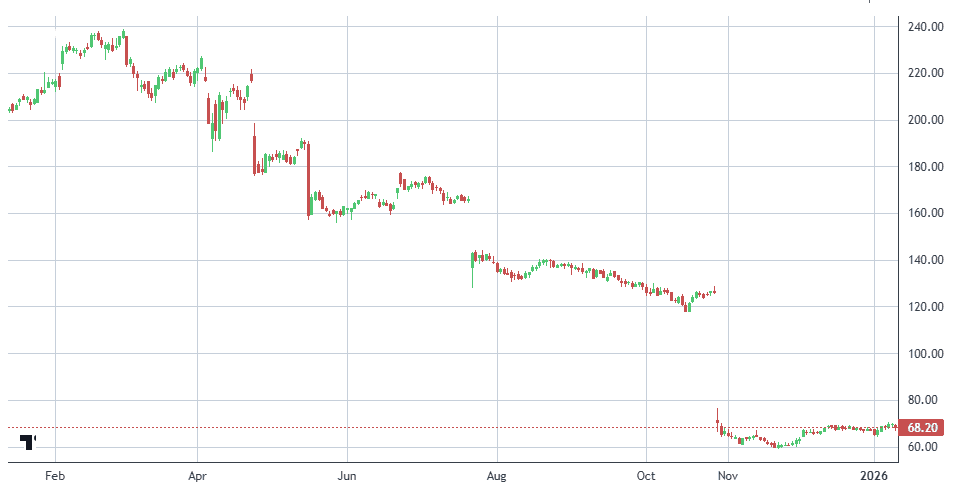

Fiserv has collapsed nearly 75% from its all-time high, transforming what was once a growth favorite into a stock now trading more like a value play.

The selloff accelerated after Q3 2025 results, when shares plunged roughly 42% in the company’s worst single-day decline ever.

Earnings and revenue missed expectations by a wide margin, and guidance disappointed.

The core issue was a sharp slowdown in Merchant Solutions, particularly the Clover platform, where growth fell to just 5% amid rising competition, weaker pricing power, and signs of customer churn.

Investor confidence was further shaken by a major leadership reset, including a new CFO, co-presidents effective December 2025, and three new board members, underscoring execution issues and past missteps.

Growth is now lagging the broader payments industry, a concerning signal of potential market-share losses.

Still, valuation has reset meaningfully. At roughly 10× earnings and a free-cash-flow yield near 7%, the stock is no longer expensive.

Fiserv is now a turnaround bet rather than a compounder: if management can stabilize the business and restore growth, upside exists.

The recent $1.5 million insider purchase adds a note of confidence, but risks remain high and position sizing matters.

Description: Fiserv is a leading provider of core processing and complementary services, such as electronic funds transfer, payment processing, and loan processing, for US banks and credit unions, with a focus on small and midsize banks. Following its 2019 merger with First Data, Fiserv also provides payment processing services to merchants. About 10% of the company's revenue is generated internationally.

