November Trade Recap & Strategy Outlook:

As we close out November and move toward 2026, our measured, low-velocity trading approach has continued to serve us well, allowing us to stay flexible while managing risk in a market that is increasingly selective.

Portfolio Activity

This month, we exited one position: JAMF (JAMF), acquired via a private equity M&A deal, delivering a 27% return in just one month.

On the buying side, we added two familiar names: ACM Research (ACMR) and Pony AI (PONY). While we remain bullish on the broader portfolio, these purchases were made prudently on dips, reflecting strong fundamentals and upside potential, similar to past opportunities in these names.

Macro Overview

The broader macro landscape continues to show a divergence between two economies: the cyclical economy, constrained by inflation and cost pressures, and the secular economy, driven by high-capex sectors like technology, defense, and infrastructure, which remain in full expansion mode.

The U.S. is now in an era of fiscal primacy, where government spending increasingly guides economic direction more than monetary policy. With midterms approaching and fiscal dominance shaping the agenda, we expect policy support to continue stabilizing growth-sensitive sectors through the election cycle.

2026 Strategy

As we transition into 2026, the market setup remains constructive, though not without challenges. Elevated valuations will require selectivity and a focus on quality. Beneath the surface, however, the pillars of a healthier cycle are forming: steadier growth, a gentler rate environment, and the potential for profit expansion across major sectors. Together, these factors provide a more balanced backdrop than what we entered 2025 with.

This season invites reflection a moment to acknowledge both uncertainty and opportunity. The goal is not to predict every macro turn, but to position portfolios for resilience and compounding. Markets will continue to provide openings for thoughtful risk-taking, making it essential to align positions where durable growth is most likely to appear. In this sense, 2026 appears less like a reset and more like a continuation of the current cycle, with room to run.

We remain cautiously optimistic but recognize that even the best-laid plans can shift. While we are exploring ways to be more aggressive on the swing trade front, experience reminds us that markets rarely unfold exactly as anticipated.

Overweight

Technology: AI, robotics, and automation remain structural winners, benefiting from strong capital inflows and long-term demand visibility.

Crypto: Positioned ahead of potential institutional adoption and clearer regulatory frameworks.

M&A-linked Midcaps: Consolidation momentum remains strong, offering asymmetric upside.

Select Retail & Restaurants: Valuations are attractive, though current sentiment warrants caution.

Underweight / Avoid

Cyclical or overextended sectors facing margin compression, policy risks, or valuation fatigue.

Heading into year-end, we expect rotations, volatility, and opportunities—the kind of environment where discipline, timing, and careful positioning matter most.

Longs:

These are stocks we have been long for some time and the current BT doesn’t represent other entry prices, The BT is updated weekly for new subscribers to jump in and know when to get out.

These stocks tend to have 6 Month-2 years holding period and is suggested for larger capital Allocations in your portfolio.

Please read the Overviews for full research and instructions on how to trade each name individually

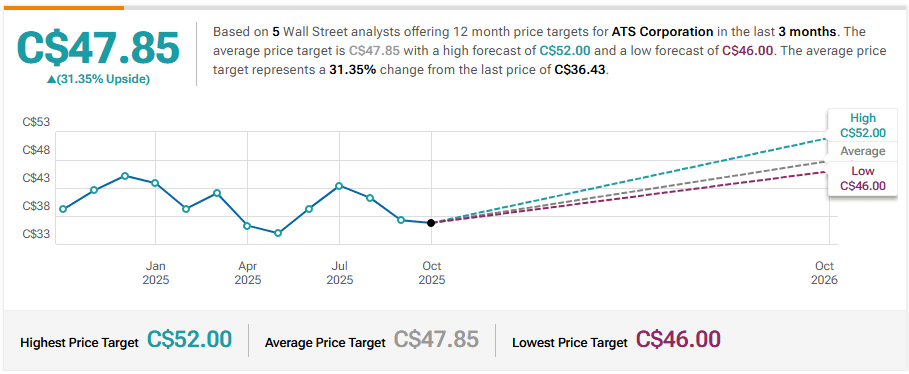

Company: ATS Corporation

Quote: $ATS

BT: $29.72

ST: $48

Sharks Opinion:

ATS has finished the year below expectations, but we remain steadfast in our bullish view. We see the name as a long-term strategic play, particularly for potential M&A activity in 2026. While we are eager to increase our position at the start of the year, we are remaining prudent until broader buy-side volume signals renewed confidence.

1️⃣ Valuation Tailwinds from Strategic M&A

The recent SoftBank acquisition of ABB’s robotics division at 2.4× sales and 17.2× EBITDA has effectively reset the market’s pricing floor for automation assets tied to AI-driven manufacturing.

In comparison, ATS currently trades at just 12× NTM EBITDA, despite exposure to the same secular trends. Its valuation is constrained by transitory factors including an EV cycle unwind, a CEO transition, and elevated leverage (~3.5×).

This transaction reinforces our conviction that the market is underappreciating the intrinsic and strategic value embedded in ATS’s platform, creating an asymmetric opportunity for investors ahead of potential M&A re-rating.

2️⃣ Structural Demand: $350B in U.S. Manufacturing Commitments

ATS’s client base has collectively committed over $350 billion in U.S. manufacturing investments this year, highlighting a structural, long-term need for automation solutions.

As reshoring accelerates and North American manufacturing capacity expands, ATS stands to benefit directly from this capex-led reindustrialization cycle, reinforcing the durability of its growth runway.

Why We’re Staying Overweight ATS

Direct industrial automation exposure linked to AI-driven manufacturing processes.

Multi-year automation supercycle fueled by reshoring and supply chain localization.

M&A re-rating potential as strategic buyers and institutional investors increase exposure to robotics and precision automation.

The market has not fully recognized ATS’s positioning yet, and that is where opportunity lies. The company is quietly building its foundation, with operational leverage and balance sheet optionality that compounds over time. As AI, robotics, and industrial automation shift from narrative to necessity, ATS is poised to evolve from an overlooked operator into a core holding for capital rotating into AI-linked manufacturing exposure.

Description: ATS Corporation, together with its subsidiaries, provides automation solutions worldwide. The company is involved in planning, designing, building, commissioning, and servicing automated manufacturing and assembly systems, including automation products and test solutions. It also offers pre-automation services comprising discovery and analysis, concept development, simulation, and total cost of ownership modelling; post-automation services, including training, process optimization, preventative maintenance, emergency and on-call support, spare parts, retooling, retrofits, and equipment relocation; and contract manufacturing services, as well as after sales and services.

TD Securities maintained a Buy rating on ATS Corporation, with a price target of C$49.00.

Raymond James analyst Michael Glen maintained a Buy rating on ATS Corporation today and set a price target of C$48.00.

RBC Capital Maintains Outperform on ATS, Lowers Price Target to C$48

Goldman Sachs Maintains Sell on ATS, Lowers Price Target to $30

JP Morgan Maintains Neutral on ATS, Lowers Price Target to $31

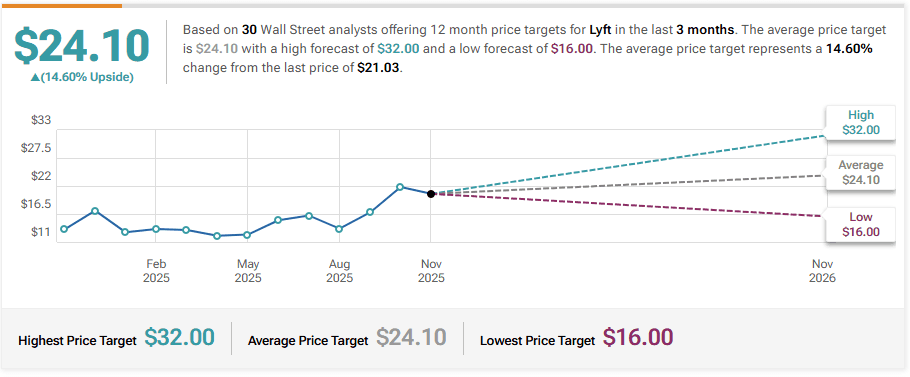

Company: Lyft, Inc

Quote: $LYFT

BT: $20.54

ST: $34-$40

Sharks Opinion:

Since our re-entry into Lyft (LYFT), the stock hasn’t moved dramatically, but our thesis remains intact, and we continue to view the name with prudent optimism.