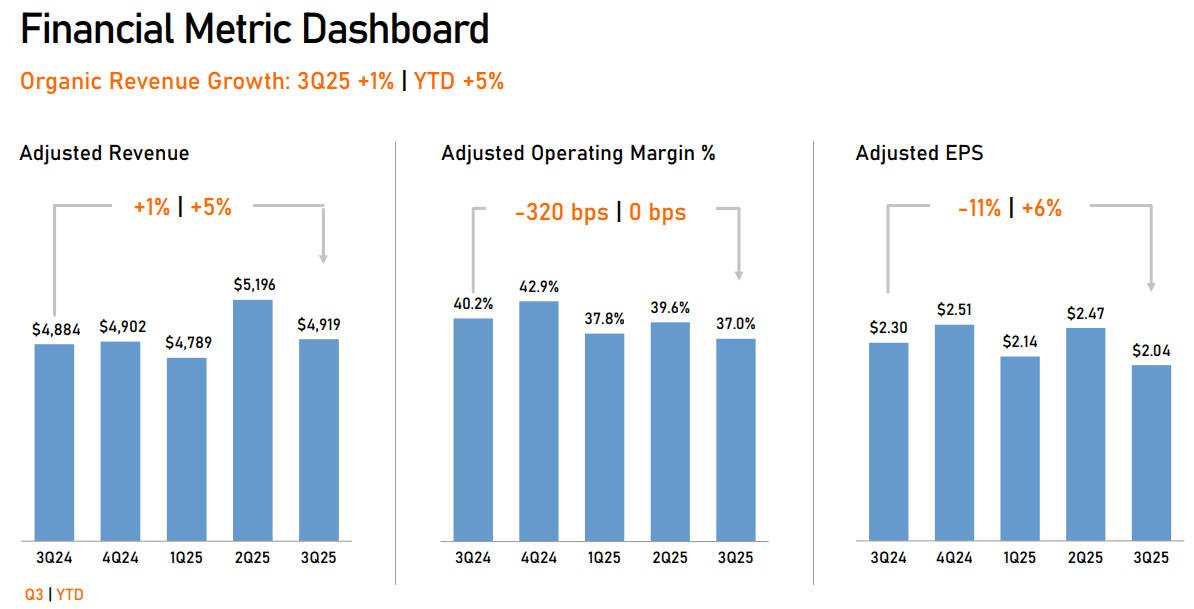

Fiserv’s latest quarter underscored the pressure on the business. Revenue rose just 1% year over year to $5.26 billion, missing expectations of roughly $5.36 billion.

Merchant Solutions, including Clover, grew 5%, but this was more than offset by a 3% decline in Financial Solutions as international markets like Argentina were hit by currency volatility and weaker economic conditions.

Profitability also deteriorated. Adjusted EPS fell 11% to $2.04 versus the $2.09 expected, as margins compressed to 37% from 40% a year ago due to deferred investments and strategic shifts.

Management responded by sharply cutting full-year 2025 guidance. Organic revenue growth is now seen at just 3.5%–4%, down from a prior 10% target, while adjusted EPS is projected at $8.50–$8.60 versus $10.15–$10.30 previously.

The company cited heavier competition, pricing pressure, Clover churn, and a pivot toward longer-term initiatives under its “One Fiserv” plan, which aims to reaccelerate growth by 2027.

Despite the weak outlook, valuation is compelling. Fiserv generates a cash flow yield of about 12.5%, has delivered roughly 5% revenue growth over the past year, and now trades at steep discounts around 46% below its 3-month high and more than 70% below its one- and two-year highs.

Tigress Financial Maintains Buy on Fiserv, Lowers Price Target to $95

Mizuho Maintains Outperform on Fiserv, Lowers Price Target to $100

Citigroup Maintains Buy on Fiserv, Raises Price Target to $140

Stephens & Co. Maintains Equal-Weight on Fiserv, Raises Price Target to $125

RBC Capital Maintains Outperform on Fiserv, Raises Price Target to $133

Company: Viper Energy

Quote: VNOM

BT: $35-$40

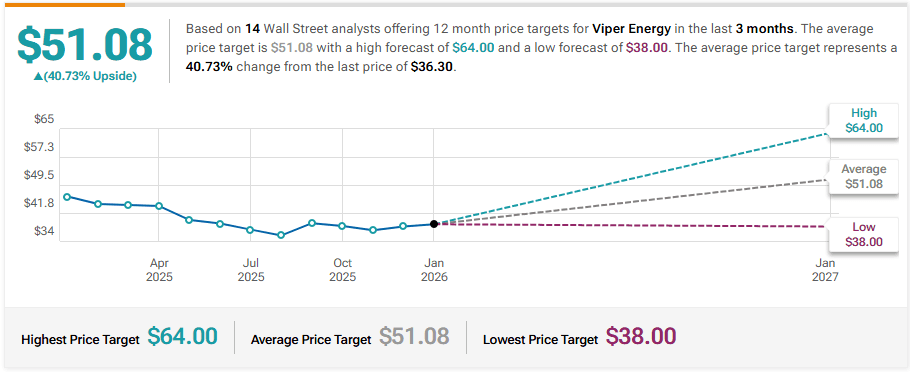

ST: $52-$60

Sharks Opinion:

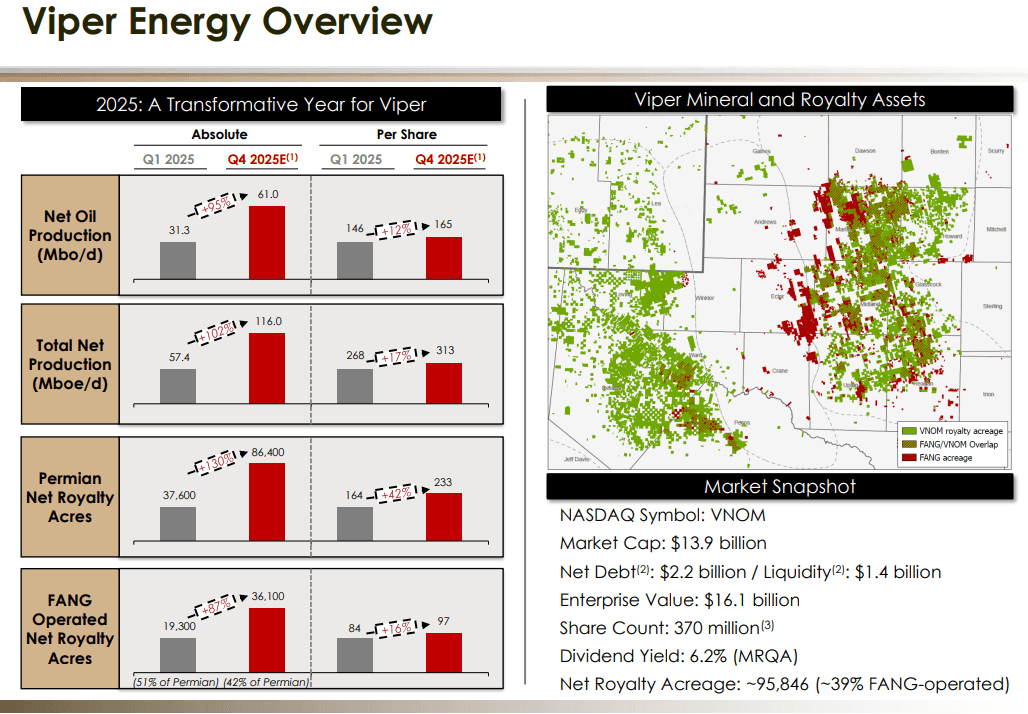

Oil and energy are back in focus amid rising geopolitical risk. While Cenovus (CVE) remains a high-quality Canadian operator, deeper work over the past month suggests Viper Energy (VNOM) may offer better upside from here.

Viper is a pure-play oil and gas royalty company with roughly 34,500 net royalty acres concentrated in the Permian Basin, where about 68 rigs are currently active.

The company converted from a partnership to a corporation in late 2023 and operates as a subsidiary of Diamondback Energy, giving it strong operational alignment without direct capital or execution risk.

Despite solid execution in a difficult energy tape, VNOM trades at a valuation discount to comparable royalty businesses, including PrairieSky in Canada and mineral-focused peers in metals and mining.

Shares are down roughly 26% over the past year, but analyst sentiment remains constructive, with a Moderate Buy consensus creating a setup where downside appears priced in while upside remains optional.

Description: Viper Energy Inc is focused on owning and acquiring mineral and royalty interests in oil and natural gas properties in the Permian Basin. The Permian Basin is known to have a number of zones of oil and natural gas-bearing rock throughout.

Viper Energy is a pure-play, Permian-focused royalty asset generating over 70% fully taxed free cash flow margins and offering double-digit FCF yields even at sub-$60 oil.

The setup delivers strong current returns with upside tied to rising production, growing gas volumes, commodity price recovery, and potential multiple re-rating.

Its C-corp structure sets VNOM apart from traditional royalty trusts, eliminating K-1s, enabling index inclusion, and lowering its cost of capital.

The merger with Sitio added scale, further strengthening the royalty model where access to cheap capital matters most.

In Q3 2025, Viper beat expectations with adjusted EPS of $0.40 and revenue of $418 million, nearly doubling year over year due to acquisition-driven production growth. A GAAP net loss was driven by a one-time non-cash impairment.

The company declared a $0.58 base-plus-variable dividend, equating to a roughly 6% yield at the time.

Looking ahead, Viper guided Q4 2025 production at 124–128 mboe/d and expects mid-single-digit organic oil growth in 2026, alongside the closing of a $670 million non-Permian asset sale in early 2026.

Q4 earnings are expected on February 23, with consensus EPS of $0.31–$0.35 and full-year 2025 revenue around $1.4 billion.

Mizuho Maintains Outperform on Viper Energy, Raises Price Target to $52

Piper Sandler Maintains Overweight on Viper Energy, Lowers Price Target to $64

Wells Fargo Maintains Overweight on Viper Energy, Raises Price Target to $51

Barclays Maintains Overweight on Viper Energy, Raises Price Target to $60

Morgan Stanley Maintains Overweight on Viper Energy, Lowers Price Target to $45