M&A Potential Increasing

We believe the likelihood of a Lyft acquisition is rising, and this goes beyond mere speculation. Key market signals support this view:

Capital constraints among ride-hailing competitors create pressure for consolidation.

Autonomous vehicle (AV) developments are poised to reshape the mobility landscape, incentivizing strategic acquisitions.

Historical patterns show that the market rewards early positioning ahead of M&A announcements.

Swing Trade Opportunity

This position is best approached as a swing long, given the inherent unpredictability of M&A timing. Recent volume upticks on tape suggest growing market interest, making now an attractive entry point for disciplined investors.

In summary, while LYFT’s near-term price action remains muted, the structural thesis consolidation in mobility, capital pressures, and AV-driven strategic shifts remains firmly in place.

We see meaningful upside if and when M&A activity accelerates, positioning LYFT as both a tactical swing and strategic play.

Description: Lyft, Inc. operates a peer-to-peer marketplace for on-demand ridesharing in the United States and Canada. The company operates multimodal transportation networks that offer access to various transportation options through the Lyft platform and mobile-based applications.

Guggenheim Initiates Coverage On Lyft with Buy Rating, Announces Price Target of $22

Mizuho Initiates Coverage On Lyft with Neutral Rating, Announces Price Target of $24

TD Cowen Maintains Buy on Lyft, Raises Price Target to $30

Benchmark Maintains Buy on Lyft, Raises Price Target to $26

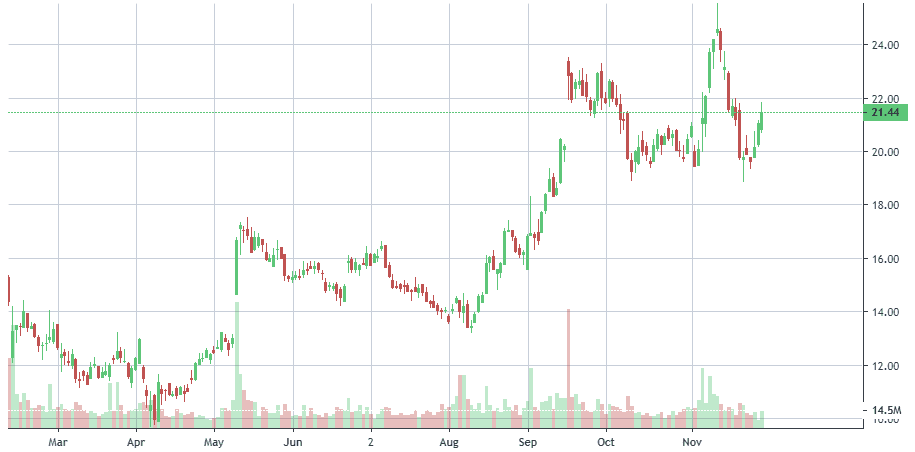

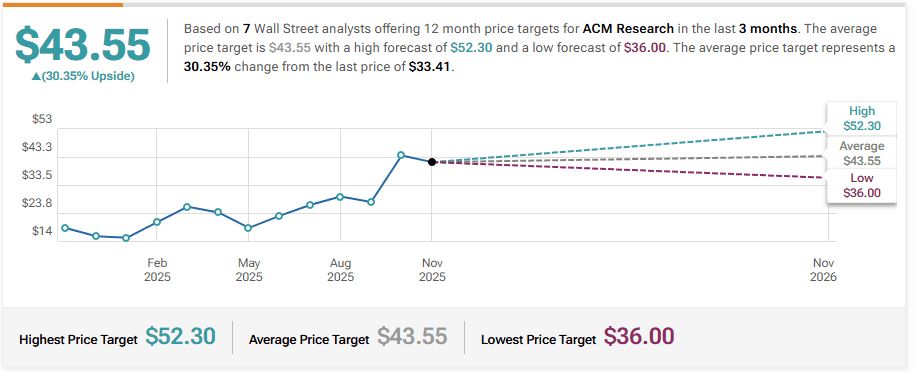

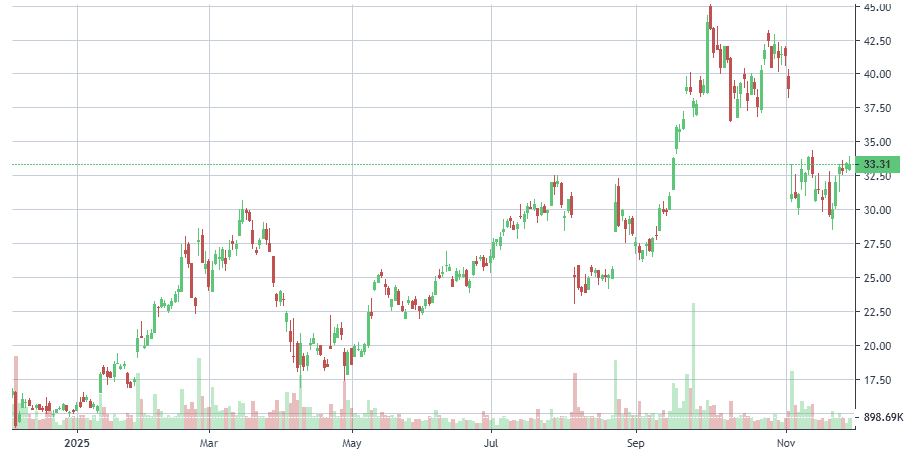

Company: ACM Research, Inc

Quote: $ACMR

BT: $32.84

ST: $48

Sharks Opinion:

Earlier this year, we traded ACMR

(ACM Research) but exited too soon.

After a meaningful pullback and improving market conditions, we’re rebuilding a position to position ahead of the next semiconductor capex cycle.

Why ACMR Stands Out

ACMR remains one of the strongest players in wafer-cleaning technology, a critical segment in semiconductor fabrication. Despite this, its U.S. shares continue to trade at a discount relative to its Asia listing, creating a valuation gap that we find attractive.

Investment Approach

Given the inherent volatility in both the stock and the broader semiconductor sector, ACMR serves as a dual-purpose opportunity:

Swing trade: Capturing near-term upside as sentiment recovers.

Long-term hold: Benefiting from structural growth in semiconductor capital expenditure and technology adoption.

At current levels, with sentiment reset and the next semi capex cycle on the horizon, we are confident in ACMR’s trajectory and see room for meaningful upside both near-term and over the next several quarters.

Description: ACM Research Inc supplies advanced, innovative capital equipment developed for the world-wide semiconductor industry. Fabricators of advanced integrated circuits, or chips, can use its wet-cleaning and other frontend processing tools in numerous steps to improve product yield, even at increasingly advanced process nodes. It has designed these tools for use in fabricating foundry, logic and memory chips, including dynamic random-access memory, or DRAM, and 3D NAND-flash memory chips.

The company also develops, manufactures and sells advanced packaging tools to wafer

assembly and packaging customers.

Roth Capital Maintains Buy on ACM Research, Raises Price Target to $50

JP Morgan Initiates Coverage On ACM Research with Overweight Rating, Announces Price Target of $36

Craig-Hallum Downgrades ACM Research to Hold, Lowers Price Target to $18

Needham Downgrades ACM Research to Hold, Maintains Price Target to $25

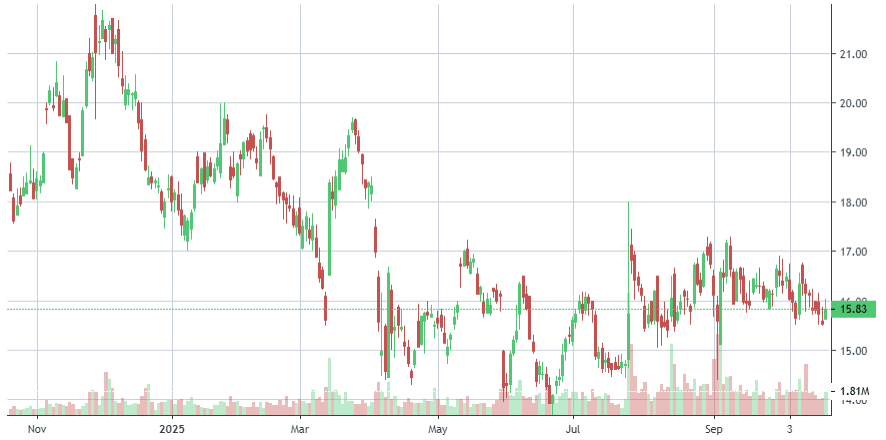

Company: PagerDuty, Inc.

Quote: $PD

BT: $15.89

ST: $24-$30

Sharks Opinion:

PagerDuty’s recent earnings were disappointing to shareholders, despite the company reporting a fairly solid quarter overall. We covered the results in detail and, while fundamentals remain intact, the next earnings report will be a true “show-me” moment. The market will be looking for clear signals of growth acceleration or potential M&A activity; without these catalysts, we would reconsider our position.

Company Context

PagerDuty is a name we know well, having traded it multiple times in the past. At its core, the story hasn’t changed: this is a small enterprise software business with slow growth and thin cash flow margins. Fundamentally, it appears more like a product suite primed for acquisition rather than a standalone long-term compounding growth story.

Why It’s Interesting Now

The current environment makes PagerDuty intriguing. Despite a solid quarter, the stock fell post-earnings, reflecting skepticism about its standalone growth prospects. Instead, the real narrative may be M&A-driven accumulation. Prominent hedge funds, including ARK Invest, Renaissance Technologies, and State Street, have quietly positioned in PD, signaling confidence in potential strategic upside.

Sale Rumors & Corporate Actions

Management recently confirmed they are exploring strategic alternatives, including a possible sale. PagerDuty also announced a $200 million share repurchase program, a move that often precedes or accompanies M&A discussions, supporting valuation and shareholder returns.

Strategic Takeaway

Nothing in recent management actions suggests PagerDuty can scale into a dominant independent enterprise software player. Its product suite, while highly useful, is better suited for integration into a larger enterprise software platform. Essentially, PagerDuty fits the profile of a tuck-in acquisition rather than a standalone growth engine, making it a unique opportunity for investors focused on M&A-driven upside.

Description: PagerDuty, Inc. engages in the operation of a digital operations management platform in the United States and internationally. The company's digital operations management platform collects data and digital signals from virtually any software-enabled system or device and leverage machine learning to correlate, process, and predict opportunities and incidents.

Truist Securities Maintains Buy on PagerDuty, Lowers Price Target to $20

Baird Maintains Neutral on PagerDuty, Lowers Price Target to $16

Canaccord Genuity Maintains Buy on PagerDuty, Lowers Price Target to $19

RBC Capital Maintains Outperform on PagerDuty, Lowers Price Target to $20

JP Morgan Maintains Underweight on PagerDuty, Lowers Price Target to $18

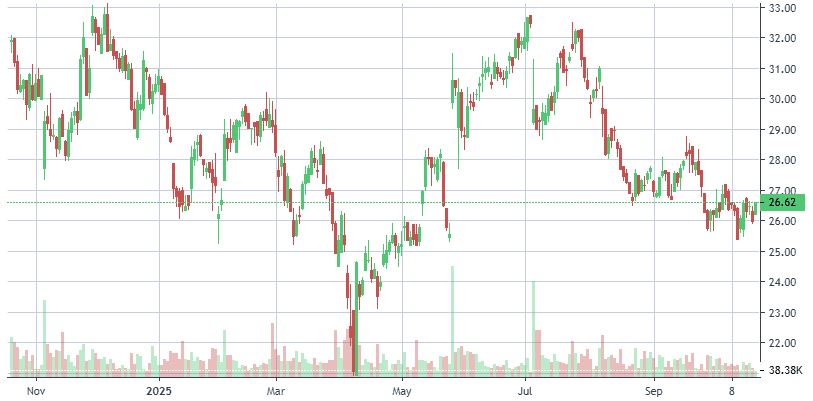

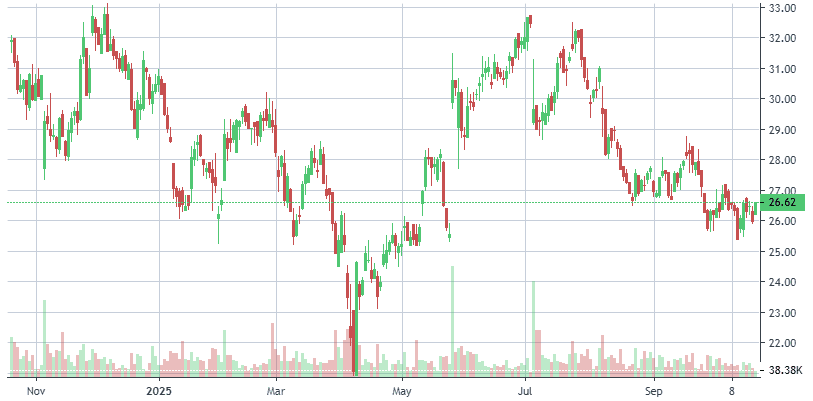

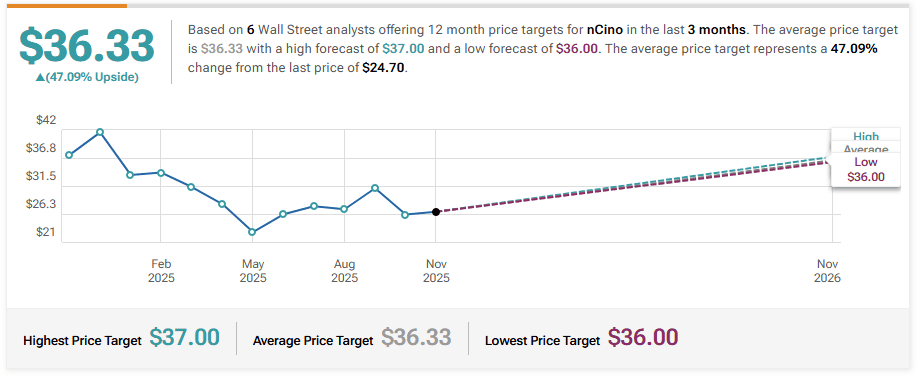

Company: nCino, Inc

Quote: $NCNO

BT: $25.83

ST: $40

Sharks Opinion:

nCino is scheduled to report its third-quarter results on Wednesday after the bell, and we will provide a full recap along with insights on potential trade setups once the report is released.

As noted in our watchlist overview, NCNO remains a high-conviction swing trade candidate. Timing catalysts around earnings announcements has proven effective, and we see upside potential whenever the stock dips below key support levels, creating attractive entry points for disciplined swing traders.

The name continues to show technical and structural patterns that support short-term trades, while earnings events provide additional volatility that can be leveraged for tactical positioning.

In short, NCNO is a name we’re actively monitoring for swing opportunities, with earnings serving as a near-term catalyst and any pullbacks offering a potential entry for upside moves.

Description:

nCino, Inc., a software-as-a-service company, provides software solutions to financial institutions in the United States, the United Kingdom, and internationally. It offers solutions on the nCino Platform, including Onboarding solution that streamlines and enhances the customer onboarding process through a digital platform for credit and non-credit onboarding, commercial account opening, and enterprise-level onboarding; and Account Opening solution, which includes Deposit Account Opening solution for consumers and small businesses.

Raymond James Upgrades Ncino to Strong Buy, Announces $36 Price Target

Morgan Stanley Upgrades Ncino to Overweight, Raises Price Target to $36

Barclays Maintains Overweight on Ncino, Raises Price Target to $37

B of A Securities Maintains Neutral on Ncino, Raises Price Target to $38

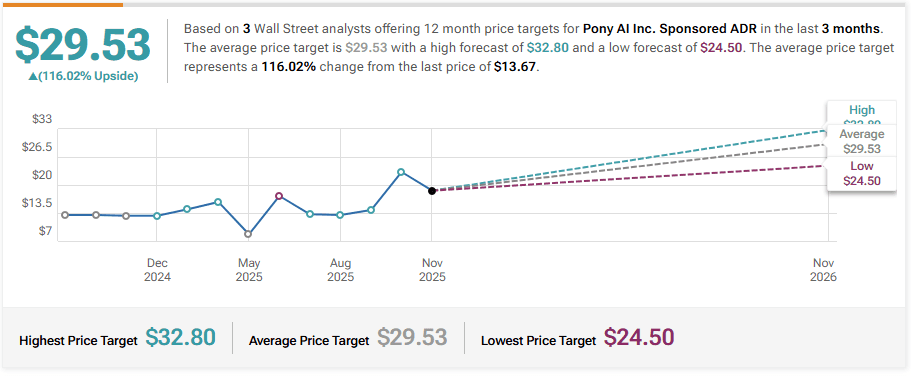

Company: Pony AI Inc

Quote: $PONY

BT: $13.53

ST: $28

Sharks Opinion:

We recently re-entered Pony AI, and the stock has already gained roughly 5% since our entry, reflecting early positive momentum.

Pony remains one of the leading autonomous aerial vehicle (AAV) names in the market, and last night’s earnings results reinforced its strong positioning.

The numbers showed growth across multiple segments,

highlighting both operational progress and market adoption. Today’s price action reflects renewed investor confidence and a shift in sentiment toward the name.

We like our entry point here and continue to see upside as the story regains traction. Heading into year-end, we expect PONY to trend higher, supported by investor rotation back into high-quality AAV plays and continued execution in the business.

Description: Pony AI Inc is an artificial intelligence technology company that is principally engaged in the operation and development of autonomous vehicles. It operates fully driverless robotaxis through the PonyPilot mobile app in Beijing, Shanghai, Guangzhou, and Shenzhen. The company operates a fleet of robotaxis. The Group conducts its operations mainly in the People's Republic of China (PRC) and the United States of America (U.S.) through subsidiaries. Key revenue is generated from the People's Republic of China.

Citigroup Initiates Coverage On Pony AI with Buy Rating, Announces Price Target of $29

UBS Initiates Coverage On Pony AI with Buy Rating, Announces Price Target of $20

Deutsche Bank Initiates Coverage On Pony AI with Buy Rating, Announces Price Target of $20

B of A Securities Initiates Coverage On Pony AI with Buy Rating, Announces Price Target of $18

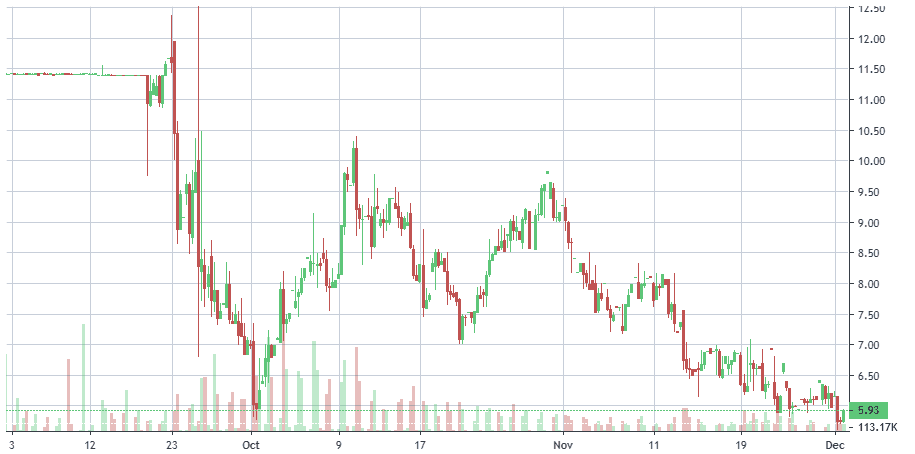

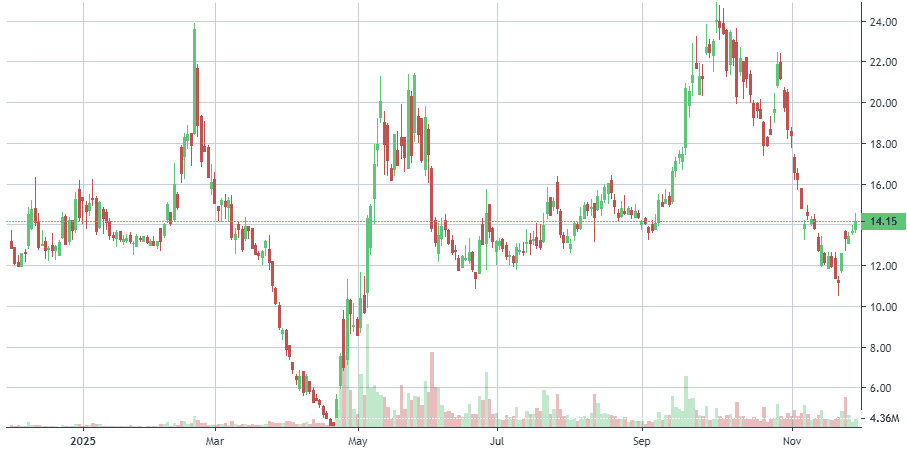

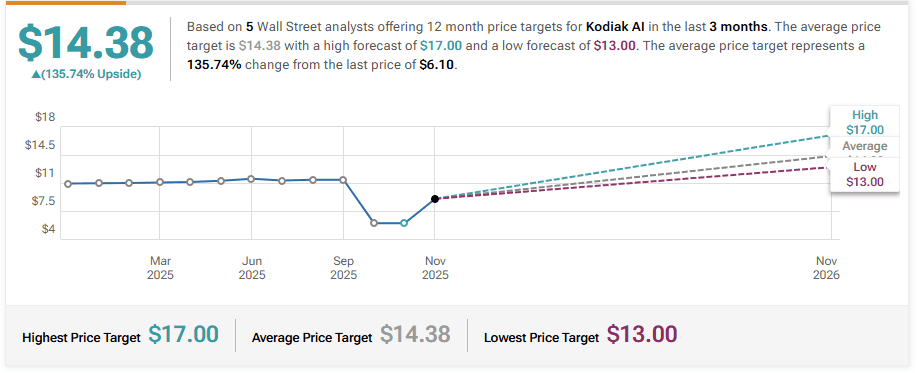

Company: Kodiak AI, Inc.

Quote: $KDK

BT: $7.31

ST: $12-$14

Sharks Opinion:

Kodiak AI’s recent earnings report came in below expectations, though this was largely anticipated given the company’s minimal current revenue while developing its autonomous trucking technology. Despite the short-term volatility, we remain bullish on the name, fully aware that its path to scale will be a rollercoaster.

When compared to industry peers, Kodiak screens as one of the most undervalued names in autonomous driving. For context, Alphabet’s Waymo carries an estimated $45 billion valuation, while Aurora Innovation (AUR) averages around $11.7 billion over the past six months. In contrast, Kodiak trades at a fraction of those levels, despite already generating revenue, securing government and military contracts, and achieving key operational milestones.

The company is now approved to operate in 24 states, with both commercial and military partnerships in place, and thousands of autonomous trucks slated for deployment by 2027. Kodiak is not just a concept it is actively executing its roadmap.

We approach this trade with measured conviction, setting a short-term swing target of $12 (roughly aligning with its initial listing price) and a long-term target above $20 as adoption scales and institutional ownership grows.

For now, Kodiak is positioned as a swing setup with long-term potential: volatile, yes, but in an industry where volatility often creates opportunity.

Description: Kodiak Robotics, Inc. builds and operates self-driving trucks. The company delivers freight for its customers between Dallas-Fort Worth and Houston. It offers solutions in the areas of updating automated drivers, a network of transfer points facilitates, and fleet management tools. The company was incorporated in 2018 and is based in Mountain View, California, with an operations center in Lancaster, Texas.

Chardan Capital Maintains Buy on Kodiak AI, Maintains $22 Price Target

TD Cowen Initiates Coverage On Kodiak AI with Buy Rating, Announces Price Target of $14

Citigroup Initiates Coverage On Kodiak AI with Buy Rating, Announces Price Target of $13.5

Cantor Fitzgerald Initiates Coverage On Kodiak AI with Overweight Rating, Announces Price Target of $13